Every trader aspires to make profitable decisions in the fast-paced forex market. Navigating its complexities requires precise tools that enhance your ability to predict price movements. Enter the forex weekly pivot points indicator, a beacon of clarity amidst the market’s turbulence. Join us as we embark on a comprehensive journey into the realm of pivot points, empowering you to harness their potential and transform your trading strategies.

Image: learnpriceaction.com

Before we delve into the intricacies of pivot points, it’s essential to establish a solid foundation. A pivot point, in essence, serves as a crucial reference point in price action. Traders meticulously calculate pivot points based on previous trading sessions’ high, low, and closing prices. These pivotal levels serve as potential support or resistance levels, providing valuable insights into market sentiment.

Imagine yourself navigating a treacherous mountain pass, where every twist and turn holds surprises. Pivot points act as signposts, guiding you through the complexities of price movements. They reveal potential areas where prices may encounter resistance or support, arming you with knowledge to anticipate market turns.

Forex weekly pivot points, as the name suggests, focus on a broader timeframe, encompassing a week’s worth of trading data. By incorporating a longer-term perspective, weekly pivot points offer a panoramic view of market trends, helping you decipher the ebb and flow with enhanced precision.

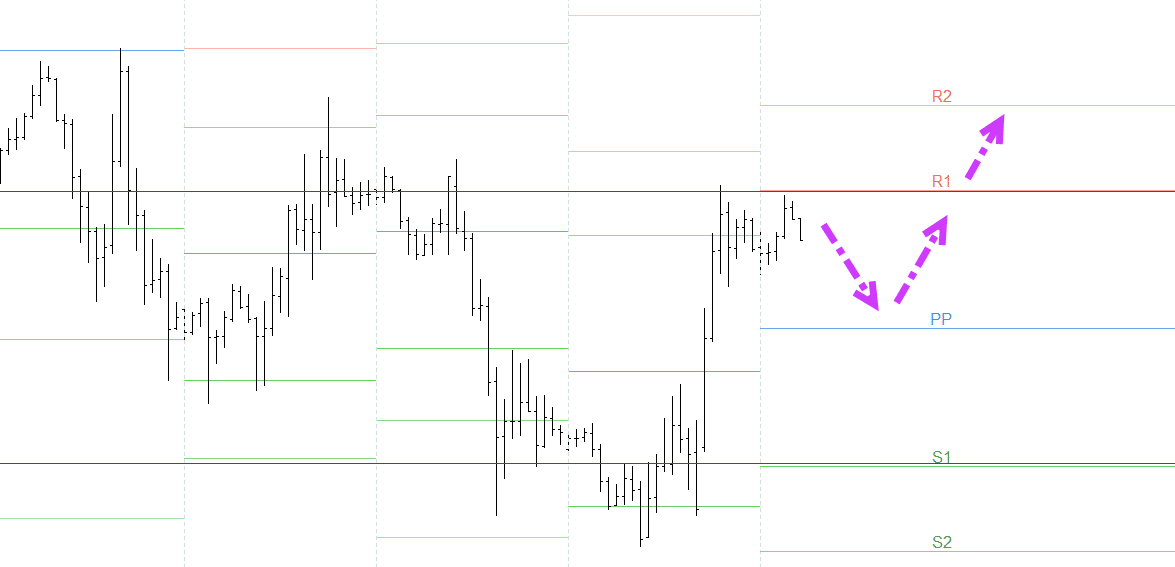

Mastering the art of utilizing weekly pivot points requires a deep understanding of their calculation. The central pivot point, denoted as “P,” forms the foundation. It is derived by taking the average of the previous session’s high, low, and closing prices. Once “P” is established, a series of additional pivot points are calculated, including resistance levels (R1, R2, R3) and support levels (S1, S2, S3).

To illustrate, consider a hypothetical scenario where the previous session closed with a high of 1.2000, a low of 1.1800, and a close of 1.1900. Using these values, we calculate the central pivot point “P” as (1.2000 + 1.1800 + 1.1900) / 3 = 1.1900. From this central pivot, we derive the resistance levels R1 (1.2020), R2 (1.2140), R3 (1.2260) and the support levels S1 (1.1780), S2 (1.1660), and S3 (1.1540).

Armed with these calculated pivot points, traders can begin to anticipate potential price movements. Prices often gravitate toward pivot points, either bouncing off support levels or facing resistance at higher levels. Identifying these key levels empowers traders to make informed decisions, entering and exiting trades at optimal points.

Of course, relying solely on pivot points would be akin to navigating treacherous waters with an incomplete map. To enhance your trading prowess, consider combining weekly pivot points with other technical analysis tools. Moving averages, Bollinger Bands, and Fibonacci retracements can provide complementary insights, painting a more comprehensive picture of market dynamics.

As with any valuable tool, understanding the limitations of forex weekly pivot points is crucial. While they offer powerful insights, they do not guarantee foolproof predictions. Market conditions are inherently dynamic, and prices may deviate from pivot point levels. Volatility, market sentiment, and unexpected news events can all influence price action, sometimes leading to deviations from anticipated pivot point behavior.

Traders must approach pivot points as a valuable addition to their trading toolkit, not as a substitute for comprehensive market analysis. By incorporating weekly pivot points into your trading strategy, you gain an edge in deciphering market trends and making informed decisions.

In conclusion, forex weekly pivot points are a time-tested tool, empowering traders with invaluable insights into price movements. Calculated based on past trading data, pivot points serve as signposts, indicating potential support and resistance levels. By embracing the power of weekly pivot points, you unlock a deeper understanding of market movements and enhance your ability to navigate the challenges and opportunities the forex market presents.

Image: www.pinterest.com

Forex Weekly Pivot Points Indicator Mt4