Unveiling India’s Forex Reserve

The forex reserve of a nation is a crucial monetary asset, representing the total value of all foreign currencies, gold, and other financial instruments held by its central bank. India’s forex reserve holds profound significance for the country’s economic stability and growth.

Image: www.siasat.com

Significance of Foreign Exchange Reserves

India’s forex reserve serves as a pillar of financial strength in various ways:

1. Import Coverage:

Forex reserves enable India to import essential goods and services, such as crude oil, machinery, and electronic components. The dwindling of reserves could pose challenges in meeting import demands, leading to price increases and economic slowdown.

2. Currency Stability:

Forex reserves act as a buffer against external shocks, such as currency fluctuations and capital outflows. By intervening in the foreign exchange market, the Reserve Bank of India (RBI) can prevent extreme volatility and maintain currency stability.

Image: currentaffairs.adda247.com

3. Debt Servicing:

India has significant external debt obligations. Sufficient forex reserves ensure timely servicing of these debts, preventing default and maintaining the country’s creditworthiness in international markets.

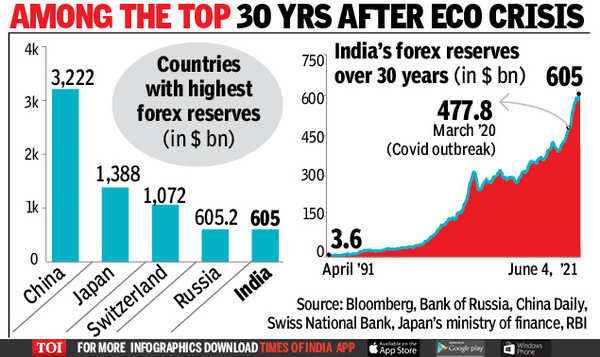

Growth and Trends

India’s forex reserve has witnessed a steady upward trajectory in recent years, influenced by various factors such as:

1. Inward Remittances:

Remittances from Indians working abroad constitute a major source of foreign exchange for India. These inflows boost forex reserves and contribute to economic growth.

2. Foreign Direct Investment:

Foreign direct investment (FDI) is another significant contributor to India’s forex reserves. FDI inflows indicate confidence in the Indian economy, leading to capital inflows and reserve accumulation.

3. Exports and Imports:

A favorable trade balance, with exports exceeding imports, enhances foreign currency earnings and contributes to forex reserves.

Managing Forex Reserves

The RBI, under the stewardship of the Government of India, is responsible for managing India’s forex reserves. Prudent reserve management involves:

1. Diversification:

The RBI diversifies India’s forex reserves across multiple currencies and assets, reducing risks associated with fluctuations in any single currency or asset class.

2. Gold Holdings:

Gold remains a valuable component of India’s forex reserves, providing a hedge against currency volatility and economic uncertainties.

3. Investment Decisions:

The RBI invests forex reserves in a spectrum of financial instruments, maximizing yields while ensuring liquidity and安全性.

Benefits of Ample Forex Reserves

Ample forex reserves bring numerous benefits to India:

1. Economic Resilience:

Adequate forex reserves enhance economic resilience, enabling the country to withstand external shocks and maintain stable economic conditions.

2. Investment Opportunities:

Forex reserves provide flexibility in exploring investment opportunities abroad, leading to diversification of portfolios and potential returns.

3. International Standing:

High forex reserves boost India’s international standing, showcasing the country’s financial strength and creditworthiness to global investors.

What Is Forex Reserve Of India

Conclusion

India’s forex reserve stands as a cornerstone of economic stability and growth. Prudent management of these reserves, coupled with favorable economic conditions, will continue to strengthen India’s position in the global economy. Understanding the importance of forex reserves imparts a sense of confidence and assurance to citizens and investors alike, paving the way for a prosperous future.