In the bustling labyrinth of forex, a force both enigmatic and relentless, inflation weaves its intricate dance. Like the intertwining currents of a river, demand and supply meet and mingle, sculpting the economic landscape and dictating the ebb and flow of currencies.

Image: mungfali.com

Inflation, in its essence, is the relentless rise in prices of goods and services. This upward spiral has a profound impact on our lives, eroding the purchasing power of our hard-earned money, and amplifying the cost of everyday necessities. To comprehend the intricate relationship between inflation, demand, and supply, we must delve into the economic trenches where these forces converge.

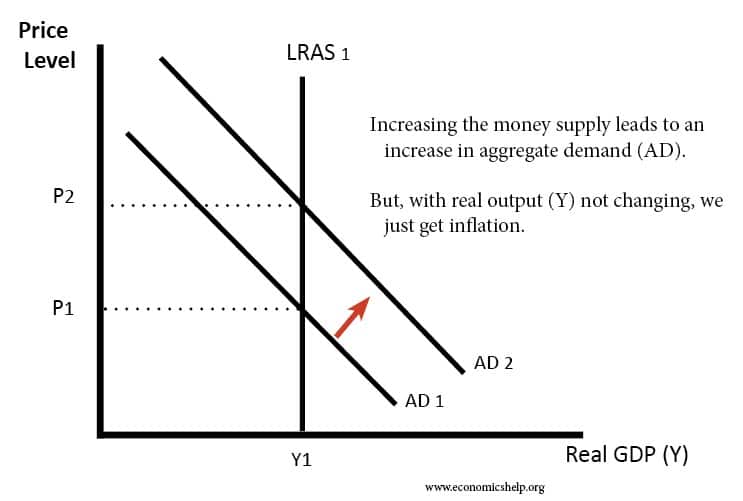

Firstly, let us consider the role of demand. As consumers, our desires for goods and services drive the economic engine forward. When demand outstrips supply, businesses can confidently raise prices, knowing that eager buyers will flock to their doorstep. This scenario sparks the flames of inflation, as the rising cost of producing goods and services is passed on to consumers through higher prices.

Conversely, when supply exceeds demand, a different dynamic unfolds. Businesses are compelled to lower prices to entice cautious consumers, leading to a deflationary environment. This decline in prices has a chilling effect on the economy, discouraging investment and economic growth.

Understanding the interplay of demand and supply is paramount for central banks, the watchful guardians of economic stability. When inflation threatens to overheat the economy, central banks intervene by raising interest rates. This move makes borrowing more expensive, curtailing demand and reining in runaway prices. Conversely, when deflationary pressures loom, central banks lower interest rates, stimulating demand and encouraging businesses to invest and hire.

In the realm of forex, inflation plays a pivotal role in currency valuation. When a country experiences relatively high inflation compared to its trading partners, its currency tends to depreciate. This devaluation makes exports cheaper and imports more expensive, helping to adjust the balance of trade. Conversely, a country with low inflation can see its currency appreciate, making imports cheaper and exports more expensive.

The delicate dance of inflation, demand, and supply is a constant feature of the forex market, with their intricate interactions shaping the relative value of currencies. As investors and traders, it is imperative to stay attuned to these forces, discerning their impact on the forex landscape.

In the ever-evolving realm of forex, the enigmatic dance of inflation, demand, and supply continues to captivate and influence. By deciphering the nuances of this intricate relationship, we gain the power to navigate the volatile currents of the global economy with greater clarity and confidence.

Image: www.victoriana.com

Inflation Relation With Demamd And Supply In Forex