Image: topfxmanagers.com

Introduction

In the realm of finance, leveraging has emerged as a powerful tool, transforming the way we trade and potentially multiply our profits. But what exactly is leverage, and how can we harness it effectively to unlock the full potential of our forex trading endeavors? In this comprehensive guide, we will delve into the intricacies of leverage in forex, empowering you with the knowledge and insights to navigate this dynamic market with confidence. Embark on this educational journey as we explore the intricacies of leverage, unlocking its power to elevate your trading endeavors.

Unveiling the Essence of Leverage

Leverage, in the context of forex trading, is a double-edged sword that can amplify both profits and losses. It is a financial mechanism that allows traders to control a larger amount of capital with a relatively smaller initial investment. By leveraging up, traders can gain greater exposure to market movements, increasing their potential returns. However, this amplified exposure also magnifies potential losses, making it crucial to understand the risks involved before embracing leverage.

The Mechanics of Leverage

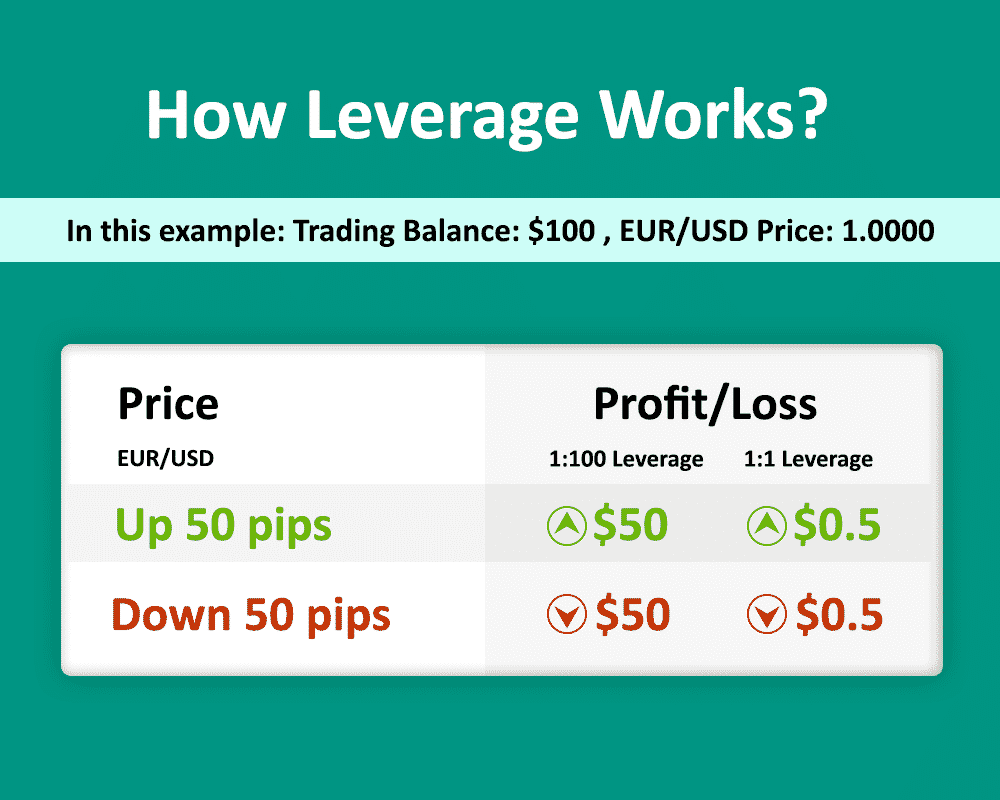

Forex leverage is expressed as a ratio, indicating the proportion of capital provided by the broker to the trader. For instance, a leverage ratio of 1:100 implies that for every dollar you invest, the broker provides an additional $99, effectively increasing your trading power by a hundredfold. This enables you to trade larger positions, potentially multiplying your profits. It is essential to note that while leverage can magnify gains, it also magnifies losses proportionally. Therefore, prudent risk management becomes paramount.

Strategic Utilization of Leverage

Leverage can be a valuable asset when employed judiciously. It allows traders to capitalize on market opportunities with limited capital, increasing their earning potential. However, it is crucial to recognize that leverage is not a risk-free venture. Traders must exercise prudence and employ appropriate risk management strategies to mitigate potential losses.

Expert Insights and Actionable Recommendations

Seasoned forex traders emphasize the significance of setting realistic expectations and understanding the inherent risks associated with leveraging. Recognizing that leverage is not a magic wand that guarantees success, they advise aspiring traders to proceed with caution and prioritize education. Practicing proper risk management, such as setting stop-loss orders and managing position sizes, is vital to safeguard your capital.

Harnessing the Power of Forex Leverage

To harness the power of leverage effectively, it is essential to approach forex trading with a well-rounded strategy. Extensive research, a thorough understanding of market dynamics, and a disciplined approach are fundamental pillars of successful trading. Leverage can serve as a valuable tool within this framework, but only when employed responsibly and in conjunction with sound risk management practices.

Conclusion

Leverage in forex trading presents both opportunities and risks. By understanding its mechanics and adopting a prudent approach, traders can potentially amplify their profits while mitigating potential losses. Remember, leverage is a double-edged sword, and responsible trading practices are indispensable. As you embark on your forex trading journey, embrace a spirit of continuous learning and risk management discipline to unlock the transformative potential of leverage and achieve your financial aspirations.

Image: www.axi.com

What Is The Meaning Of Leverage In Forex