In the dynamic and often unpredictable world of forex trading, where currency pairs fluctuate at lightning-fast speeds, successful traders rely on a strategic arsenal of tools to manage risk and capitalize on market opportunities. Among these critical tools are take profit and stop loss orders, which serve as integral parts of a comprehensive risk management strategy. Understanding and effectively utilizing these orders can profoundly enhance your trading performance and safeguard your capital in this volatile market.

Image: www.tokyo-skytree.org

What is Take Profit?

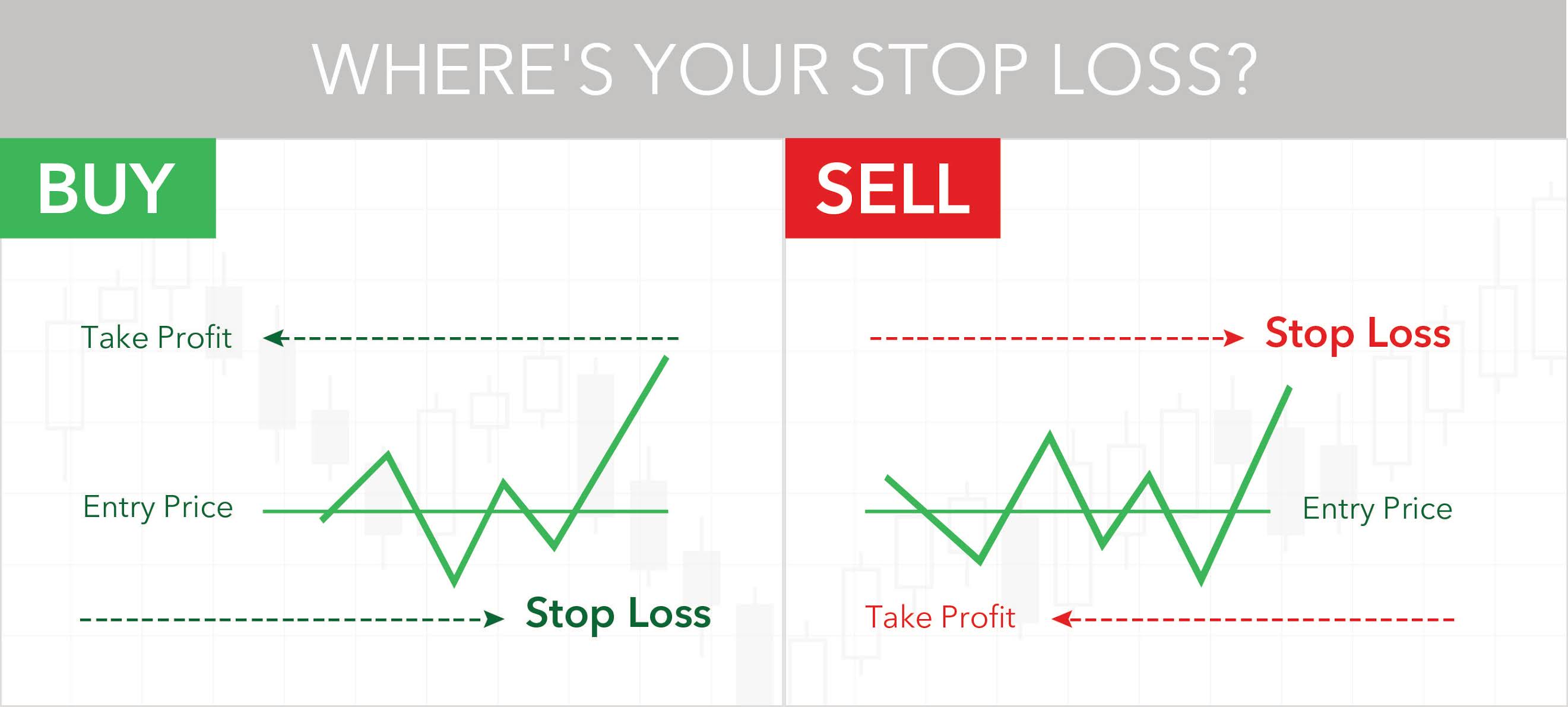

A take profit order is an instruction to automatically close a trade at a predetermined price that yields a profit. The trader sets this price target based on their analysis and risk tolerance. Once the market price reaches this predefined level, the trade is closed, securing the trader’s profit. Take profit orders function as a safety net, allowing traders to protect their gains and avoid the unpredictable swings of the market.

Benefits of Take Profit

Take profit orders offer a range of tangible benefits for forex traders:

- Predefined Exit Strategy: Take profit orders eliminate the subjective element of closing trades. Traders can define their exit points in advance, avoiding emotional decisions or hasty reactions in the heat of the trading moment.

- Ensuring a Profit Lock-in: When volatility spikes, market conditions can change rapidly. Take profit orders safeguard traders by locking in their profits at the predetermined price, preventing sudden market downturns from wiping out gains.

- Risk Mitigation: By closing a trade at a predetermined profit, traders limit their exposure to potential losses. The take profit order acts as a built-in risk management tool, preventing further losses if the market turns against the trade.

What is Stop Loss?

A stop loss order is an equally vital risk management tool in forex trading. It is an instruction to automatically close a trade at a specific price that limits potential losses. The trader sets this price target based on their analysis and risk tolerance. Once the market price reaches this predefined level, the trade is closed, effectively cutting the trader’s losses.

Image: www.youtube.com

Benefits of Stop Loss

Stop loss orders provide a potent array of advantages to forex traders:

- Limiting Losses: Stop loss orders serve as a protective measure, helping traders mitigate the extent of potential losses. By automatically closing a losing trade when the market turns unfavorable, stop loss orders prevent substantial depletions of trading capital.

- Emotional Trading Prevention: Like take profit orders, stop loss orders remove the influence of emotions in trading. Traders may hesitate to exit losing trades, hoping for a market reversal, but stop loss orders execute the trade closure at the predefined price, safeguarding capital.

- Adaptability: Stop loss orders can be adjusted dynamically based on evolving market conditions and trading strategies. Traders can modify their stop loss levels to align with changing market volatility and risk tolerance, ensuring optimal protection.

Executing Effective Take Profit and Stop Loss Orders

The precise execution of take profit and stop loss orders is crucial to maximize their effectiveness. Here are some key considerations:

- Appropriate Market Analysis: Informed take profit and stop loss orders should be based on thorough market research, technical analysis, and sound understanding of the currency pair’s movement patterns.

- Realistic Targets: Take profit targets should be realistic and aligned with market conditions. Setting prices too aggressively can lead to unnecessary order closures, while prices set too conservatively may limit profit potential.

- Proper Placement: Stop loss orders should be placed at levels that protect a substantial portion of trading capital. Too tight a stop loss may prematurely close profitable trades, while too lenient a stop loss may expose traders to excessive risk.

- Monitoring: Traders should continuously monitor their take profit and stop loss orders, especially when market conditions are highly volatile. Adjustments may be necessary to adapt to changing price dynamics.

What Is Take Profit And Stop Loss In Forex Trading

Conclusion

Take profit and stop loss orders are indispensable tools for successful forex trading, providing a robust framework for risk management and profit safeguarding. By implementing these orders into their trading strategies, traders can navigate the complexities of the forex market with greater confidence, maximizing potential gains and minimizing potential losses. Remember, the judicious application of these tools is not only about protecting capital but also about securing a sustainable path to long-term trading success.