Introduction

Are you a seasoned forex trader or just starting your journey into the world of currency trading? Maximizing exposure in lots is a paramount strategy that can elevate your profits to stratospheric heights, potentially multiplying your earnings tenfold. In this comprehensive guide, we delve deep into the concept of max exposure in lots, unraveling its intricacies and equipping you with the knowledge and strategies to reap its incredible rewards.

Image: tradeciety.com

Understanding Max Exposure in Lots

In the realm of forex trading, execution volume is measured in lots. A standard lot represents 100,000 units of the base currency, while a mini lot represents 10,000 units. When traders increase their exposure, they effectively trade with a higher number of lots, proportionally magnifying their potential profits.

Benefits of Maximizing Exposure in Lots

-

Magnify Profits: The allure of max exposure in lots lies in its ability to multiply potential profits. By leveraging a higher number of lots, traders amplify their earnings пропорционально.

-

Capitalize on Market Moves: The greater the exposure, the more traders can capitalize on even minor price movements in the market. This strategy becomes particularly lucrative during periods of high volatility.

-

Offset Drawdowns: When managed prudently, max exposure in lots can serve as a powerful tool to offset potential losses. By spreading risk across multiple trades, traders can minimize the impact of adverse price movements.

Strategies for Managing Max Exposure in Lots

-

Define Risk Tolerance: Before venturing into max exposure, it is crucial to establish a clear understanding of your risk tolerance. Your risk tolerance should guide the maximum number of lots you trade with.

-

Employ Risk Management Tools: Leverage risk management tools such as stop-loss orders and position sizing to control your risk. Stop-loss orders automatically exit trades when prices reach a predetermined level, while position sizing limits the number of lots you trade relative to your account balance.

-

Stagger Lot Execution: Avoid executing all your trades simultaneously with the same lot size. Instead, stagger your lot entries and exits to mitigate risk and optimize entry and exit points.

-

Monitor Market Conditions: Keep a watchful eye on market conditions. If volatility spikes, consider reducing your exposure or implementing more conservative risk management strategies.

-

Educate Yourself Continuously: Mastery in max exposure in lots demands ongoing education. Study market trends, technical analysis, and risk management principles to refine your strategies.

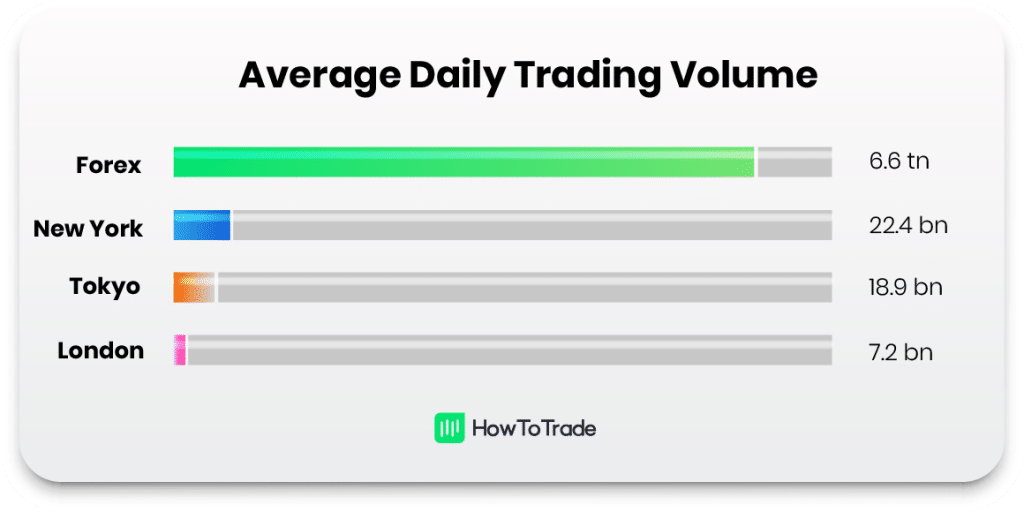

Image: howtotrade.com

Expert Insights on Max Exposure in Lots

“Max exposure in lots is a valuable strategy for experienced traders who have a deep understanding of risk management,” says renowned forex trader John Carter. “However, it’s crucial to recognize that it also carries greater potential for losses.”

“To succeed with max exposure,” advises master trader Kathy Lien, “traders must have a comprehensive trading plan, impeccable discipline, and the ability to manage their emotions effectively.”

Max Exposure In Lots Forex

Conclusion

Maximizing exposure in lots presents a transformative pathway to bolstering forex profits. By understanding the principles outlined in this guide, implementing prudent risk management strategies, and seeking expert guidance, you can harness the full potential of this powerful trading technique. Remember, risk management is the cornerstone of success in forex trading. By navigating the markets with informed decisions and controlled execution, you can unlock the doors to limitless earning possibilities.