Unlock the Power of Global Transactions with the Centrum Forex Visa Card

In a globalized world, seamless cross-currency conversions have become imperative for international travelers and businesses. The Centrum Forex Visa Card offers a convenient and cost-effective solution, empowering individuals and companies to make foreign currency transactions with ease. This article delves into the intricacies of the card’s cross-currency conversion chart, providing insights into its benefits, usage, and maximizing its potential.

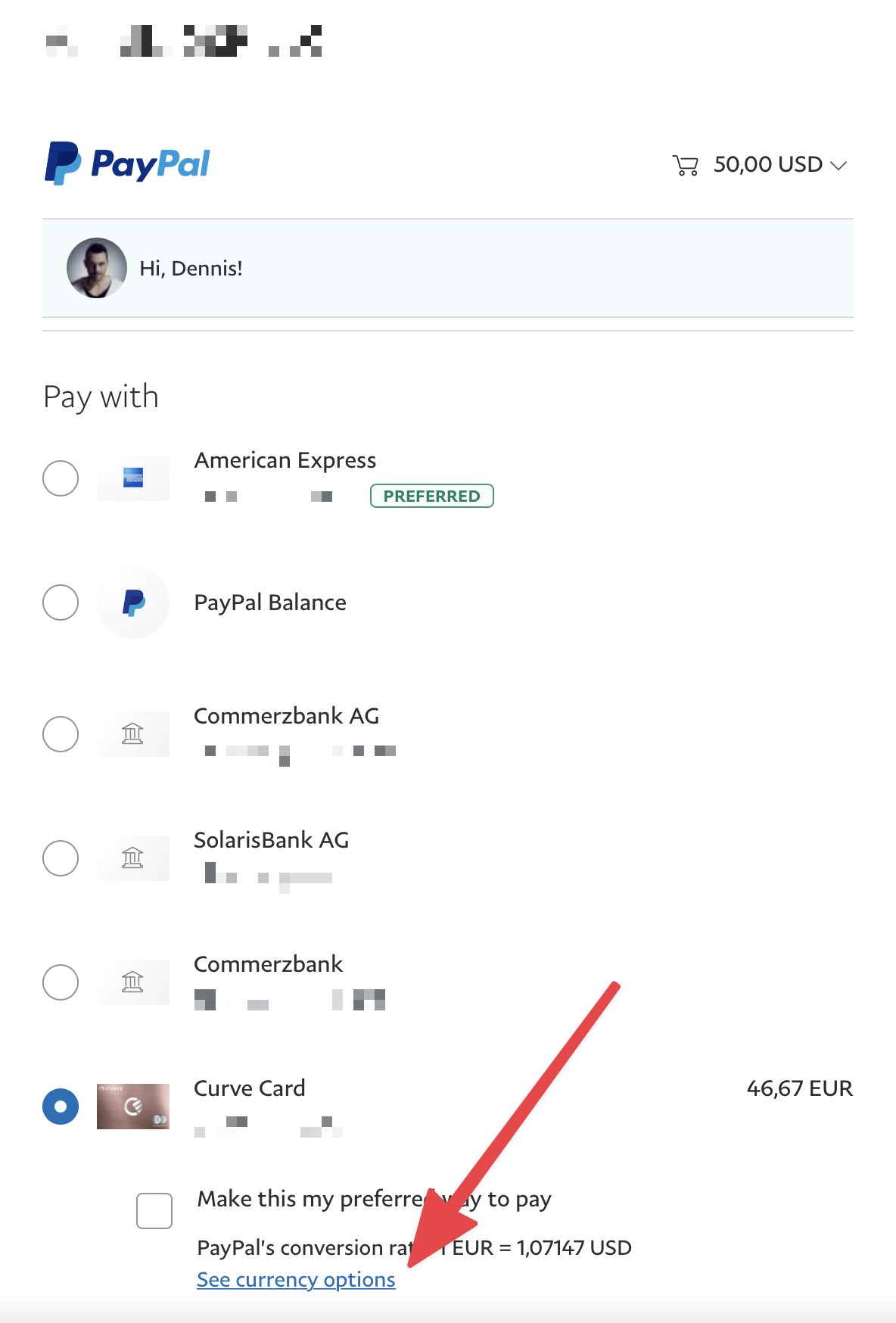

Image: katisavanah.blogspot.com

Understanding Cross-Currency Conversion

Cross-currency conversion refers to the process of exchanging one currency into another. When using traditional methods, such as cash exchange or wire transfers, individuals and businesses often incur significant fees and face unfavorable exchange rates. The Centrum Forex Visa Card eliminates these hurdles, offering competitive exchange rates and minimal transaction fees.

Centrum Forex Visa Card: A Comprehensive Guide

The Centrum Forex Visa Card operates like any other Visa credit card, with the added advantage of multi-currency support. It allows users to load multiple currencies onto the card and switch between them seamlessly, eliminating the need to carry physical foreign currency or incur hefty international transaction fees.

The Power of the Cross-Currency Conversion Chart

The Centrum Forex Visa Card’s cross-currency conversion chart serves as a valuable tool for travelers and businesses alike. It provides real-time exchange rates for over 150 currencies, enabling users to make informed decisions about their transactions. The chart is regularly updated to reflect market fluctuations, ensuring users receive the most competitive rates available.

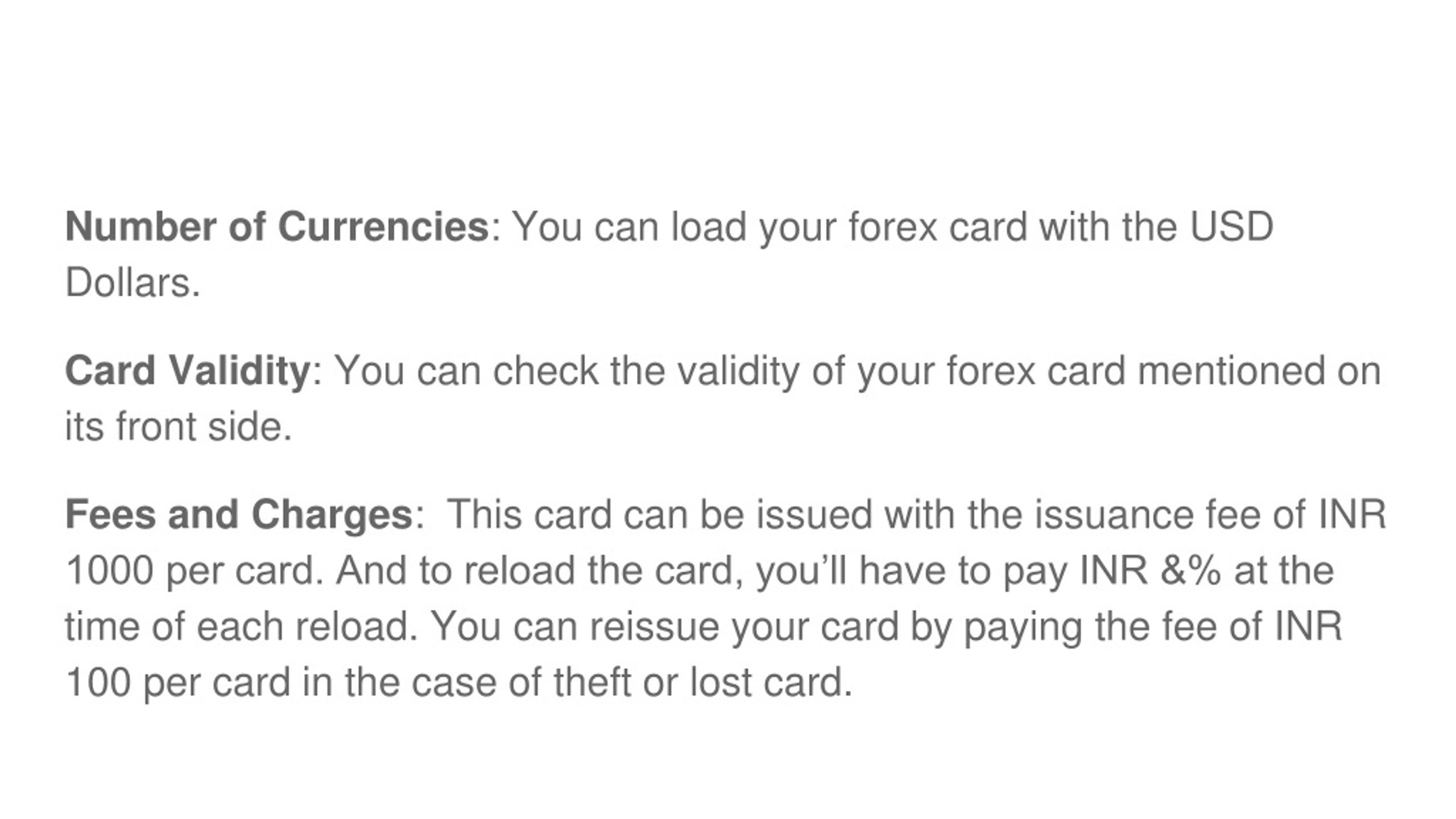

Image: www.slideserve.com

Tips for Maximizing Card Value

To optimize the use of the Centrum Forex Visa Card, consider these expert tips:

- Load Major Currencies: Focus on loading commonly used currencies, such as USD, EUR, and GBP, to benefit from the most favorable exchange rates.

- Monitor Exchange Rates: Keep an eye on currency fluctuations using the cross-currency conversion chart and make transactions when rates are in your favor.

- Use Card for Large Transactions: Minimize transaction fees by using the card for larger purchases, as the fees are typically a fixed amount.

Frequently Asked Questions

Q: Is the Centrum Forex Visa Card available globally?

A: Yes, the card can be used worldwide wherever Visa is accepted.

Q: Are there any annual or maintenance fees?

A: No, the Centrum Forex Visa Card has no annual or maintenance fees.

Q: How do I check my balance and transaction history?

A: Users can manage their account online or through the mobile app, which provides real-time balance updates and transaction details.

Centrum Forex Visa Card Cross Currency Conversion Chart

Conclusion

In the realm of cross-currency conversions, the Centrum Forex Visa Card is a game-changer. Its comprehensive cross-currency conversion chart, coupled with competitive rates and minimal fees, empowers travelers and businesses to embark on global transactions with confidence. By understanding the intricacies of the card’s functionality and embracing the expert tips provided, individuals and companies can harness the full potential of the Centrum Forex Visa Card, unlocking a world of seamless and cost-effective international transactions.

Call to Action:

If you’re seeking a seamless solution for your global currency needs, consider the Centrum Forex Visa Card. Its cutting-edge features and unwavering reliability make it the ideal choice for travelers, businesses, and anyone looking to navigate cross-currency conversions with ease. Are you ready to revolutionize your international transactions? Contact Centrum Forex today to learn more and apply for your card!