In the tumultuous world of finance, navigating the forex market can be a daunting task. Currency fluctuations, economic uncertainties, and geopolitical events can wreak havoc on your investments, leaving you vulnerable to losses. However, there is a beacon of hope in the financial landscape – the art of forex hedging.

Image: domisa.co.za

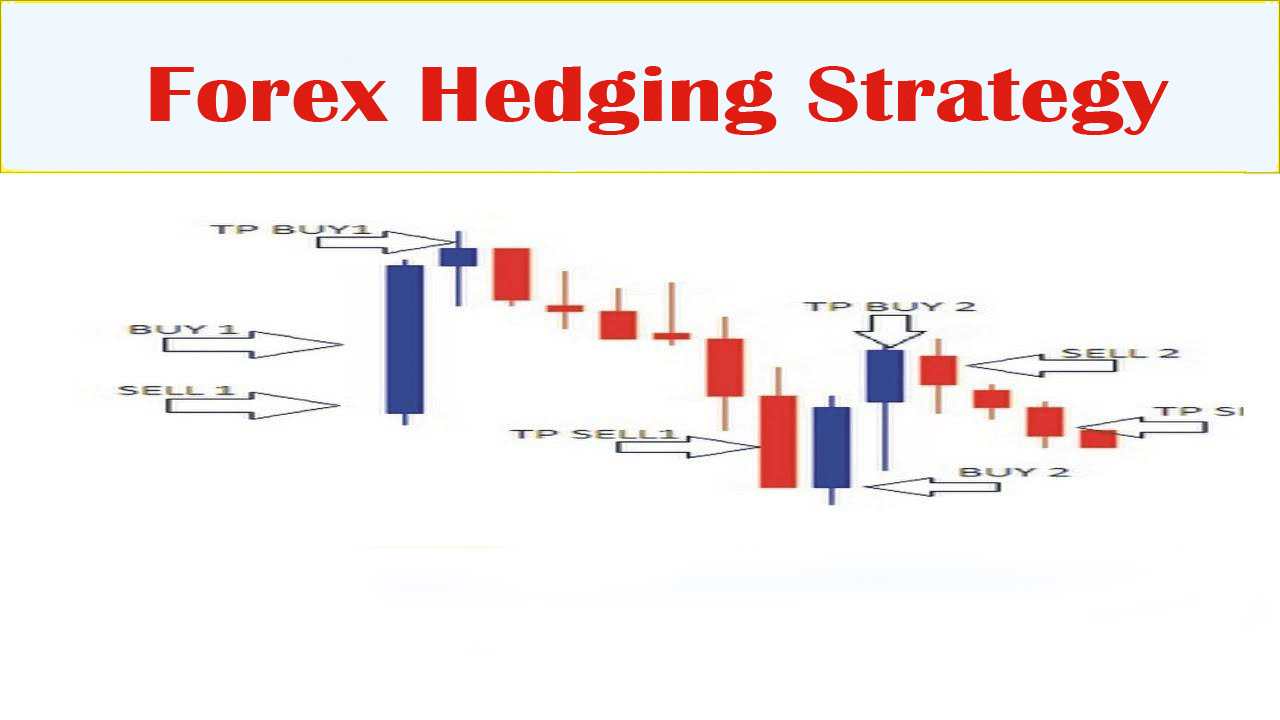

Forex hedging, simply put, is a financial strategy employed to mitigate the risk associated with currency exchange rate fluctuations. By engaging in hedging techniques, you can effectively safeguard your assets and stabilize your financial position, even amidst the unpredictable tides of the forex market. Let’s delve into the complexities of forex hedging, unravel its benefits, and explore how it can empower you to seize opportunities and minimize risks.

Unlocking the Benefits of Forex Hedging

Picture yourself as an entrepreneur engaged in international trade. Your business thrives on importing goods from overseas, exposing you to the fluctuations of exchange rates. Unfavorably unfavorable es, fluctuations can erode your profit margins and introduce a significant degree of uncertainty into your cash flows. Forex ways Forex hedging comes to the rescue, providing a strategic solution to protect your business.

By implementing hedging strategies, such as forward contracts or currency options, you can lock in exchange rates at predetermined levels, effectively immunizing your business against adverse currency movements. This newfound certainty allows you to plan your operations with confidence, secure in the knowledge that your financial exposure is under control.

Furthermore, forex hedging is not merely a tool for mitigating risks; it also presents opportunities to capitalize on favorable market conditions. Through advanced hedging strategies, you can speculate on currency movements, potentially generating additional income streams and maximizing your overall liquidity.

Harnessing Liquidity: A Key to Financial Empowerment

Liquidity, the lifeblood of any financial market, is essential for executing trades, seizing opportunities, and adjusting your portfolio as needed. This is where forex hedging plays a pivotal role, allowing you to unlock liquidity and enhance your financial flexibility.

By utilizing hedging instruments, you can convert illiquid assets into more liquid ones, providing immediate access to funds when you need them most. This newfound liquidity empowers you to capitalize on market opportunities, make strategic investments, and respond swiftly to changing economic conditions.

Imagine yourself as an investor with a substantial portion of your portfolio invested in real estate. While real estate offers long-term returns, it is often an illiquid asset, making it challenging to access funds quickly. Forex hedging provides a solution, enabling you to hedge your exposure to currency fluctuations and release liquidity from your real estate holdings. This enhanced liquidity empowers you to diversify your investments, pursue new opportunities, and weather financial storms with greater resilience.

Empowering Individuals and Businesses

Forex hedging and liquidity utilization are not solely reserved for large corporations or institutional investors. Individuals and small businesses can also harness these powerful financial tools to safeguard their assets and pursue their financial goals.

Whether you’re an entrepreneur seeking to protect your business from currency risks or an individual saving for your future, forex hedging offers a path toward financial stability and empowerment. By embracing this financial strategy, you can mitigate risks, seize opportunities, and take control of your financial destiny.

Image: forexezy.com

Hedging Of Forex And Utilization Of Liquidity

Conclusion: Navigating the Financial Landscape

In the ever-evolving landscape of finance, knowledge is power, and forex hedging places that power in your hands. By comprehending the intricacies of forex hedging and its impact on liquidity, you gain an invaluable tool for navigating the financial markets with confidence and resilience.

Unlock the transformative potential of forex hedging today, empower yourself to mitigate risks, maximize returns, and forge a path toward financial prosperity. Remember, in the world of finance, it’s not about predicting the future; it’s about preparing for it – and forex hedging is the key to unlocking that preparedness. Embrace the power of forex hedging and harness the transformative power of liquidity to achieve your financial aspirations.