In the realm of global finance, foreign exchange rates (forex rates) play a pivotal role, facilitating international trade and shaping the economic landscape. Understanding how these rates are determined is crucial for navigating the complexities of the forex market.

Image: www.britannica.com

Forex rates are influenced by a multitude of factors, ranging from fundamental macroeconomic indicators to geopolitical events. Let’s delve into the intricate mechanisms that govern these enigmatic fluctuations.

The Fundamentals of Forex Rates

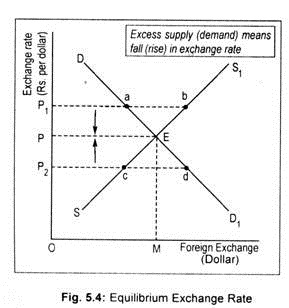

At its core, the forex market operates on the principles of supply and demand. When demand for a particular currency outstrips its supply, its value appreciates relative to other currencies. Conversely, if supply exceeds demand, the currency’s value depreciates.

Economic indicators such as GDP growth, inflation, interest rates, and unemployment rates have a significant impact on currency demand and supply. Strong economic growth, low inflation, and high interest rates tend to bolster a currency’s value, while the reverse can lead to depreciation.

Central Bank Intervention

Central banks play a crucial role in managing forex rates through various monetary policy tools. They can influence interest rates, buy or sell currencies in the market, and implement capital controls to stabilize exchange rates and achieve specific economic objectives.

Geopolitical Events

Geopolitical events, such as wars, elections, and natural disasters, can have profound effects on forex rates. Uncertainty and instability can trigger market volatility and drive rapid currency fluctuations.

Image: www.economicsdiscussion.net

Market Sentiment and Speculation

Forex rates are also influenced by market sentiment and speculation. Traders and investors often base their decisions on rumors, news headlines, and technical analysis, which can amplify price movements and create temporary market imbalances.

Latest Trends and Developments

The forex market is constantly evolving, with new trends and developments emerging regularly. Technological advancements, such as high-frequency trading and algorithmic trading, are transforming market dynamics.

Growing economic interdependence and globalization have also increased the interconnectedness of forex rates. Trade imbalances, currency manipulation concerns, and geopolitical risks continue to shape the market landscape.

Tips and Expert Advice for Forex Traders

Navigating the forex market requires a combination of knowledge, experience, and a strategic approach. Here are some insights and expert advice to enhance your trading decisions:

1. Educate Yourself: Understand the fundamental factors influencing forex rates and keep abreast of the latest economic news and events.

2. Develop a Trading Strategy: Define your trading objectives, risk tolerance, and trading style, and create a consistent strategy that aligns with your goals.

3. Manage Risk Effectively: Implement proper risk management techniques, such as stop-loss orders and position sizing, to mitigate potential losses.

4. Seek Professional Mentorship: Consider seeking guidance from experienced forex traders or financial advisors to gain valuable insights and improve your trading skills.

FAQ on Forex Trading

- Q: What is the most important factor influencing forex rates?

A: Economic indicators and central bank policy play a significant role in determining forex rates. - Q: How can I stay updated on currency market news and events?

A: Monitor financial news outlets, economic reports, and forex-related websites to gather real-time information. - Q: Is forex trading suitable for beginners?

A: While forex trading can be lucrative, it also carries significant risks. Beginners should approach trading cautiously, educate themselves thoroughly, and start with small positions.

How Are Forex Rates Determined

Conclusion

Forex rates are a complex and dynamic subject, influenced by a myriad of economic, geopolitical, and market-related factors. Understanding these determinants is essential for informed decision-making in the forex market. Armed with knowledge and strategic planning, traders can navigate the challenges and seize opportunities in this ever-evolving arena.

Are you eager to delve deeper into the world of forex trading? Share your questions and insights in the comments section below to continue the exploration.