Introduction

In today’s globalized financial landscape, the foreign exchange (forex) market presents a dynamic environment where technology plays a pivotal role in shaping trading strategies and maximizing profits. With the advent of digital tools, forex traders have unprecedented access to real-time data, advanced analytics, and automated trading systems, transforming the way they approach the market.

Image: topbinaryoptionsbrokers.logdown.com

This article delves into the transformative digital trends that are redefining forex trading, focusing on the Average Directional Index (ADX), an essential technical indicator that empowers traders with insights into price momentum and market trends. By exploring the latest technological advancements and leveraging the power of ADX, forex traders can enhance their decision-making capabilities and achieve greater profitability.

The Forex Market: A Digital Revolution

The forex market, the world’s largest financial market, has undergone a profound digitalization in recent years. The rise of online trading platforms, mobile applications, and sophisticated software solutions has revolutionized the way traders access and analyze market information.

Digital platforms provide traders with real-time data feeds, cutting-edge charting tools, and customizable trading interfaces. With the ability to trade from anywhere with an internet connection, digitalization has removed geographical barriers and extended trading opportunities to a global audience.

Average Directional Index (ADX): A Powerful Momentum Indicator

Amidst the plethora of technical indicators available to forex traders, the Average Directional Index (ADX) stands out as a valuable tool for identifying strong and weak price trends. Developed by J. Welles Wilder, the ADX measures the strength of a trend by analyzing the difference between positive and negative price movements over a specified period.

Traders use ADX to determine the direction and strength of a trend, providing insights into potential trading opportunities. When the ADX line is above a predefined threshold (typically 25), it indicates a strong trend, while a value below this threshold signifies a range-bound market.

Leveraging ADX in Forex Trading

Integrating the ADX into a forex trading strategy can enhance decision-making and optimize trade execution. Here’s how traders can leverage ADX to improve their outcomes:

-

Trend Identification: ADX helps traders identify the direction of a market trend, enabling them to align their trading positions accordingly.

-

Trend Strength: The magnitude of the ADX value indicates the strength of the trend, allowing traders to differentiate between strong and weak trends.

-

Trade Timing: By analyzing ADX in conjunction with other indicators, traders can determine optimal entry and exit points, maximizing their profit potential.

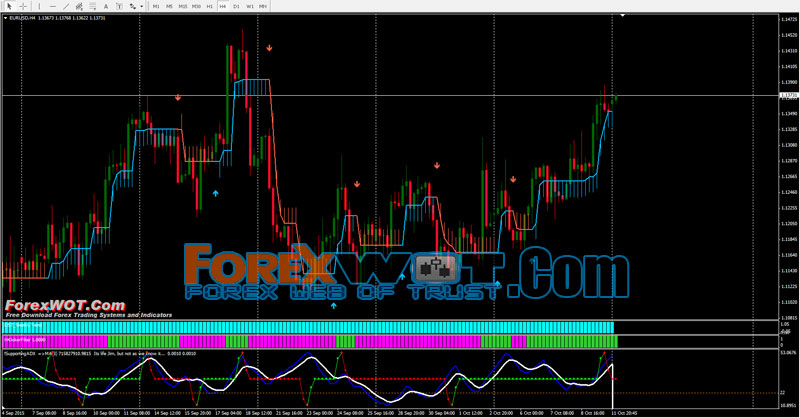

Image: forexwot.com

Digitalization and ADX: The Power Duo

The digital transformation of the forex market and the availability of ADX as a technical indicator have created a powerful combination for traders. Digital platforms provide the infrastructure for real-time data analysis, while ADX offers actionable insights into market dynamics.

Traders can now access advanced ADX calculation software that automates the indicator’s construction and provides visual representations of price trends. This greatly simplifies the analysis process, allowing traders to make informed decisions more efficiently.

Forex Digital Trend And Adx

Conclusion

The intersection of digital trends and powerful technical indicators like ADX has revolutionized forex trading. With the advent of real-time data, sophisticated charting tools, and automated trading systems, traders have become empowered to make better-informed decisions and achieve greater profitability.

By leveraging ADX within a digitalized trading environment, forex traders gain a competitive edge in navigating the complex and ever-changing forex market. This dynamic tool provides insights into price momentum and market trends, enabling traders to identify trading opportunities, maximize profits, and minimize risks. Embrace the transformative power of digital technology and the analytical capabilities of ADX to unlock your full potential as a successful forex trader.