Introduction

In the dynamic realm of financial markets, the economic growth rate stands as a beacon of macroeconomic influence, casting its shadow upon the forex market like a towering monolith. As the heartbeat of any economy, the growth rate serves as a potent barometer of future prospects, providing invaluable insights into the overall health and stability of a nation. Understanding the intricate interplay between economic growth and forex dynamics is paramount for successful navigation of the currency market’s turbulent waters.

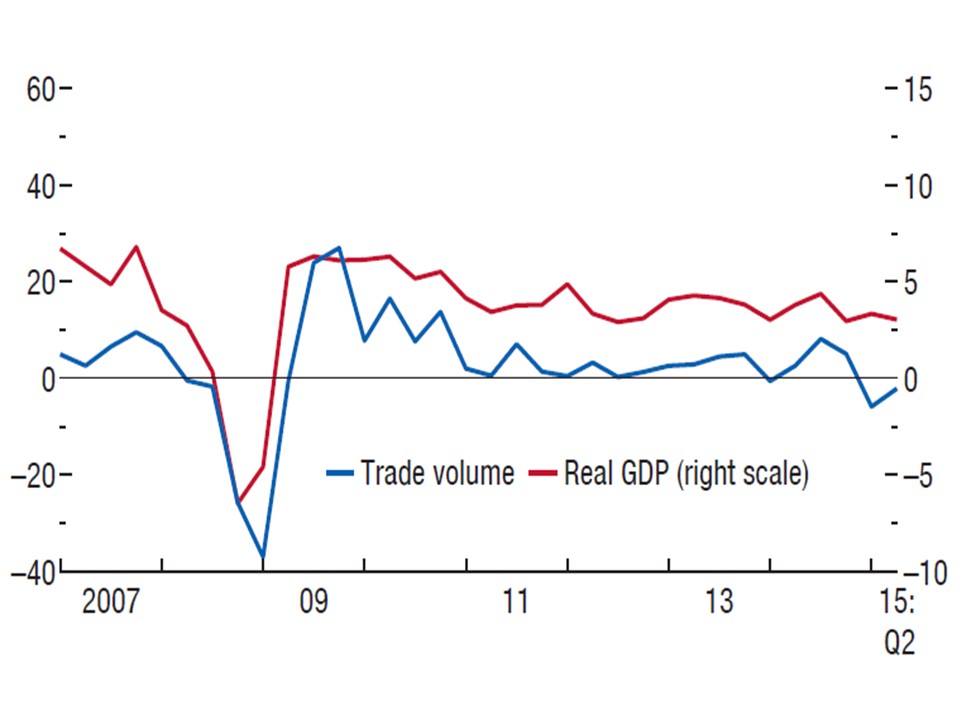

Image: thedailyjournalist.com

Economic growth, measured as the percentage change in a country’s gross domestic product (GDP) over a specific period, serves as a comprehensive indicator of an economy’s performance. Robust economic growth typically signifies increased consumer spending, corporate investment, and government expenditure, all of which contribute to heightened market optimism. This positive sentiment often translates into an appreciation of the domestic currency, as investors seek to capitalize on the promising growth prospects.

Economic Growth and Currency Appreciation

A direct correlation exists between economic growth and the appreciation of a currency. As an economy expands, demand for its goods and services rises, leading to increased exports. The influx of foreign capital seeking to invest in a thriving economy further drives up the value of the local currency. This process is often referred to as “currency appreciation.”

Consider the case of China, which has experienced phenomenal economic growth over the past few decades. The resulting rise in Chinese exports has made the人民币 (renminbi) one of the world’s most sought-after currencies, leading to its steady rise in value against other global currencies.

Economic Growth and Currency Depreciation

However, the relationship between economic growth and currency value is not always straightforward. In certain cases, a rapidly expanding economy can also trigger the depreciation of a currency. When economic growth outpaces the ability of the central bank to maintain a stable monetary supply, inflation can arise. As inflation erodes the purchasing power of a currency, its value on the forex market depreciates.

For example, during the economic boom of the late 1990s in the United States, the Federal Reserve raised interest rates aggressively to combat rising inflation. This caused the US dollar to depreciate against other currencies, as investors feared that the US economy was overheating and sought refuge in safer assets.

Assessing Economic Growth Rate for Forex Trading

For forex traders, accurately assessing economic growth rates is crucial for making informed trading decisions. Economic growth data is typically released by government agencies on a quarterly basis, and traders closely monitor these reports for any signs of deviations from market expectations.

Stronger-than-expected growth figures can boost the value of a currency, while weaker-than-expected figures can trigger a depreciation. Traders use this information to speculate on currency price movements and make strategic trades. By incorporating economic growth rate analysis into their trading strategies, forex traders can enhance their chances of capitalizing on market inefficiencies and achieving profitable outcomes.

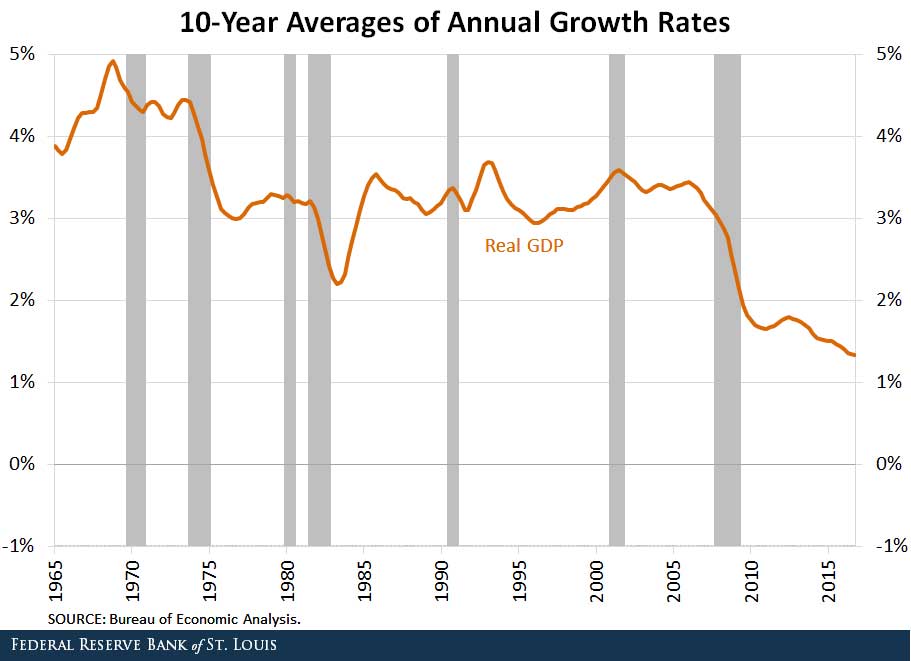

Image: ar.inspiredpencil.com

Additional Factors Influencing Forex Markets

It is important to note that economic growth rate is not the sole determinant of currency value on the forex market. Other factors, such as interest rates, political stability, and geopolitical events, can also exert significant influence. Forex traders must consider these variables in conjunction with economic growth rate data to gain a holistic understanding of market dynamics.

Economic Growth Rate Effect In Forex

Conclusion

Understanding the profound influence of economic growth rate on forex markets is a cornerstone of successful currency trading. By closely monitoring economic data and analyzing its implications for currency values, forex traders can make informed decisions that maximize their chances of profitability. The ever-evolving nature of global economies and forex markets underscores the importance of staying abreast of the latest developments and conducting thorough research before making any trades.