Introduction

Embark on a global journey or send money abroad? Understanding the fluctuating world of currency exchange rates is crucial. Especially when traveling to India, navigating through the USD to INR conversion process on platforms like ICICI Bank becomes essential. This comprehensive guide will unravel the intricacies of forex rates, empowering you with the knowledge to make informed decisions and ensure seamless currency exchange.

Image: niyudideh.web.fc2.com

Understanding Forex Rates

Forex rates determine the value of one currency against another, influenced by various economic factors like supply and demand, interest rates, inflation, and political stability. The USD to INR forex rate specifically indicates how many Indian Rupees (INR) you can get for one US Dollar (USD). A higher rate means more INR for your USD, while a lower rate implies fewer INR.

ICICI Bank’s USD to INR Forex Services

ICICI Bank, a leading financial institution in India, offers a range of currency exchange services, including USD to INR conversions. Their online platform, iMobile, and extensive network of branches across India provide convenient options for forex transactions. ICICI Bank’s competitive rates and reliable services make it a preferred choice for those seeking cost-effective and efficient currency exchange solutions.

Steps for Currency Exchange on ICICI Bank

Exchanging currency on ICICI Bank is a quick and straightforward process. Here’s how it works:

-

Opening an Account: Create a savings or current account with ICICI Bank if you don’t already have one.

-

Initiating the Transaction: Visit your nearest ICICI Bank branch or log in to iMobile and select the ‘Forex’ option.

-

Choosing Exchange Type: Select ‘Buy’ if you’re exchanging USD to INR and ‘Sell’ if you’re exchanging INR to USD.

-

Currency Details: Enter the amount of USD or INR you want to exchange and the desired exchange rate.

-

Verification and Charges: Review the transaction details, including the applicable charges and taxes.

-

Confirming the Transaction: Authorize the transaction through OTP or other verification methods.

-

Receiving the Funds: Once confirmed, the converted INR or USD will be credited to your ICICI Bank account, and you’ll receive a transaction receipt.

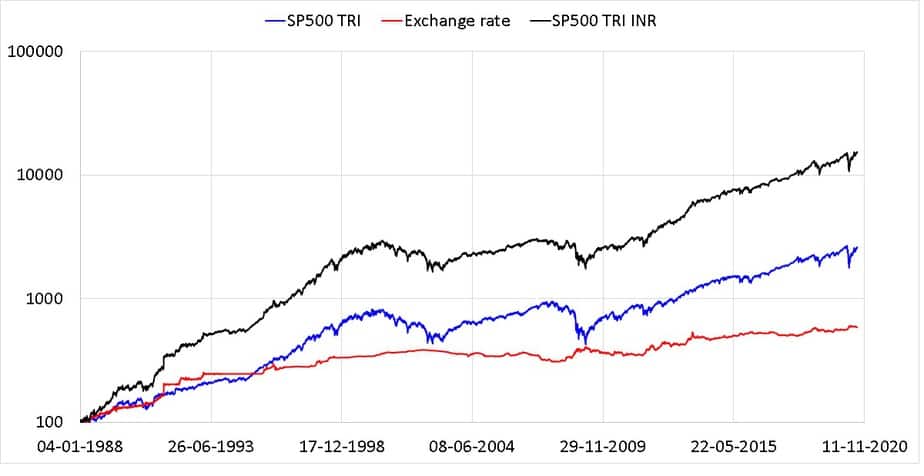

Image: freefincal.com

Tips for Best Exchange Rates

-

Monitor Exchange Rates: Keep an eye on currency fluctuations to identify the most favorable rates.

-

Bulk Transactions: Consider exchanging larger amounts at once, as banks often offer better rates for larger transactions.

-

Time of the Day: Forex rates fluctuate throughout the day. Check rates during peak hours when markets are active.

-

Negotiate: Don’t hesitate to inquire about lower charges or better exchange rates, especially when dealing with substantial amounts.

Usd To Inr Forex Rate Icici

Conclusion

Understanding the USD to INR forex rate and utilizing reliable services like ICICI Bank’s currency exchange platform can empower you to make informed decisions and secure the most favorable rates for your international transactions. Embark on your global adventures or navigate cross-border payments with confidence, knowing that you have the insights and resources to seamlessly navigate the world of currency exchange.