Introduction:

Navigating the volatile world of forex trading requires astute decision-making and a profound understanding of market dynamics. Embracing advanced technologies like IBM Watson empowers traders with cutting-edge tools to enhance their strategies and maximize profits.

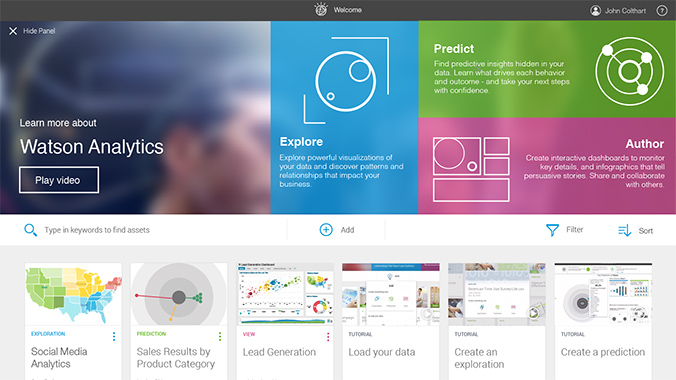

Image: www.betterbuys.com

IBM Watson, the cognitive computing system, is transforming industries by processing massive data volumes and unveiling hidden insights. Its capabilities in forex trading unlock a realm of possibilities for traders seeking an edge in this competitive market.

Comprehending Watson’s Architecture and its Applications:

IBM Watson comprises multiple layers, including a knowledge repository, a natural language processing engine, and machine learning algorithms. This powerful system ingests vast quantities of financial data, including historical market movements, economic indicators, and news feeds. Watson then analyzes this data using advanced algorithms, extracting valuable insights and identifying trading opportunities.

Harnessing Watson’s capabilities, forex traders can gain a comprehensive view of market trends, anticipate price movements, and optimize their trading strategies. The system’s predictive analytics provide traders with actionable insights, empowering them to fine-tune their positions and minimize risks.

Decoding Market Dynamics with Watson’s Cognitive Abilities:

Watson’s cognitive abilities empower forex traders in numerous ways. Firstly, it offers in-depth market analysis by identifying patterns and anomalies within historical data. This enables traders to understand market cycles and make well-informed decisions.

Secondly, Watson provides real-time insights into market sentiment, analyzing newsfeeds and social media platforms. By assessing market sentiment, traders can gauge the collective情绪,并相应地调整自己的策略

Thirdly, Watson’s machine learning algorithms learn from past trades and identify successful trading strategies. Traders can leverage these strategies to improve their performance and increase their profitability.

Enhancing Portfolio Performance with Watson’s Precision:

Integrating IBM Watson into forex trading enhances portfolio performance through several key benefits:

- Enhanced Risk Management: Watson’s predictive analytics pinpoints potential risks, enabling traders to make informed decisions and mitigate losses.

- Optimized Trade Execution: The system analyzes market conditions and identifies optimal entry and exit points, ensuring timely trade execution and profit maximization.

- Personalized Trading Strategies: Watson’s tailored insights empower traders to develop customized strategies that align with their risk appetite and trading goals.

- Adaptive Learning: The system continuously learns from historical and real-time data, refining its insights and adapting to changing market conditions.

Conclusion:

IBM Watson’s integration into forex trading marks a paradigm shift, leveling the trading field for both seasoned professionals and aspiring traders. Its cognitive capabilities and predictive analytics enable traders to unlock a world of possibilities, enhancing their performance, mitigating risks, and maximizing profits. Embracing Watson is akin to harnessing the power of the future to conquer the challenges of forex trading and secure financial success.

Image: www.element61.be

Ibm Watson For Forex Trading