If you’re a Forex trader, you know that the open, high, low, and close prices are some of the most important data points you can track. This information can help you understand market trends and make informed trading decisions. One of the best ways to track this data is to use Excel. In this article, we’ll show you how to calculate the open, high, low, and close prices in Forex Factory using Excel.

Image: destinationdelta.weebly.com

We’ll also provide some tips and expert advice on how to use this data to improve your trading.

Introduction to Open, High, Low, and Close Prices

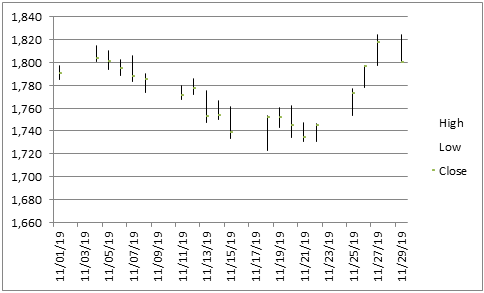

The open price is the price of a currency pair at the beginning of a trading session. The high price is the highest price of the currency pair during the trading session. The low price is the lowest price of the currency pair during the trading session. The close price is the price of the currency pair at the end of the trading session.

These four prices give you a snapshot of the market activity during the trading session. They can help you identify trends, support and resistance levels, and potential trading opportunities.

Calculating Open, High, Low, and Close Prices in Forex Factory

To calculate the open, high, low, and close prices in Forex Factory using Excel, you’ll need to follow these steps:

- Open Forex Factory in your web browser.

- Find the currency pair you want to track.

- Click on the “Historical Data” tab.

- Select the date range you want to analyze.

- Click on the “Download” button.

- Open the downloaded file in Excel.

- The open, high, low, and close prices will be listed in the first four columns of the spreadsheet.

Tips and Expert Advice

Here are a few tips and expert advice on how to use the open, high, low, and close prices to improve your trading:

- Use the open price to identify potential trading opportunities. If the open price is significantly higher or lower than the previous close price, it could be a sign of a trend reversal.

- Use the high and low prices to identify support and resistance levels. The high price is the highest price that the currency pair has reached during the trading session. The low price is the lowest price that the currency pair has reached during the trading session. Support and resistance levels are areas where the price is likely to bounce off. This information can be helpful for identifying potential trading opportunities.

- Use the close price to confirm your trading decisions. The close price is the last price of the currency pair at the end of the trading session. This price can help you confirm your trading decisions. For example, if you’re considering buying a currency pair, you should wait until the close price is above the open price.

Image: blog.deriscope.com

FAQ

Q: What is the difference between the open price and the close price?

A: The open price is the price of a currency pair at the beginning of a trading session. The close price is the price of the currency pair at the end of the trading session.

Q: How do I identify support and resistance levels using the open, high, low, and close prices?

A: Support levels are areas where the price of a currency pair is likely to bounce off. Resistance levels are areas where the price of a currency pair is likely to turn around and go down. You can identify support and resistance levels by looking for areas where the price has previously bounced off.

Q: How do I use the open, high, low, and close prices to confirm my trading decisions?

A: You can use the close price to confirm your trading decisions. For example, if you’re considering buying a currency pair, you should wait until the close price is above the open price. This will help you avoid getting into trades that are likely to lose money.

Excel Calculation In Open High Low In Forex Factory

Conclusion

The open, high, low, and close prices are some of the most important data points you can track as a Forex trader. This information can help you understand market trends and make informed trading decisions. By following the steps outlined in this article, you can easily calculate the open, high, low, and close prices in Forex Factory using Excel.

Once you have this data, you can use it to identify trading opportunities, confirm your trading decisions, and improve your overall trading performance.

We hope you found this article helpful. If you have any questions, please feel free to leave a comment below.

Are you interested in learning more about Forex trading? If so, please check out our other articles on the topic.