In the labyrinthine world of forex trading, where currencies dance in a perpetual symphony of supply and demand, the accurate calculation of exchange rates is paramount. As traders navigate the fluctuating markets, they must grapple with the enigmatic concept of 0.0139 – the standard lot size. Embark on a journey of enlightenment as we delve into the intricate details of forex calculations, empowering you to conquer the complexities of the currency exchange.

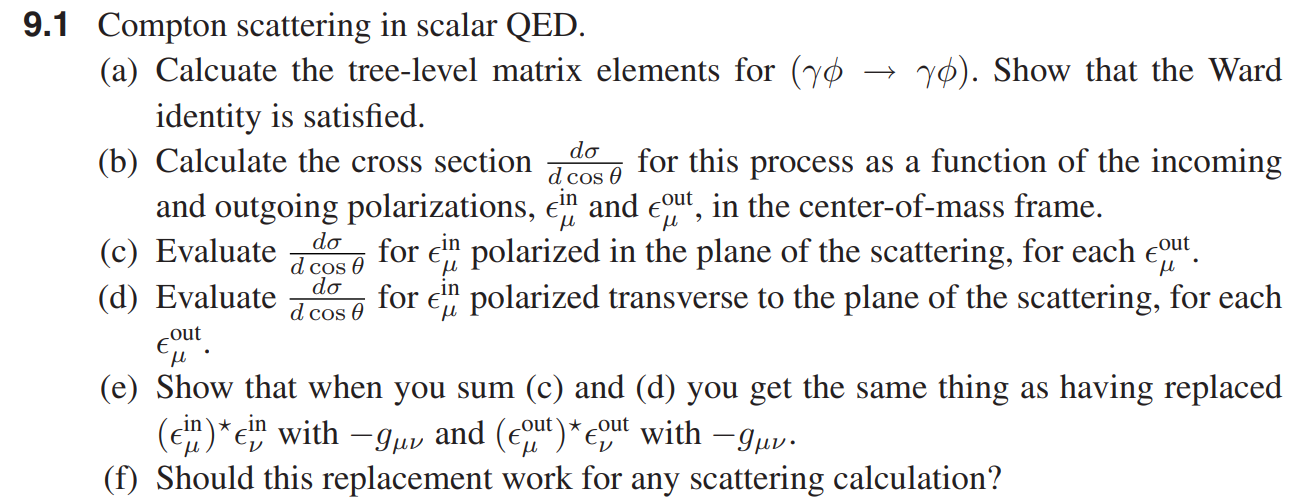

Image: www.chegg.com

Demystifying the Standard Lot: 100,000 Units of Curiosity

To unravel the mystery behind 0.0139, we must first comprehend the concept of a standard lot. Envision a bustling marketplace where currencies are traded in varying denominations, akin to different sizes of bags. The standard lot, the most prevalent unit of measurement, embodies a monumental quantity of 100,000 units of the base currency. This hefty figure serves as the foundation for all forex calculations, providing a steadfast benchmark amidst the ebb and flow of exchange rates.

Unveiling the Essence of Pips: Precision in a Miniature World

Pips, the fundamental building blocks of forex calculations, represent the minute fluctuations in currency values. Each pip embodies a fractional movement of 0.0001, equivalent to a single unit of the quoted currency. These minuscule variations, measured in increments of the fourth decimal place, are the lifeblood of forex trading, signaling shifts in market sentiment and influencing investment decisions.

Dissecting the Calculation: Unlocking the Formula

The crux of forex calculations lies in comprehending the relationship between pips, lot size, and the exchange rate. Let us unravel the formula that governs this intricate dance:

Pip Value = (Lot Size / Exchange Rate) x Pip Movement

Imagine yourself as a seasoned trader, scrutinizing the exchange rate between the enigmatic euro and the stalwart US dollar. The current rate stands at 0.9235. With a standard lot of 100,000 euros at your disposal, you seek to determine the pip value. Plugging these figures into the formula, we arrive at:

Pip Value = (100,000 / 0.9235) x 0.0001 = 10.82

This calculation reveals that each pip movement in the EUR/USD pair will result in a fluctuation of 10.82 US dollars. Armed with this knowledge, you now possess the power to assess potential gains or losses with unmatched precision.

Image: hi.octafx.com

Embracing the Nuances: Beyond the Standard Lot

While the standard lot reigns supreme, forex traders are not confined to its boundaries. Mini lots, representing 10,000 units of the base currency, and micro lots, embodying a mere 1,000 units, offer traders greater flexibility in scaling their positions. Understanding the nuances of these lot sizes is essential for navigating the currency markets with finesse.

Empowering Traders: Harnessing the Knowledge

Now, armed with the intricate knowledge of forex calculations, you stand at the threshold of a transformative trading experience. No longer will 0.0139 remain an enigma but instead serve as a beacon of clarity, guiding your every move. Trade with confidence, knowing that you possess the tools to navigate the treacherous waters of currency exchange.

How To Calcuate Forex 0.0139

Conclusion: Unlocking the Gates of Triumph

As you embark on this exhilarating journey, remember that mastery of forex calculations is not a mere destination but an ongoing quest for knowledge and precision. Embrace the challenges, delve into the intricacies, and witness your trading prowess soar to unprecedented heights. May your pips yield bountiful harvests, and may the markets bow to your astute calculations.