As a forex trader, mastering candlestick patterns is like unlocking the secret vault to the financial markets. These visual representations of price action can reveal hidden insights into market sentiment and support strategic trading decisions.

Image: postandlintel.eu

From simple to complex, various candlestick patterns each hold unique significance. Let’s embark on a journey to understand their nuances, empowering you with the knowledge to navigate the ever-changing forex landscape.

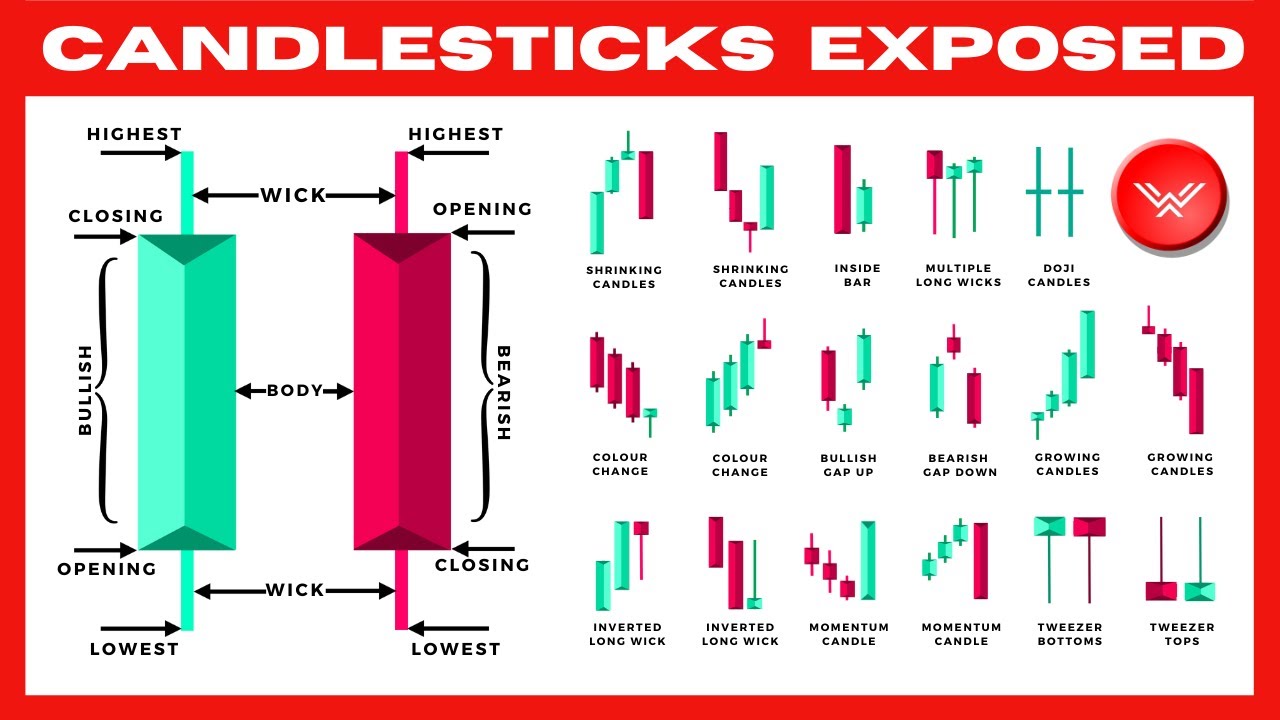

The Anatomy of a Candlestick

A candlestick is a powerful graphical element that depicts the movement of a financial asset over a specific period, typically an hour, day, or week. It consists of:

- Body: The filled portion of the candlestick, representing the price range between the open and close.

- Wicks: Thin lines extending above and below the body, indicating the highest and lowest prices reached during the period.

- Open: The starting price of the asset for the period.

- Close: The ending price of the asset for the period.

Bullish and Bearish Candlesticks

Candlesticks are classified as either bullish or bearish, based on their color and shape:

- Bullish Candlesticks: Green or white in color, with the opening price below the closing price, indicating an upward market trend.

- Bearish Candlesticks: Red or black in color, with the closing price below the opening price, indicating a downward market trend.

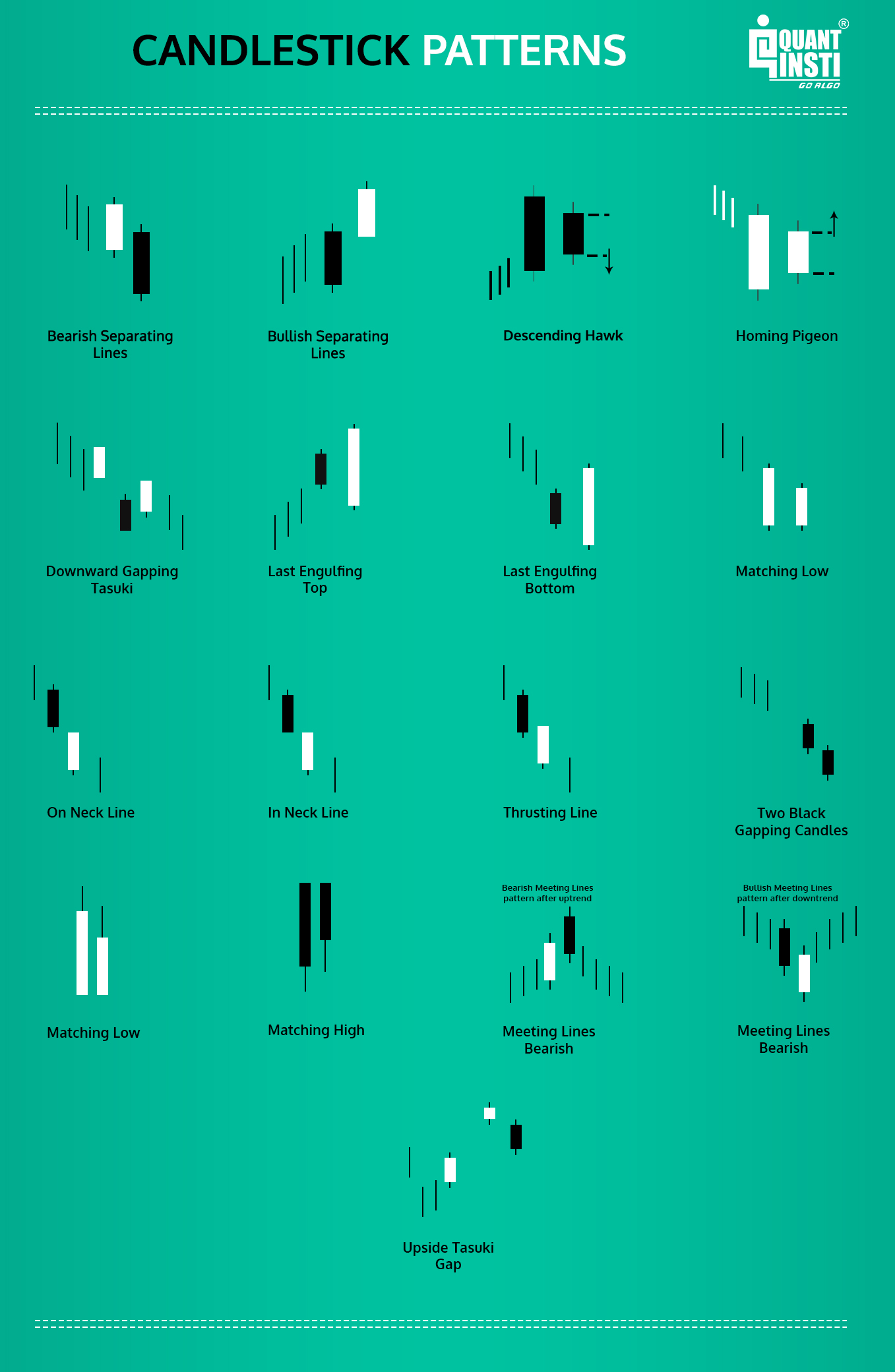

Popular Candlestick Patterns

Experienced traders rely on numerous candlestick patterns to identify potential trading opportunities. Here are some of the most common and reliable:

- Doji: A cross-shaped candlestick with a small body and extended wicks, indicating market indecision.

- Hammer: A bullish candlestick with a small body and long lower wick, suggesting a reversal from a downtrend.

- Inverted Hammer: A bearish candlestick similar to the hammer, but with a long upper wick, indicating a potential reversal from an uptrend.

- Bullish Engulfing: A bullish pattern where a large green candle completely engulfs the previous red candle.

- Bearish Engulfing: A bearish pattern where a large red candle completely engulfs the previous green candle.

Image: creative-currency.org

Latest Trends and Developments

The forex market is constantly evolving, and so too are candlestick analysis techniques. Traders are now utilizing:

- Algorithmic Trading: Using computer algorithms to identify and execute trades based on Candlestick patterns.

- Multi-Timeframe Analysis: Considering candlestick patterns on different timeframes to uncover hidden opportunities.

- Volatility-Driven Strategies: Using candlestick patterns to determine market volatility and adapt trading strategies accordingly.

Tips and Expert Advice

Mastering candlestick patterns requires practice and a keen eye. Here’s how to improve your analysis skills:

- Start with a few patterns: Don’t try to learn everything at once. Focus on a few essential patterns and master them.

- Use multiple timeframes: Look at candlestick patterns on different timeframes to confirm signals and identify potential trend transitions.

- Combine Candlesticks with other indicators: Enhance your analysis by using Candlesticks in conjunction with technical indicators, such as moving averages or oscillators.

FAQ

- What is the most reliable candlestick pattern? There is no single most reliable pattern. The effectiveness of each pattern depends on market context.

- Can candlestick patterns predict the future? No, but they can provide valuable insights into market sentiment and potential price movements.

- How long does it take to learn candlestick patterns? With consistent practice, you can gain a good understanding of candlestick patterns within a few months.

Different Types Of Candlesticks Forex

Conclusion

Understanding the different types of candlesticks in forex trading is a cornerstone of successful market analysis. By mastering these visual cues, you can unlock the secrets of price action and make informed trading decisions. Remember, practice makes perfect. The more you analyze candlestick patterns, the better you’ll become at recognizing their significance and leveraging them for profitable trades.

Are you ready to delve deeper into the world of Candlestick patterns? Explore our comprehensive resources and start your journey towards trading mastery today!