As a seasoned forex trader, I’ve witnessed firsthand the transformative power of candlestick patterns in predicting market movements. Candle charts, with their rhythmic ebb and flow, provide invaluable insights into price dynamics, enabling traders to make informed decisions in volatile markets. This comprehensive guide delves into the world of live forex trading with candlesticks, unlocking strategies that will empower you to navigate the market with confidence.

Image: ibonosotax.web.fc2.com

The Anatomy of Candle Charts

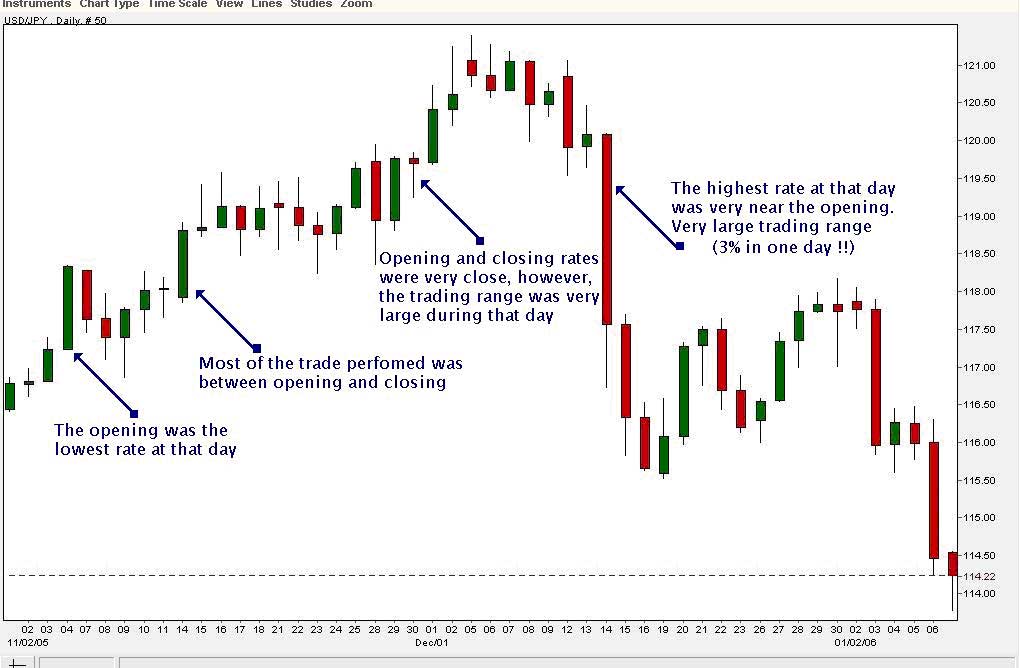

Candlestick charts visually represent price fluctuations over a specific period, with each candle consisting of an open, high, low, and close price. The body of the candle denotes the difference between the open and close prices, while the upper and lower wicks indicate the highs and lows reached during that period. This concise presentation allows traders to quickly assess market sentiment and identify potential trading opportunities.

Decoding Candle Patterns

Traders rely on a myriad of candlestick patterns to decipher market behavior. These patterns, formed by the interplay of multiple candles, provide clues about impending price directions. Common candlestick formations include: Doji (signaling indecision), Hammer (indicating a potential reversal), Engulfing (suggesting a strong trend change), and Shooting Star (foreshadowing a downward move). By recognizing these patterns and their significance, traders can anticipate market dynamics and position themselves accordingly.

Applying Candlesticks in Live Trading

Candle charts become an indispensable tool for traders in live forex trading. By observing price action in conjunction with candlestick patterns, traders can identify key price levels, anticipate market reversals, and plan their entries and exits strategically. Candlesticks enable traders to spot trends, assess risk-to-reward ratios, and make adjustments to their trading strategies on the fly. The ability to interpret candlestick patterns in real-time empowers traders to navigate market complexities with greater confidence and precision.

Image: admiralmarkets.com

Latest Trends and Developments

The realm of forex trading is constantly evolving, and candlestick charting continues to play a key role. Technological advancements have introduced automated pattern recognition software, allowing traders to scan markets for specific patterns. Additionally, the rise of social trading platforms has facilitated the exchange of trading ideas and strategies, including those revolving around candlesticks. By staying attuned to the latest trends and developments, traders can enhance their arsenal of candlestick-based strategies and stay ahead of the competition.

Expert Advice for Live Trading Success

As a veteran trader, I emphasize the importance of continuously refining your trading skills and seeking expert guidance. Consider the following insights:

- Learning candlestick patterns is an ongoing process. Study the different formations, how they evolve, and their reliability in various market conditions.

- Combine candlestick analysis with other technical indicators to enhance your decision-making. Indicators such as moving averages, oscillators, and trendlines can provide complementary insights into market dynamics.

- Trade with discipline and risk management strategies in place. Candlesticks can be powerful indicators, but they are not infallible. Manage your risk by setting appropriate stop-loss and take-profit levels.

Frequently Asked Questions on Candlestick Trading

Q: Is forex trading with candlesticks suitable for beginners?

A: While understanding candlestick patterns is beneficial, it’s recommended to gain a solid foundation in forex trading principles before employing candlestick strategies in live trading.

Q: How many candlestick patterns should I focus on?

A: Concentrate on mastering a few high-probability candlestick patterns rather than trying to memorize an exhaustive list. Focus on patterns that are visually distinctive and provide consistent results.

Q: Can candlestick patterns be misleading?

A: While candlestick patterns are valuable, it’s crucial to remember that no single pattern is absolutely reliable. Patterns can sometimes form in isolation or in combination with other patterns, creating ambiguous signals. Always consider the overall market context when interpreting candlestick patterns.

Live Trading Forex Market With Candlesticks

https://youtube.com/watch?v=THscNVV87sY

Conclusion

Unlocking the power of candlesticks in live forex trading empowers traders with invaluable insights into market dynamics. By mastering the interpretation of candlestick patterns, you gain the edge in predicting price movements, identifying trading opportunities, and managing risk effectively. Whether you’re a novice trader or a seasoned veteran, incorporating candlestick strategies into your trading arsenal can elevate your results to new heights. Are you ready to embark on the path to successful live forex trading with candlesticks?