In the world of forex trading, precision is paramount. Understanding the nuances of pip calculation can empower you to maximize your profitability and navigate the markets with confidence. This comprehensive guide will unravel the secrets of calculating pips, unlocking your potential as a successful forex trader.

Image: www.cmcmarkets.com

Unveiling the Essence of Forex Pips

What is a Pip?

A pip, short for “point in percentage,” represents the smallest price movement in a currency pair. It measures the percentage change in the value of one currency against another. Pips are crucial for calculating profit, loss, and risk management in forex.

History and Evolution

The concept of pips originated in the early days of forex trading, when currency exchange rates were quoted in increments of 1/100 of a unit. Over time, the pip has evolved to represent increasingly smaller changes, with most currency pairs now quoted to four decimal places.

Image: www.fondazionealdorossi.org

Calculating Pips: A Simplified Approach

Pip Value Derivation

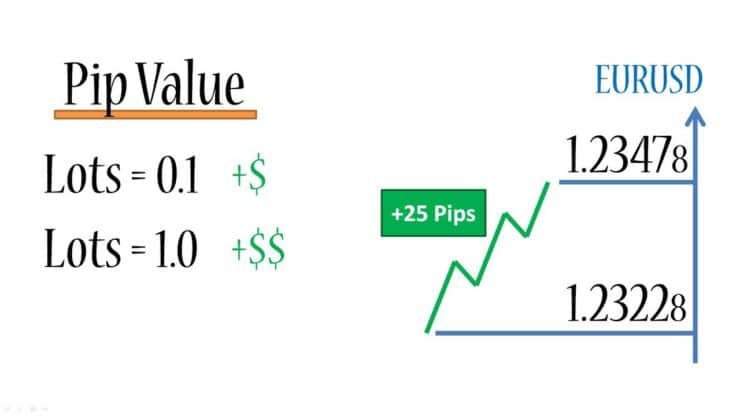

To calculate the pip value, you need to determine the exchange rate multiplier. The multiplier is simply the number of units of the quote currency in one unit of the base currency. For instance, if EUR/USD is trading at 1.2500, the exchange rate multiplier is 100,000 (1.2500 x 100,000 = 125000).

Pip Calculation Formula

The pip calculation formula is:

Pip Value = (1 Pip / Exchange Rate Multiplier) x 100

Example

Let’s calculate the pip value for EUR/USD, assuming an exchange rate multiplier of 100,000. Using the formula, we get:

Pip Value = (1 Pip / 100,000) x 100 = 0.0001

Profit Calculation and Pip Appreciation

Profit Calculation

Calculating profit in forex involves multiplying the pip value by the number of pips gained or lost. For instance, if you had an EUR/USD position of 10,000 units and closed it after a 20-pip gain, your profit would be calculated as follows:

Profit = Pip Value x Pip Gain x Position Size

Profit = 0.0001 x 20 x 10,000 = 2.00

Pip Appreciation

As the value of a currency pair increases or decreases, the pips also appreciate or depreciate. A one-pip appreciation означает, что значение валютной пары увеличивается на 0,0001. Similarly, a one-pip depreciation означает, что значение валютной пары падает на 0,0001.

Expert Tips and Advice for Pip Mastery

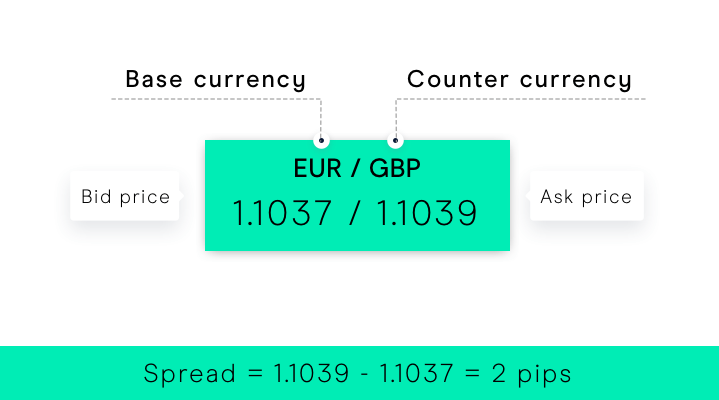

Avoid Large Spreads

When choosing a broker, consider their spreads, which represent the difference between the bid and ask prices. Smaller spreads reduce transaction costs and can significantly enhance your profitability.

Utilize Leverage Responsibly

Leverage can magnify both profits and losses. Use leverage with prudence, ensuring that your risk management strategy is robust and can accommodate potential market fluctuations.

Frequently Asked Questions on Forex Pips

Q: Why is it important to calculate pips accurately?

A: Accurate pip calculation is crucial for profit and risk management. It allows you to precisely determine your exposure, track your performance, and make informed trading decisions.

Q: How can I improve my pip calculation skills?

A: Practice regularly and develop a deep understanding of exchange rate multipliers. Use online tools or trading platforms that provide real-time pip calculations.

How To Calculate Pips In Forex

Conclusion

Mastering pip calculation in forex is a gateway to maximizing profitability and navigating the markets with confidence. By understanding the mechanics of pip calculation, you can make informed trades, control risk, and optimize your results. Whether you are a seasoned trader or just starting your forex journey, this guide will empower you to unlock the full potential of pip analysis and achieve your financial goals.

Are you ready to embrace the world of forex pip calculation and unlock the path to trading mastery?