Dive into the World of Forex

Traveling abroad or conducting international business can be a whirlwind of excitement. However, managing currency exchange rates and carrying cash can add unnecessary stress. Fortunately, Forex cards offer a convenient and secure solution, allowing you to navigate global finance with ease. Axis Bank, a leading financial institution in India, provides Forex Cards in various denominations, making it easier than ever to access foreign currencies at competitive exchange rates.

Image: robotforexkaskus.blogspot.com

To obtain an Axis Forex Card, you will need to fulfill certain requirements and submit the necessary documentation. This process ensures your identity and eligibility for the service.

Essential Documents:

- Application Form: Fill out the Axis Forex Card application form with accurate and complete details.

- Identity Proof: Submit a valid passport or Voter ID card as proof of identity.

- Address Proof: Provide a recent utility bill, bank statement, or rental agreement as address proof.

- Income Proof: For cards with higher limits, you may need to furnish proof of income such as salary slips, business registration certificates, or income tax returns.

Additional Requirements:

- Minimum Age: The applicant must be at least 18 years old to apply for a Forex Card.

- Indian Citizenship: Axis Forex Cards are available only to Indian citizens and residents.

- Competitive Exchange Rates: Get the best possible exchange rates when making purchases or withdrawing cash abroad.

- Worldwide Acceptance: Use your card at millions of merchant establishments and ATMs worldwide.

- Multiple Currency Options: Load multiple currencies onto your card for greater convenience and flexibility.

- Easy Loading: Replenish your card’s balance through net banking, mobile banking, or designated Axis Bank branches.

- Security and Convenience: Rest assured that your transactions are secure with PIN protection, chip technology, and 24/7 customer support.

- Set Up SMS Alerts: Stay informed about your card transactions and balance.

- Notify the Bank: Inform Axis Bank of your travel dates to avoid card blocking for security reasons.

- Use ATMs Wisely: Choose ATMs with reliable networks and low withdrawal fees to minimize charges.

- What is the validity period of an Axis Forex Card?

- Can I use my Forex Card for online transactions?

- Are there any transaction limits on Forex Cards?

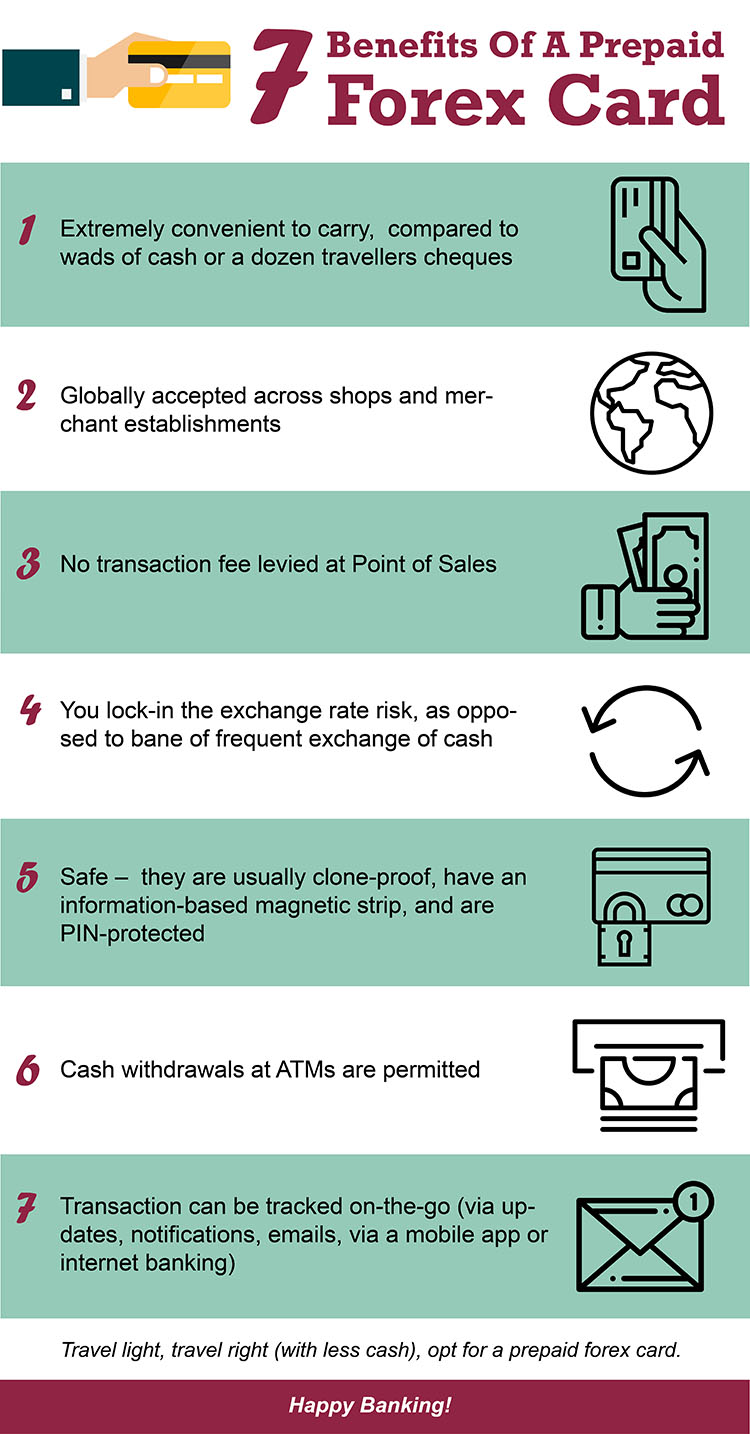

Benefits of Axis Forex Cards:

Axis Forex Cards offer a wide range of benefits for seamless international transactions:

Image: www.fondazionealdorossi.org

Tips for Using Forex Cards:

For optimal use of your Axis Forex Card, consider these expert tips:

FAQs on Forex Cards:

Axis Forex Cards typically have a validity of 5 years from the date of issuance.

Yes, Axis Forex Cards can be used for secure online purchases in supported currencies.

Yes, transaction limits vary depending on the card type and customer profile. Check with Axis Bank for specific details.

Documents For Forex Card Axis

Conclusion:

Embark on your global financial adventures with confidence with an Axis Forex Card. To acquire your card, assemble the necessary documents outlined above and visit your nearest Axis Bank branch. Remember to maximize the benefits and follow our expert tips to make your international transactions smooth and secure. Are you ready to unlock the world with Axis Forex Cards?