Imagine the exhilaration of identifying a hidden gem in the turbulent waters of the Forex market. Imagine recognizing an uptrend line that whispers the promise of significant profits. It’s a thrilling experience that can transform your trading journey. This guide will equip you with the knowledge you need to spot these golden opportunities and navigate the market with unwavering confidence.

Image: choose-forex.com

Up Trend Lines: A Gateway to Profitable Trades

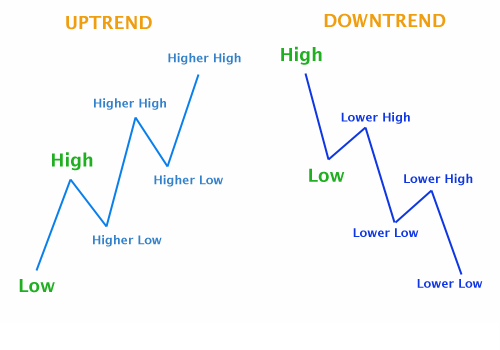

An uptrend line represents a diagonal line connecting a series of rising lows. It signifies that an asset’s price is trending upwards, indicating a bullish market sentiment. Traders use uptrend lines to identify potential breakout points and profit from price rallies. They act as a valuable technical analysis tool that helps predict market trends and optimize trading decisions.

Understanding the Mechanics of Up Trend Lines

Constructing an uptrend line requires marking two lows on a price chart. The first low should be further left on the chart than the second low. Draw a straight line connecting these two points. The resulting line is the uptrend line. As price remains above the line, it indicates an ongoing upward trend. A break below the line signals a potential trend reversal.

The slope of the trend line offers insights into the strength of the trend. A steeper slope indicates a more robust trend, while a gentler slope suggests a weaker trend. Several uptrend lines can coexist on a price chart, representing different timeframes and indicating multiple opportunities.

Spotting Up Trend Lines with Precision

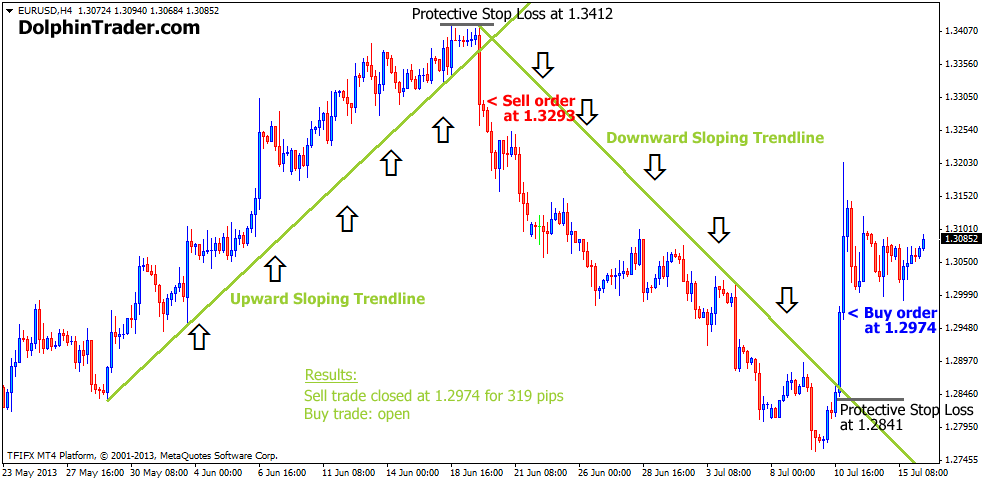

Image: www.dolphintrader.com

1. Use a Line Chart

Line charts are the foundation for identifying uptrend lines. They display raw price data without additional indicators or distractions, making it easier to observe price movements and establish trend lines.

2. Identify Swing Lows

Swing lows represent points where price retraces to a lower level but fails to break below a previous low. These lows serve as the anchor points for constructing uptrend lines.

3. Draw the Line and Test its Validity

Connect the identified swing lows with a diagonal line. If the price continues to rise and remains above the trend line, it confirms the trend’s validity. However, if price breaks below the line, the trend may be reversing or consolidating.

Exploiting Up Trend Lines for Profitable Trading

Up trend lines offer a versatile tool for devising profitable trading strategies:

1. Buy Signals

As long as price remains above an uptrend line, it presents potential buy opportunities. When price touches or approaches the line, watch for bullish confirmation signals, such as a break above a moving average or a candlestick pattern indicating a reversal.

2. Sell Signals

A break below an uptrend line often indicates a trend reversal and a potential selling opportunity. However, it’s crucial to confirm the break using other technical indicators and wait for a retest of the trend line as support before executing a sell trade.

3. Position Sizing

Use uptrend lines to determine proper position sizing. Enter larger positions when price is positioned far above the trend line and closer to its previous high. Reduce positions as price approaches the trend line to manage risk and protect profits.

Frequently Asked Questions

Q: Can uptrend lines be used on any financial instrument?

A: Yes, uptrend lines are applicable to all financial instruments, including stocks, Forex pairs, commodities, and indices.

Q: How do I determine the significance of an uptrend line?

A: The significance of an uptrend line depends on its duration, slope, and consistency. Stronger lines are validated by a longer duration, a steeper slope, and numerous successful tests by price.

Forex Trading Up Trend Lines

Conclusion

Mastering the art of identifying uptrend lines in Forex trading is a skill that unlocks countless opportunities for profit. By carefully studying the techniques outlined in this guide, you can increase your trading confidence, make well-informed decisions, and leverage market trends to maximize your returns. Are you ready to conquer the Forex market with precision and profitability? Embrace the power of uptrend lines today and embark on a journey of trading success.