In the vast and unpredictable world of forex trading, traders constantly strive to gain an edge over the markets. Among the many technical indicators, support and resistance zones stand out as a powerful tool that can guide traders towards profitable opportunities. In this comprehensive guide, we’ll delve into the intricacies of forex support and resistance zones and empower you with actionable strategies to enhance your trading performance.

Image: www.nordman-algorithms.com

Understanding the Essence of Support and Resistance

In the world of forex, support and resistance zones are crucial price levels that act as barriers in the market. Support is a level at which the price tends to bounce back higher, indicating that buyers are actively involved at that price point. Conversely, resistance is a level where the price often encounters resistance and falls lower, indicating the presence of strong selling pressure.

Pinpoint Forex Market Boundaries

Identifying support and resistance zones is an art that requires a keen eye for detail and an in-depth understanding of market behavior. Seasoned traders utilize multiple methods to determine these key levels, including:

- Horizontal Support and Resistance: Identifying key price levels at which the market has repeatedly reversed in the past.

- Moving Averages and Pivot Points: Employing technical indicators such as moving averages and pivot points to establish potential support and resistance lines.

- Trendlines: Drawing lines to connect troughs and peaks to identify the underlying trend and potential reversals.

Strategies to Exploit Support and Resistance for Profitable Trading

Harnessing the power of support and resistance zones opens a gateway to lucrative trading opportunities. Here’s how you can leverage this knowledge to your advantage:

- Buy at Support: When the price retraces to a major support zone, consider entering a long (buy) position, anticipating a price bounce towards resistance.

- Sell at Resistance: Conversely, if the price approaches a resistance zone, consider a short (sell) position, expecting a pullback towards support.

- Trend Confirmation: Trade in the direction of the prevailing trend, utilizing support and resistance levels as confirmation of the trend’s continuation.

- False Breakouts: Be cautious of false breakouts, which occur when the price momentarily penetrates a support or resistance zone but fails to sustain the breakout.

Image: forexstrategiesresources.com

Empowering Traders with Expert Insights

To further enhance your trading prowess, we’ve tapped into the wisdom of seasoned forex experts:

- “Support and resistance are dynamic zones, not rigid lines. Adapt your trading strategy based on market conditions,” advises renowned trader Peter Brandt.

- “Use multiple time frames to identify higher probability support and resistance levels,” emphasizes technical analyst Kathy Lien.

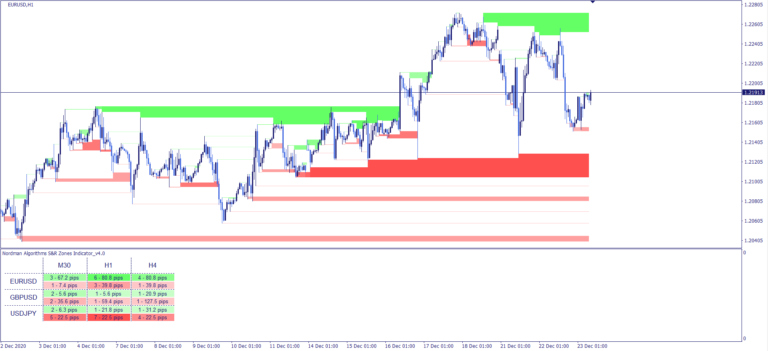

Forex Support Resistant Zone Indicator Mt4

Conclusion

Navigating the complex world of forex can be daunting, but mastering the concept of support and resistance zones empowers traders with a powerful tool. By understanding their significance, identifying them effectively, and implementing strategic trading techniques, you can enhance your trading performance and unlock the potential for consistent profits.

Remember, every successful trade begins with solid preparation and a deep understanding of the markets. Embrace the power of support and resistance zones and embark on a transformative journey towards forex trading success.