In the tumultuous realm of global finance, where currency fluctuations can wreak havoc on businesses and economies, the art of forex hedging emerges as a beacon of stability. This intricate financial tool empowers organizations to mitigate the risks associated with currency exchange, safeguarding their assets and paving the way for sustained growth. India, an economic powerhouse with a burgeoning international trade sector, stands poised to reap the transformative benefits of forex hedging.

Image: forexezy.com

Delving into Forex Hedging: A Lifeline in Currency Chaos

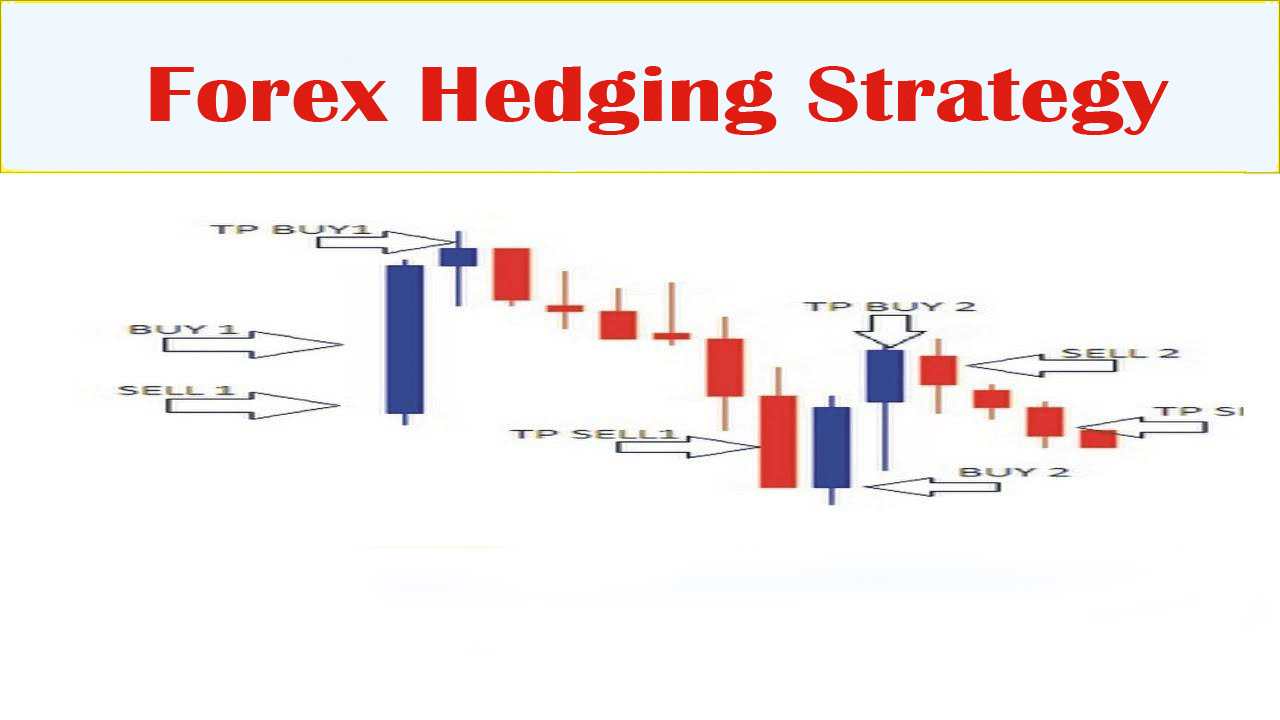

Forex hedging, in its essence, is a risk management strategy employed to minimize the impact of currency fluctuations on a company’s financial performance. By engaging in hedging contracts, organizations can effectively lock in favorable exchange rates, ensuring predictability and stability amidst turbulent currency markets. This financial lifeline shields businesses from the adverse consequences of currency depreciation, protecting profitability and fueling future growth.

The Indian Context: Embracing Forex Hedging for Global Success

India’s rapid economic expansion and integration into the global market have rendered forex hedging an indispensable tool for its businesses. Export-oriented industries, such as textiles, pharmaceuticals, and software, are particularly vulnerable to currency volatility, as fluctuations in exchange rates can significantly impact their profitability. By adopting forex hedging strategies, Indian companies can mitigate these risks, allowing them to confidently expand into new markets and forge stronger global partnerships.

Untangling the Complexities of Forex Hedging

The forex hedging landscape encompasses a myriad of strategies, each tailored to specific business objectives and risk tolerance levels. Forward contracts, options, and currency swaps are just a few of the instruments employed by financial institutions to facilitate hedging transactions. Understanding the intricacies of these hedging techniques is crucial for businesses seeking to harness their full potential.

Image: www.extension-a6.com

The Forex Hedging Journey: A Guide to Effective Implementation

For businesses embarking on their forex hedging journey, a well-informed approach is paramount. Identifying and quantifying currency-related risks is a foundational step, followed by meticulously selecting the hedging strategies that best align with the company’s financial profile and growth aspirations. Collaboration with experienced financial institutions and advisors is highly recommended to ensure the optimal design and execution of forex hedging strategies.

Expert Voices: Unlocking the Wisdom of Forex Hedging Gurus

Industry experts from the world of finance wholeheartedly endorse the transformative power of forex hedging. They emphasize its role in bolstering financial stability, enhancing predictability, and empowering businesses to navigate currency volatility with confidence. Their insights offer invaluable guidance for companies seeking to leverage forex hedging as a catalyst for growth.

Actionable Insights: A Practical Toolkit for Forex Hedging Success

Translating theoretical knowledge into practical action is essential for reaping the full benefits of forex hedging. Regularly monitoring currency trends, staying abreast of economic developments, and proactively adjusting hedging strategies are crucial practices for businesses aiming to maximize the effectiveness of their risk management efforts. A disciplined and data-driven approach to forex hedging empowers organizations to mitigate risks, optimize profitability, and unlock the full potential of their international operations.

The Future of Forex Hedging: Embracing Innovation and Sustainability

As technology and financial markets continue to evolve, the realm of forex hedging is poised for further innovation and enhancement. Artificial intelligence and machine learning algorithms are transforming the way hedging strategies are designed and executed, enhancing precision and efficiency. Additionally, the incorporation of sustainability principles into forex hedging practices is gaining traction, fostering a holistic approach that balances financial resilience with environmental consciousness.

Forex Hedging Market And Trends In India

Conclusion: Seizing the Forex Hedging Opportunity for India’s Economic Triumph

For India to fully capitalize on its economic potential, embracing forex hedging is not merely an option but a strategic imperative. By harnessing the power of this financial tool, Indian businesses can mitigate currency risks, expand their global footprint, and unlock unprecedented growth opportunities. The time is ripe for Indian companies to embrace forex hedging and forge a path towards financial stability and sustained prosperity.