A Comprehensive Guide to Navigating the Market

The world of forex trading offers traders a wide spectrum of opportunities, with numerous platforms vying for their attention. Choosing the optimal platform can be a daunting task, given the diverse needs and preferences of traders. In this article, we delve into the key factors to consider when selecting a forex trading platform, empowering you to make an informed decision that aligns with your trading style and goals.

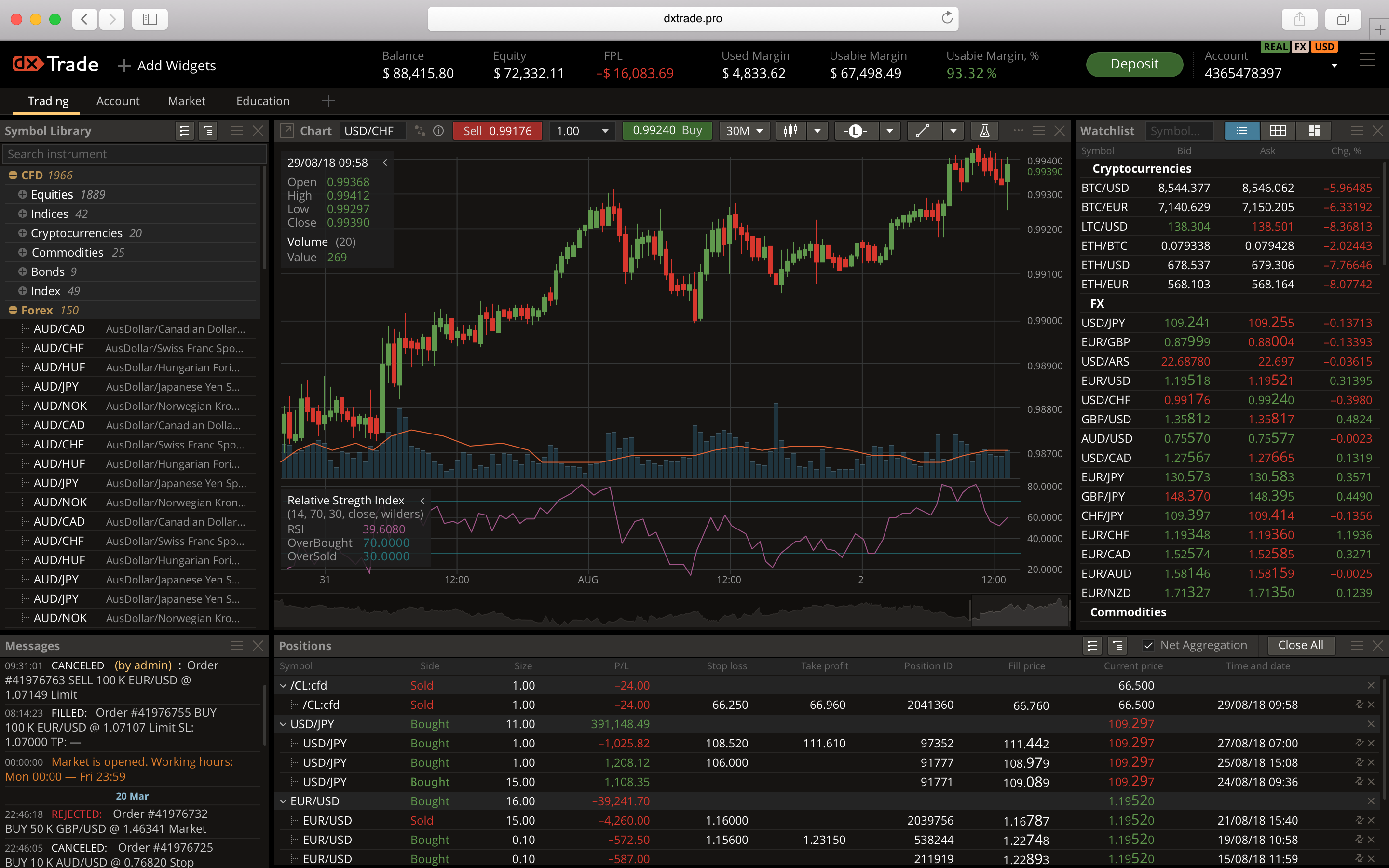

Image: hoogleko.blogg.se

Essential Features of a Forex Trading Platform

Trading Tools:

A robust platform should provide a comprehensive suite of trading tools, including:

- Real-time charting with multiple timeframes

- Technical indicators and charting tools

- Risk management tools (stop loss, take profit)

- One-click trading and advanced order types

Trading Instruments:

The platform should offer a diverse range of trading instruments, catering to different trading preferences:

- Major and minor currency pairs

- Precious metals (gold, silver)

- Commodities (oil, gas)

- Indices (S&P 500, FTSE 100)

Low Trading Costs:

Competitive trading costs are essential for profitability. Look for platforms that offer:

- Tight spreads on currency pairs

- Low commission fees

- No hidden costs or markups

Reliability and Uptime:

Stability is paramount in forex trading. Ensure the platform has:

- High uptime rates (over 99.5%)

- Robust infrastructure to handle high trading volumes

- Redundant servers for uninterrupted trading

User Interface and Ease of Use:

An intuitive user interface enhances the trading experience:

- Clear and concise navigation

- Customizable trading panels and charts

- Beginner-friendly tutorials and support

Choosing the Right Platform for Your Trading Style and Goals

Scalpers:

Scalpers aim to make multiple small profits over short periods. Choose platforms with:

- Fast order execution

- Tight spreads and low slippage

- Advanced charting tools for identifying market fluctuations

Day Traders:

Day traders close all positions before the end of the trading day. Consider platforms with:

- Real-time market data and news updates

- One-click trading and advanced order types

- Risk management tools suited for intraday trading

Swing Traders:

Swing traders hold positions for several days or weeks. Look for platforms offering:

- Comprehensive charting tools for trend analysis

- Technical indicators suited for swing trading strategies

- Extended trading hours to catch market moves

Beginner-Friendly Platforms:

For beginners, simplicity and ease of use are paramount. Choose platforms with:

- Demo accounts for risk-free practice

- Beginner-friendly tutorials and support

- Clear and accessible trading interface

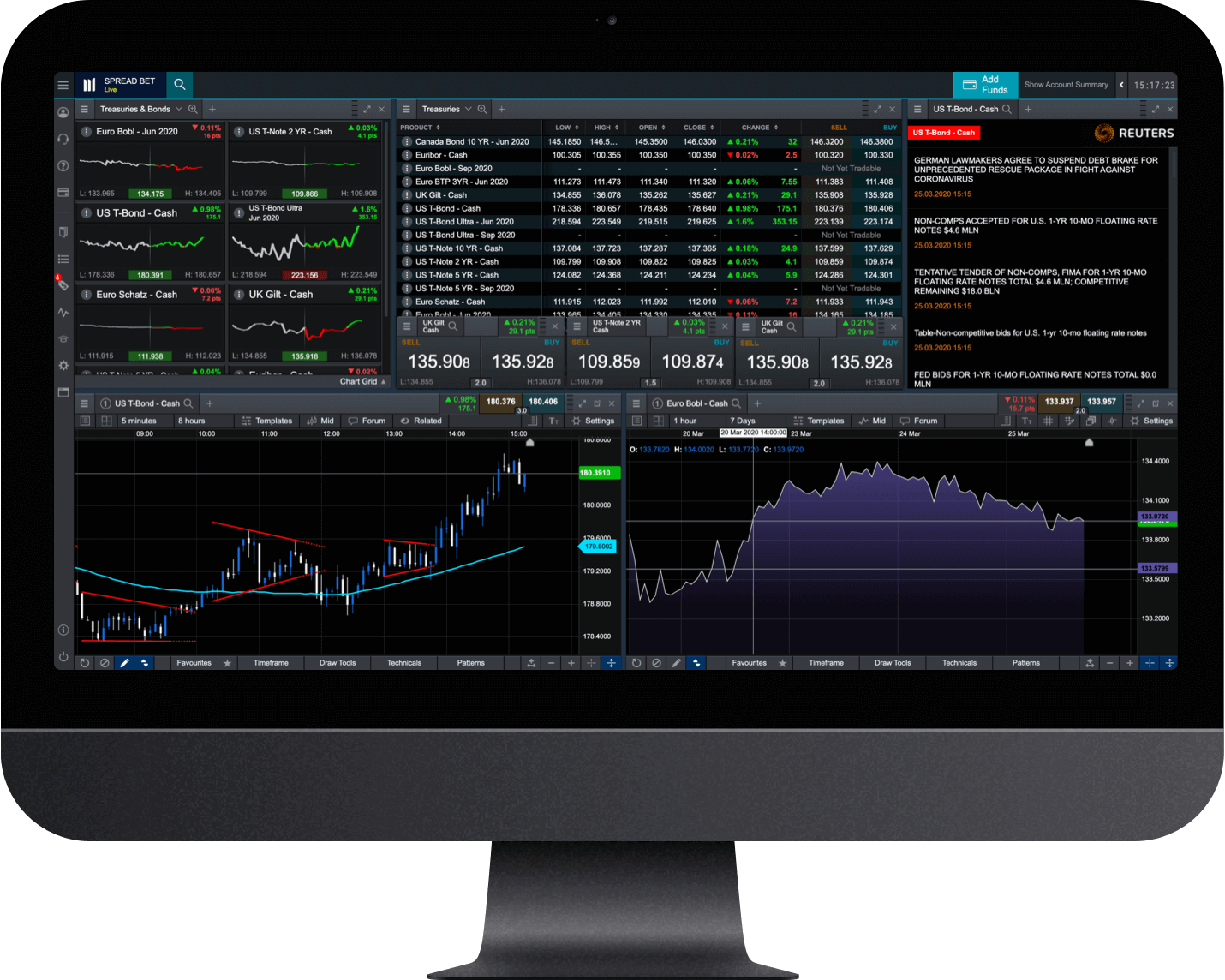

Emerging Trends in Forex Trading Platforms

Mobile Trading:

Mobile trading allows you to trade anywhere, anytime. Look for platforms with:

- Optimized mobile apps for iOS and Android

- Full functionality on mobile devices

- Biometric authentication for security

Social Trading:

Social trading platforms connect traders, allowing them to share strategies and copy top performers. Consider platforms with:

- Transparent performance tracking

- Community forums for discussion and collaboration

- Copy trading capabilities

AI-Powered Trading:

AI-powered trading platforms use algorithms and machine learning to analyze market data and generate trading recommendations. Look for platforms with:

- Algorithmic trading capabilities

- Automated risk management tools

- Data-driven insights for improved decision-making

Image: howtotradeonforex.github.io

Which Is The Best Forex Trading Platform

Conclusion

Choosing the best forex trading platform is a personal decision, influenced by your trading style, goals, and experience. By carefully considering the factors discussed in this article, you can identify a platform that meets your specific needs. Remember to factor in reliability, trading costs, and the availability of essential tools and features when making your selection.