Introduction

In the ever-evolving world of forex trading, technical analysis plays a pivotal role, providing traders with valuable insights and potential trading opportunities. Among the diverse array of technical indicators, the 200-Exponential Moving Average (EMA) stands out as a reliable and widely-used tool. The 200 EMA has gained immense popularity due to its ability to identify long-term trends and assist traders in making informed decisions. This comprehensive guide delves into the depths of the 200 EMA forex strategy, empowering traders with a thorough understanding of its concepts, applications, and potential rewards.

Image: fieldlokasin.weebly.com

Understanding the 200 EMA

The 200 EMA is a technical indicator that smooths out price fluctuations by calculating the average of closing prices over the past 200 periods. It is plotted on a price chart and acts as a dynamic support or resistance level, depending on the direction of the trend. When the price is above the 200 EMA, it suggests an uptrend; conversely, when the price is below the 200 EMA, it indicates a downtrend. The 200 EMA is particularly valuable in identifying long-term trends, as it is less susceptible to short-term price fluctuations.

Applications of the 200 EMA Forex Strategy

The 200 EMA forex strategy offers a multitude of applications, catering to the diverse needs of traders. Let’s explore some of the most common uses:

Trend Identification

One of the primary applications of the 200 EMA is trend identification. When the price is consistently above the 200 EMA, it signals an uptrend, suggesting potential buying opportunities. Conversely, when the price remains below the 200 EMA, it indicates a downtrend, favoring selling positions.

Image: learnpriceaction.com

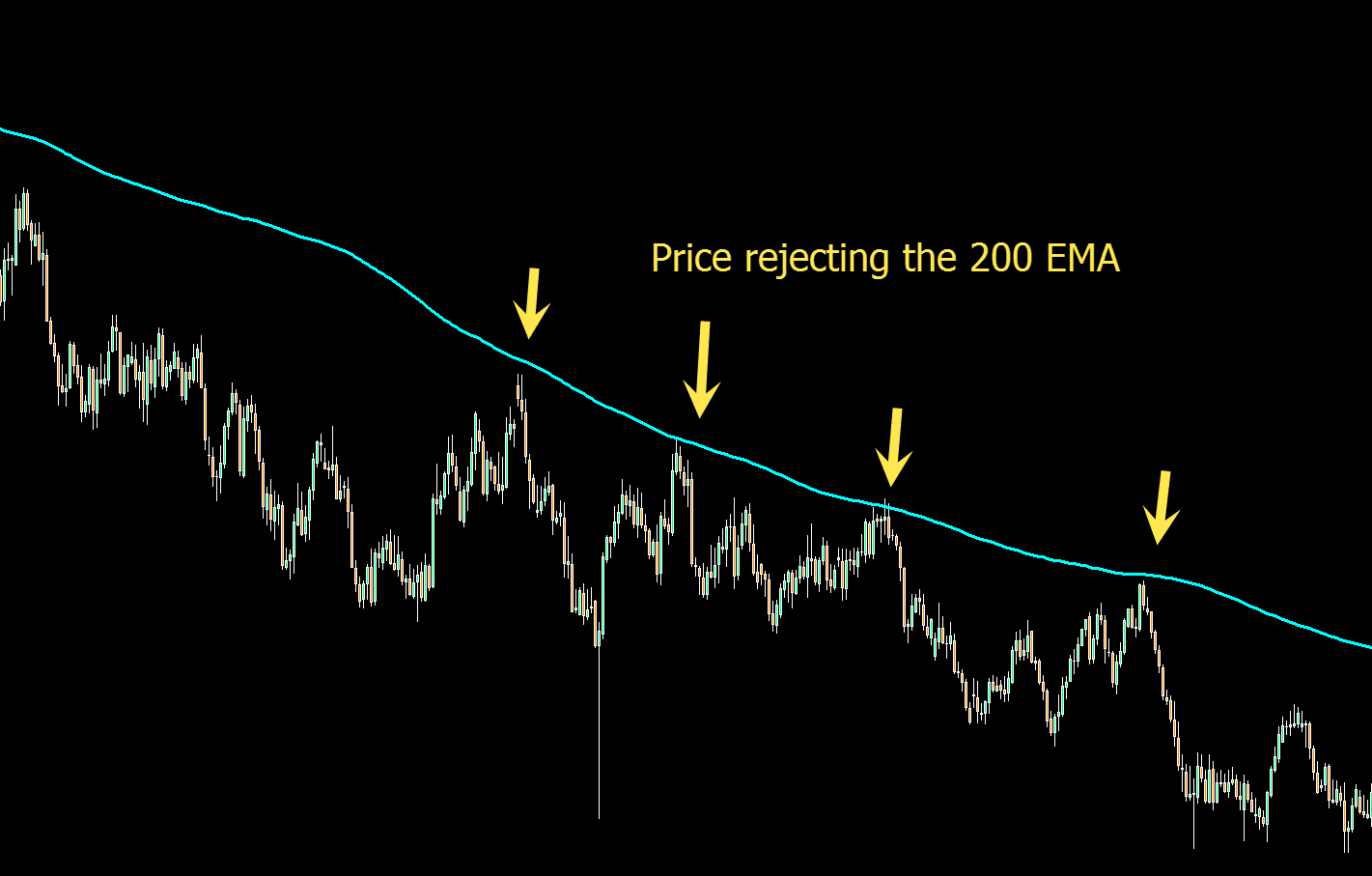

Support and Resistance Levels

The 200 EMA often acts as a dynamic support or resistance level. When the price approaches the 200 EMA from below, it may find support and bounce back up, providing an entry point for long positions. Similarly, when the price falls towards the 200 EMA from above, it may encounter resistance and reverse direction, presenting a selling opportunity.

Trend Reversal Confirmation

Traders can use the 200 EMA to confirm trend reversals. When the price breaks above the 200 EMA after a period of downtrend, it suggests a potential trend reversal to the upside, offering a buying opportunity. Conversely, when the price falls below the 200 EMA after an uptrend, it may indicate a trend reversal to the downside, favoring short positions.

Trade Management

The 200 EMA can also be employed for trade management. Traders can trail their stop-loss orders below the 200 EMA when in a long position, and above the 200 EMA when in a short position. This strategy helps protect profits while ensuring the trade remains in line with the prevailing trend.

Advantages and Disadvantages of the 200 EMA Forex Strategy

Like any trading strategy, the 200 EMA forex strategy has its advantages and disadvantages. Here’s a breakdown:

Advantages

- Simplicity and ease of use

- Provides clear trend signals

- Suitable for identifying long-term trends

- Can be used in conjunction with other technical indicators

- Can enhance risk management through trend confirmation

Disadvantages

- Lagging indicator, may not capture short-term price movements

- Not suitable for all market conditions or time frames

- Requires patience and discipline, as trends may take time to develop

- May produce false signals in choppy or sideways markets

- Overreliance on the 200 EMA may lead to missed opportunities

Tips for Successful Trading with the 200 EMA Forex Strategy

To maximize the potential of the 200 EMA forex strategy, consider these expert tips:

- Use the 200 EMA in conjunction with other technical indicators, such as moving averages, oscillators, and chart patterns.

- Wait for clear price action signals before entering trades.

- Place stop-loss orders below (for long positions) or above (for short positions) the 200 EMA.

- Manage your risk by adjusting trade size and leverage appropriately.

- Avoid trading against the prevailing trend.

- Be patient and disciplined, as trends may not always develop as quickly as expected.

200 Ema Forex Strategy Pdf

Conclusion

The 200 EMA forex strategy is a powerful tool that can help traders identify long-term trends and make informed trading decisions. By understanding the concepts, applications, and potential rewards of this strategy, traders can increase their chances of success in the ever-changing world of forex trading. While no trading strategy is foolproof, the 200 EMA forex strategy provides a reliable foundation for making profitable trades. Remember, success in forex trading requires patience, discipline, and a thorough understanding of the markets and the tools available.