Image: www.motivewave.com

In the dynamic world of foreign exchange (forex) trading, the concepts of momentum and volatility play pivotal roles in shaping market behavior and influencing trading decisions. While both factors are essential for maximizing trading opportunities, understanding their interplay is crucial for consistent profitability.

Momentum, a measure of price’s directional change, captures the strength and persistence of market movements. It helps traders identify and capitalize on trending markets, where prices move in a sustained direction for a period of time. Volatility, on the other hand, measures the amplitude or fluctuation of price changes. It reflects the level of market activity and can significantly impact the risk and reward potential of trades.

Momentum in Forex Trading

Momentum traders seek to identify and trade in the direction of the prevailing market trend. They believe that once a trend is established, it is likely to continue in the same direction. To assess momentum, technical indicators like moving averages, Bollinger Bands, and the Relative Strength Index (RSI) are commonly used.

Trading on momentum involves entering trades when the market shows clear directional bias and exiting when the momentum weakens or reverses. Momentum traders often use trend-following strategies, such as buying in uptrends and selling in downtrends, to capture the full profit potential of trending markets.

Volatility in Forex Trading

Volatility is an integral aspect of forex trading. It influences the risk-reward ratio of trades and can impact the decision of whether to enter or exit a position. High volatility markets offer the potential for greater profits but also expose traders to increased risk.

Traders can assess volatility using indicators such as the Average True Range (ATR) or the Volatility Index (VIX). Higher values of these indicators indicate higher levels of market volatility.

Balancing Momentum and Volatility

The key to successful forex trading lies in finding the right balance between momentum and volatility. While momentum provides the directional guidance, volatility determines the potential profit and risk involved. Traders need to consider both factors when making trading decisions.

In high volatility markets, conservative trading strategies are often preferred. Traders may opt for shorter-term trades with smaller positions to limit risk. Conversely, in low volatility markets, aggressive strategies may be more appropriate, allowing traders to hold positions for longer durations and target larger profits.

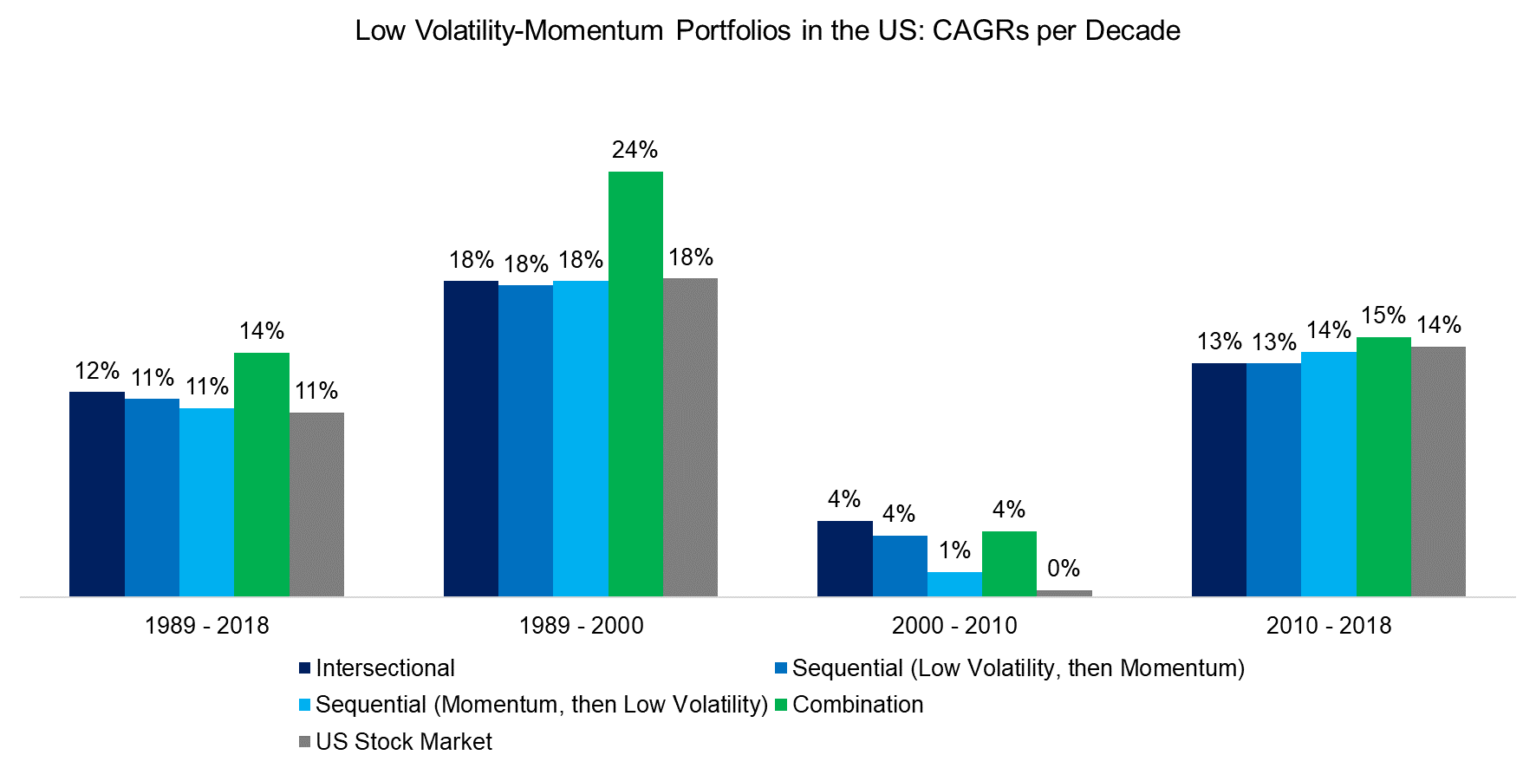

Image: alphaarchitect.com

Implications for Trading

Understanding momentum and volatility empowers forex traders with valuable insights into market behavior. Here are some practical implications for trading:

- Trend Following: Momentum trading strategies aim to identify and trade in the direction of prevailing trends. By harnessing the power of trend continuation, traders can capitalize on the momentum of the market.

- Reversal Trading: Volatility can signal potential market reversals. Traders can use volatility indicators to identify periods of high price movement and anticipate changes in market direction.

- Risk Management: Understanding volatility is crucial for effective risk management. High volatility can expose traders to greater risk, while low volatility markets provide more predictable trading conditions.

- Portfolio Diversification: By trading both trending and volatile markets, traders can diversify their portfolios and reduce overall risk. This approach allows traders to capture opportunities from different market conditions.

Momentum Vs Volatility In Forex

https://youtube.com/watch?v=0Zg-HwbD424

Conclusion

The interplay of momentum and volatility in forex trading offers traders a dynamic and rewarding environment. By mastering the concepts and developing strategies that exploit both factors, traders can navigate market fluctuations and increase their potential for profitability. Remember, the key lies in finding the right balance between momentum and volatility, tailoring trading approaches to suit different market conditions, and implementing effective risk management practices.