Unlock the Power of Candlesticks: Mastering the Art of Forex Trading

Image: www.thepharma.com.br

In the realm of forex trading, the ability to decipher candlestick patterns is an invaluable skill that sets successful traders apart. These visual representations of price action offer crucial insights into市场 sentiment, momentum shifts, and potential trading opportunities’ Each candlestick holds a wealth of information, providing traders with a powerful tool for making informed decisions. In this comprehensive guide, we delve into the world of candlestick patterns, empowering you with the knowledge and techniques to elevate your trading strategy and maximize your profits.

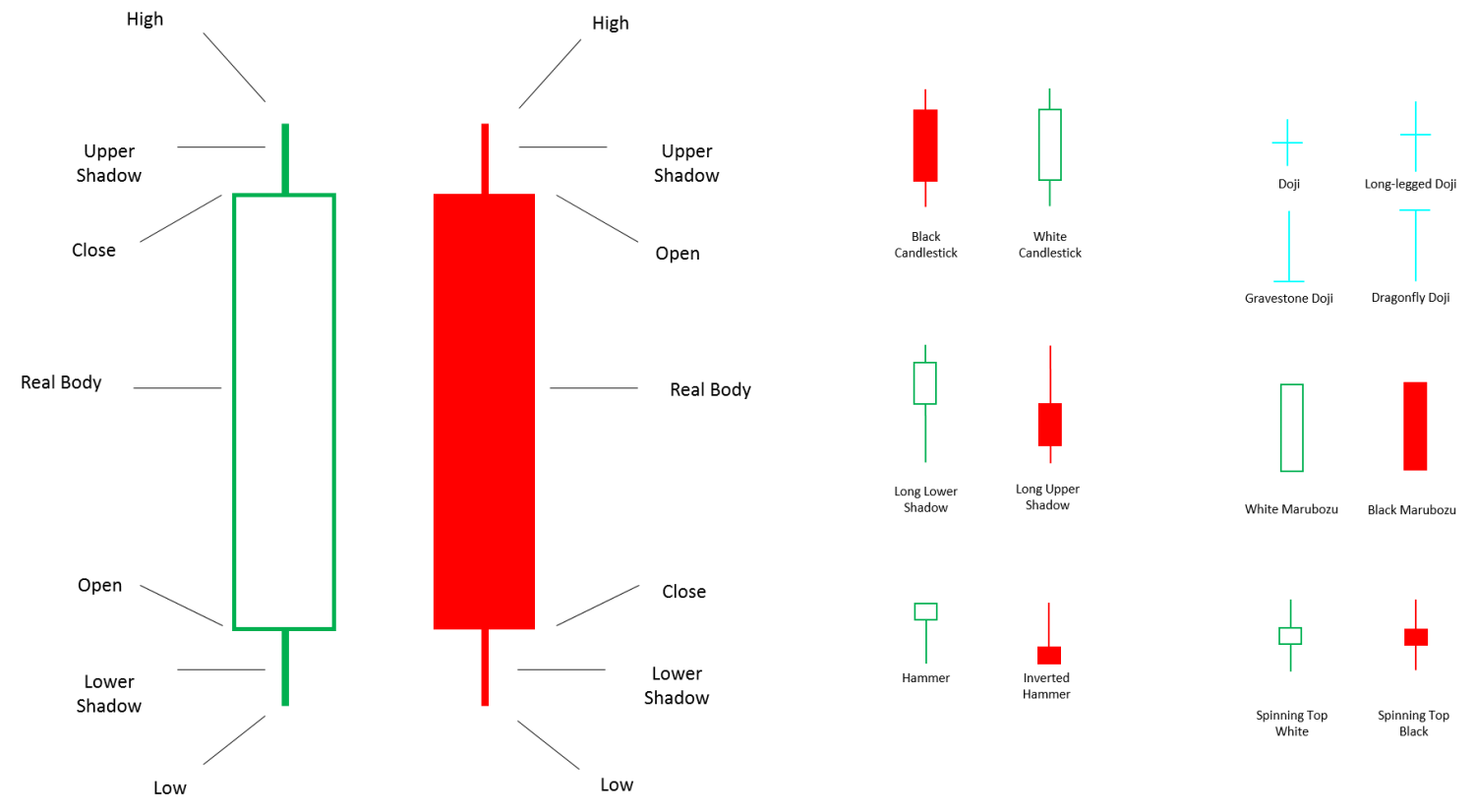

The Anatomy of Candlesticks

Candlesticks consist of four key elements:

- **Open:** The price at which the market opens during the specific timeframe represented by the candlestick.

- **Close:** The price at which the market closes during that timeframe.

- **High:** The highest price reached during the timeframe.

- **Low:** The lowest price reached during the timeframe.

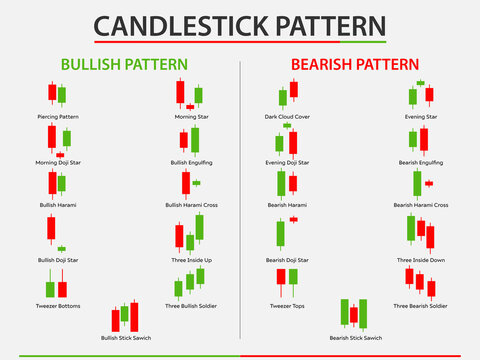

Types of Candlestick Patterns

There are numerous candlestick patterns, each with its unique characteristics and implications.

- **Bullish Patterns:** These patterns signal a potential upward trend and include patterns such as the Hammer, Bullish Engulfing, and Piercing Line.

- **Bearish Patterns:** These patterns indicate a potential downward trend and include patterns such as the Hanging Man, Bearish Engulfing, and Dark Cloud Cover.

- **Neutral Patterns:** These patterns do not provide a clear indication of future price movement and include patterns such as the Doji, Spinning Top, and Harami.

Trading with Candlestick Patterns

Candlestick patterns are not foolproof indicators of future price movements. However, when combined with other technical analysis tools and a sound understanding of market fundamentals, they can significantly enhance trading decisions.

Image: topforexbrokers.online

Identifying Trading Opportunities

Candlestick patterns can help traders identify potential entry and exit points for trades.

- **Reversal Patterns:** These patterns indicate a potential change in trend direction. For instance, a bullish reversal pattern in a downtrend may signal a buying opportunity, while a bearish reversal pattern in an uptrend may indicate a selling opportunity.

- **Continuation Patterns:** These patterns suggest that the current trend is likely to continue. A continuation pattern during an uptrend may indicate an opportunity to add to a long position, while a continuation pattern during a downtrend may present an opportunity to add to a short position.

Confirming Market Sentiment

Candlestick patterns can provide confirmation of market sentiment. A series of bullish candlestick patterns in an uptrend can strengthen the bullish bias, while a series of bearish candlestick patterns in a downtrend can reinforce the bearish bias.

Common Pitfalls to Avoid

Trading solely based on candlestick patterns is not advisable. It is important to consider other factors, such as:

- **Context:** Candlestick patterns should be interpreted within the broader market context, considering factors such as overall market sentiment, economic news, and technical indicators.

- **False Signals:** Candlestick patterns can sometimes provide false signals. It is important to have a trading plan and risk management strategies in place to mitigate potential losses.

- **Overfitting:** Relying too heavily on candlestick patterns can lead to overfitting the trading strategy. It is crucial to test and refine strategies thoroughly before implementing them with real capital.

Candlestick Pattern Forex Course Ppt

Conclusion

Mastering candlestick patterns is an essential skill for forex traders. By understanding the anatomy, types, and trading applications of candlestick patterns, traders can gain valuable insights into market behavior and make more informed trading decisions. However, it is important to approach candlestick trading with a comprehensive strategy, considering other technical analysis tools, risk management techniques, and a deep understanding of market fundamentals. With practice and dedication, traders can leverage the power of candlestick patterns to enhance their trading performance and increase their chances of success in the dynamic forex market.