Captivating Introduction

In the bustling world of financial markets, traders seek to navigate the volatile waters like seasoned seafarers. Understanding volatility, the measure of price fluctuations, becomes paramount for successful trading strategies. The volatility ratio, a crucial technical indicator, provides invaluable insights into market dynamics, enabling traders to make informed decisions amid market gyrations.

Image: forextraininggroup.com

Comprehending the Volatility Ratio

The volatility ratio, meticulously calculated as the ratio of the current range of prices to the average trading range over a defined period, quantifies the extent of price volatility in the market. It measures the current market’s volatility relative to its historical norm. A high ratio indicates heightened volatility, while a low ratio suggests a relatively stable market.

Unleashing the Power of Volatility Ratio

The volatility ratio empowers traders with a multi-faceted understanding of market conditions:

-

Gauging Market Sentiment: Extremes in volatility ratio often coincide with shifts in market sentiment. Spikes in volatility ratio may signal heightened fear or uncertainty, while sustained low ratios indicate complacency or a lack of conviction among traders.

-

Identifying Trading Opportunities: Volatility ratio fluctuations can uncover lucrative trading opportunities. When the ratio is low, traders may anticipate potential breakouts or reversals, indicating the potential for substantial price movements. Conversely, high volatility ratios suggest caution, as the market’s erratic nature may lead to substantial losses.

-

Setting Stop-Loss and Take-Profit Orders: The volatility ratio plays a pivotal role in determining appropriate stop-loss and take-profit levels. Traders can adapt these levels based on the current volatility ratio, ensuring they are not prematurely stopped out or miss significant profit opportunities.

-

Fine-tuning Trading Strategies: Each trading strategy has an optimal volatility environment. By considering the volatility ratio, traders can tailor their strategies to align with prevailing market conditions, maximizing their chances of success.

Expert Insights and Actionable Tips

Renowned market analysts emphasize the importance of integrating volatility ratio into trading strategies:

- John Bollinger: “The volatility ratio is a fundamental element of technical analysis that provides valuable insights into market behavior.”

- Alexander Elder: “Understanding volatility ratio is critical for managing risk effectively and optimizing trading performance.”

Actionable Tips for Utilizing Volatility Ratio:

-

Monitor Volatility Trends: Closely track the volatility ratio over time to identify emerging trends and anomalies.

-

Correlate Data with Other Indicators: Integrate the volatility ratio with other technical indicators like moving averages or oscillators to enhance your analysis.

-

Adjust Leverage Appropriately: Align your leverage strategy with the volatility ratio. Higher volatility warrants lower leverage to mitigate potential risks.

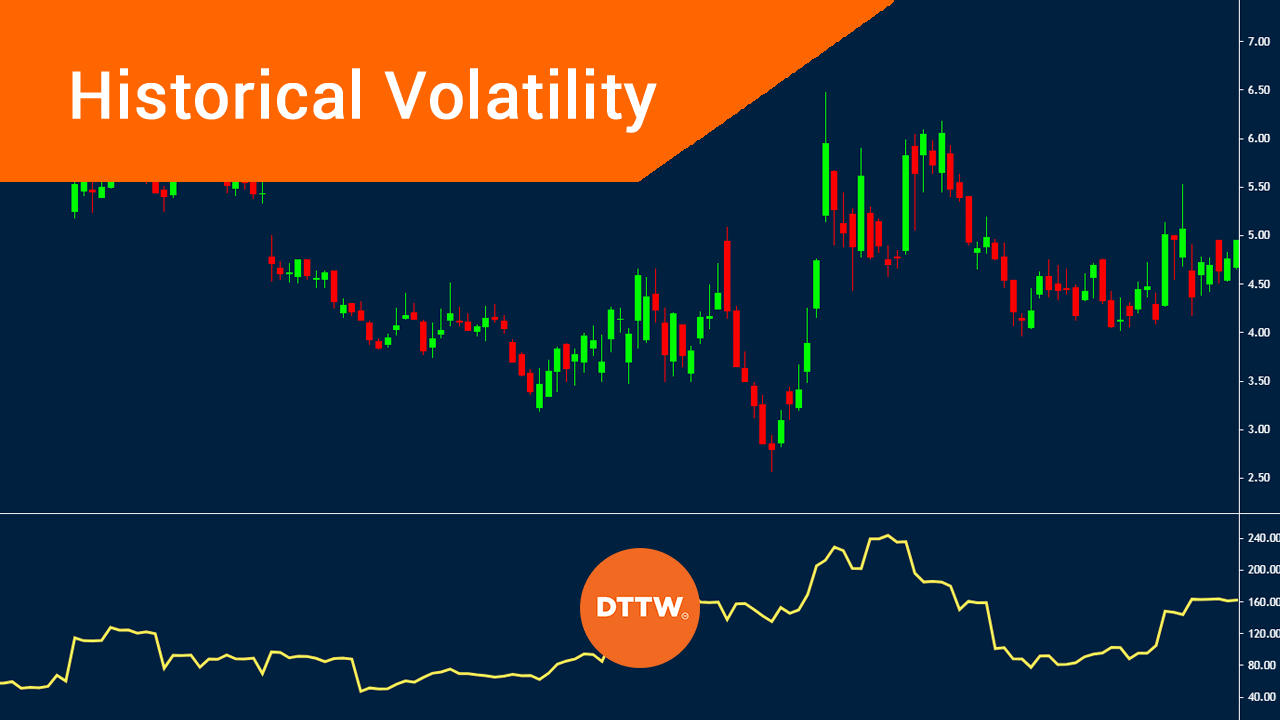

Image: www.daytradetheworld.com

How To Use Volatility Ratio In Forex

Conclusion

The volatility ratio, an indispensable technical indicator, empowers traders with a profound understanding of market dynamics. By incorporating volatility ratio into their trading strategies, traders can navigate market volatility, identify potential opportunities, fine-tune their approaches, and achieve greater success in the ever-changing world of forex trading.