India’s foreign exchange reserves, a cornerstone of the country’s economic stability, have taken center stage in recent discussions surrounding monetary policy and financial security. Forex reserves, composed primarily of foreign currencies, gold, and special drawing rights (SDRs), play a pivotal role in managing balance of payments, stabilizing currency fluctuations, and bolstering economic growth.

Image: civilspedia.com

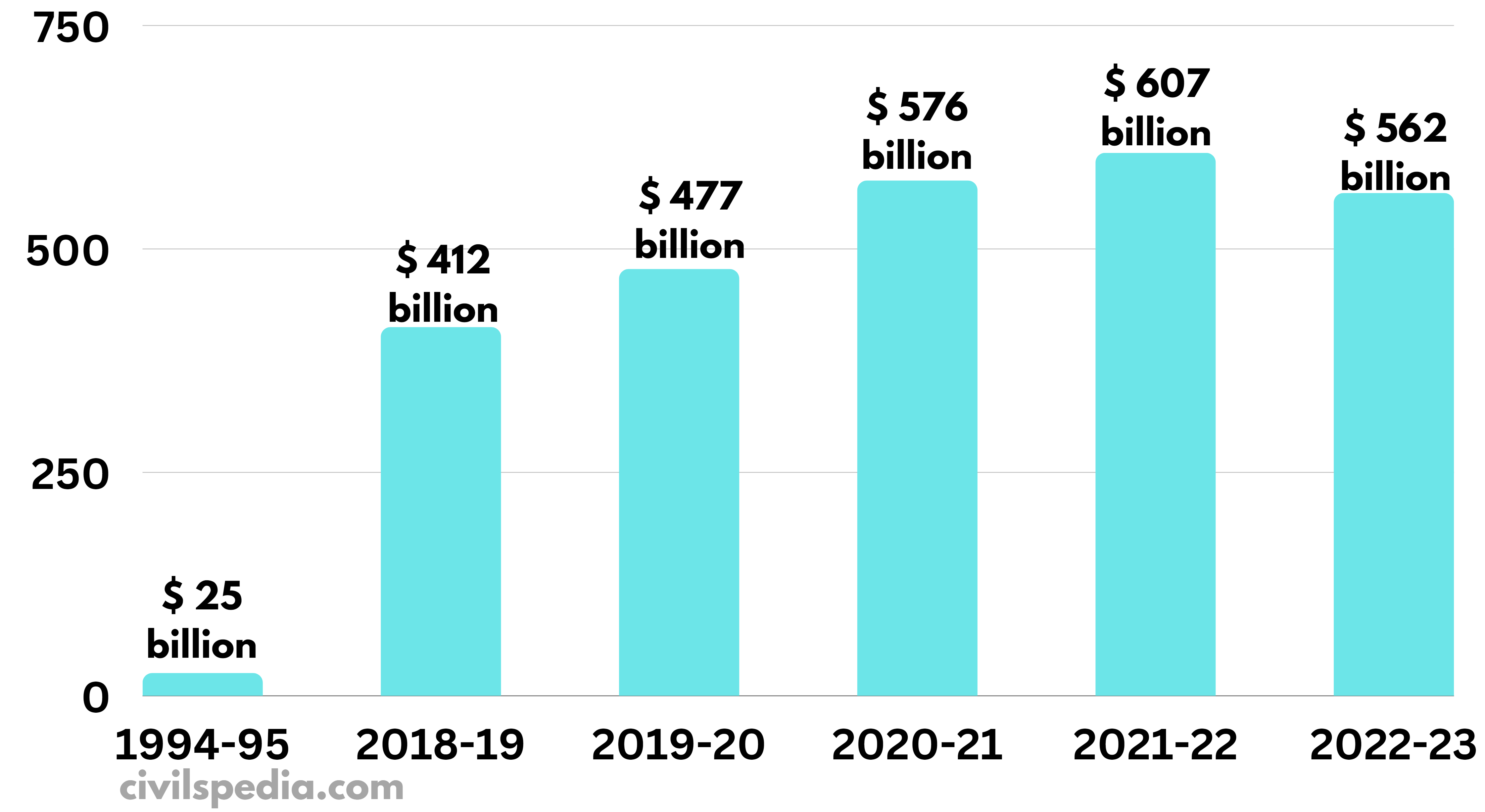

The trajectory of India’s forex reserves has been closely scrutinized by economists and policymakers alike. In the wake of the COVID-19 pandemic, the country’s reserves surged significantly, buoyed by foreign inflows and a widening trade surplus. Robust remittances from the Indian diaspora and record foreign direct investment further fortified the forex buffer, providing a buffer against external economic shocks.

Importance of Forex Reserves

India’s forex reserves serve several fundamental functions that underscore their strategic importance:

- Exchange Rate Stability: Ample forex reserves enable the Reserve Bank of India (RBI) to intervene in the currency market to moderate exchange rate volatility. This is crucial for maintaining price stability, preventing inflation, and ensuring predictable conditions for international trade.

- Debt Repayment: Foreign exchange reserves provide a safety net for servicing external debt obligations, including sovereign debt and corporate borrowings. The availability of reserves ensures that India can meet its international financial commitments and avoid default risks.

- Import Cover: Forex reserves offer a cushion to support import payments. In times of balance of payment constraints, adequate reserves ensure that essential imports, such as energy and raw materials, can be financed without disruption.

- Economic Growth: Forex reserves create a conducive environment for sustainable economic growth by mitigating external risks and fostering investor confidence. Foreign investors are more likely to invest in a country with a robust forex reserve position, as it signals monetary stability and economic resilience.

Recent Trends in India’s Forex Reserves

In recent months, India’s forex reserves have witnessed a gradual decline due to factors such as the rising cost of energy imports, a widening trade deficit, and capital outflows triggered by geopolitical uncertainties. However, the decline has been managed cautiously by the RBI, which has utilized a mix of market interventions and policy tools to maintain relative exchange rate stability.

Comparative Analysis: India vs. Pakistan

A comparative analysis of India’s forex reserves with those of its neighbor, Pakistan, highlights the contrasting economic scenarios of the two countries.

India’s forex reserves currently stand at around $580 billion, representing approximately 10 months of import cover. In contrast, Pakistan’s forex reserves have dwindled to a critically low level of around $5.9 billion, providing less than 2 months of import cover. This stark difference underscores India’s stronger external economic position and greater resilience to external shocks.

Image: www.civilsdaily.com

India Forex Reserve Pak Dawn

Conclusion

In conclusion, India’s forex reserves play a multifaceted role in safeguarding the country’s economic stability and fostering sustainable growth. The RBI’s prudent management of these reserves has been instrumental in anchoring exchange rate fluctuations, mitigating external vulnerabilities, and maintaining investor confidence. While the recent decline in reserves warrants monitoring, India’s strong economic fundamentals and strategic reserve position provide a solid foundation for continued financial resilience.