Navigating the tumultuous forex market demands precision and strategy, and support and resistance levels stand as indispensable tools for intraday traders.

Image: thesbb.com

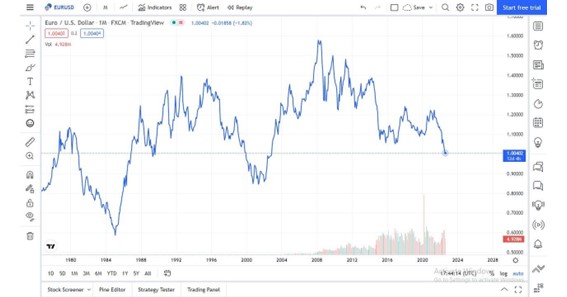

These levels mark pivotal points where price action tends to either rebound or find significant resistance, revealing crucial areas for potential reversals or breakouts.

Harnessing the Power of Support and Resistance

Support refers to the price level at which demand exceeds supply, forming a floor that prevents prices from falling further. Conversely, resistance indicates the price level where supply overpowers demand, creating a ceiling that hinders prices from rising further.

Identifying these levels is pivotal as they provide traders with precise entry and exit points. Buy signals emerge when prices break above resistance, while sell signals arise when prices pierce support.

Historical Significance: A Testament to Price Memory

Support and resistance levels are not mere technical artifacts; they carry historical significance rooted in market sentiment. Traders tend to recall and anticipate reversals at these levels, affirming their psychological impact.

When prices approach support, buyers may perceive it as an opportune moment to enter the market, envisioning a price recovery. Conversely, sellers may interpret resistance as a signal to liquidate their positions in anticipation of a price retracement.

Trading Techniques: Master the Art of Intraday Dominance

- Monitor Price Action: Identify horizontal lines where prices repeatedly bounce off, forming potential support and resistance levels.

- Use Moving Averages: Calculate the average price over a specific period to identify trend direction and potential support/resistance zones.

- Fibonacci Levels: Retracement and extension levels derived from Fibonacci ratios often coincide with significant support and resistance areas.

- Candlestick Patterns: Analyze candlestick patterns like Doji, Inside Bar, and Pin Bars for clues regarding potential price reversals or breakouts.

- Risk Management: Place stop-loss orders below support and above resistance levels to mitigate potential losses.

Image: omenejomy.web.fc2.com

Expert Advice and Tips: Enhance Your Trading Prowess

“Support and resistance levels are not static; they constantly adapt to market dynamics,” advises professional trader John Carter. “Traders must remain vigilant and adjust their strategies accordingly.”

Seasoned analyst Anna Coulling emphasizes the importance of confluence: “Look for convergence of multiple support/resistance levels, as it strengthens their significance and increases the probability of profitable trades.”

FAQs: Unraveling Forex Support and Resistance

-

What is the difference between support and resistance?

- Support marks the price level where demand exceeds supply, while resistance indicates the price level where supply overpowers demand.

-

Why are support and resistance levels significant?

- They reveal crucial areas where price action tends to either rebound or find resistance, offering traders strategic entry and exit points.

-

How do I identify support and resistance levels?

- Monitor price action, use moving averages, Fibonacci levels, and candlestick patterns to pinpoint potential support and resistance zones.

-

How can I trade using support and resistance levels?

- Look for buy signals when prices break above resistance and sell signals when prices pierce support. Place stop-loss orders below support and above resistance levels to manage risk.

Forex Support And Resistance Levels For Intraday

Conclusion

Understanding and mastering forex support and resistance levels is an indispensable skill for intraday traders. These levels provide invaluable insights into potential price reversals and breakouts, empowering traders to make informed decisions and capture profitable opportunities.

By applying the strategies and tips outlined in this article, you can enhance your forex trading acumen and unlock the path to consistent profits in the dynamic and rewarding world of intraday trading.