Demystifying the Forex Market in India

Foreign exchange market, widely recognized as Forex, stands as a vibrant hub of international currency trading. India, with its burgeoning economy and vast population, has emerged as a pivotal player in this global financial realm. To thrive in the dynamic Forex market, understanding the intricate web of economic factors and strategically timing your trades is paramount. This comprehensive guide will delve into the complexities of Forex trading in India, unveiling the most advantageous times to enter and exit the market, empowering you to maximize your profits.

Image: siteforex.net

Navigating the Market’s Rhythm

The Forex market in India, like its global counterpart, operates 24 hours a day, 5 days a week. However, identifying the most fertile trading windows is crucial for maximizing returns. Several factors intricately intertwine to influence market behavior, including:

-

Global Economic News and Events:

High-impact news releases and economic events can trigger significant market volatility, offering opportunities for lucrative trades.

-

Central Bank Decisions:

Policy announcements and interest rate adjustments by central banks, such as the Reserve Bank of India (RBI), have far-reaching effects on currency markets.

-

Image: yufyfiqec.web.fc2.comPolitical Stability:

Political or economic turmoil can trigger currency fluctuations, potentially presenting profitable trading opportunities.

-

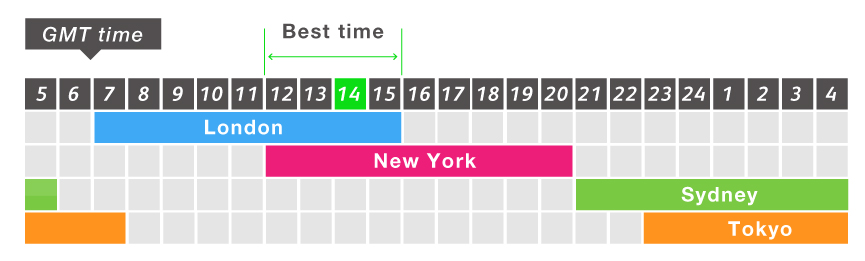

Trading Sessions Overlap:

Identifying the overlap between major trading sessions, such as London, New York, and Sydney, can be particularly favorable for trading, as liquidity and volatility surge during these periods.

Time Zones and Currency Pairs: A Synergistic Dance

To effectively navigate the Forex market in India, it is essential to consider your time zone relative to the major trading centers and the currency pairs you intend to trade. Here’s a detailed breakdown:

-

Indian Standard Time (IST):

Since IST is 5 hours and 30 minutes ahead of Coordinated Universal Time (UTC), the most suitable trading time for Indian traders is between 9:30 AM and 2:00 PM IST, which coincides with the London and European trading sessions.

-

Currency Pairs:

Identifying the most liquid and commonly traded currency pairs is crucial. Popular pairs in the Indian context include USD/INR, EUR/INR, and GBP/INR, offering ample trading opportunities throughout the day.

Tailoring Your Strategy to the Optimal Time Frames

Depending on your risk appetite, trading style, and time constraints, different time frames can yield optimal results in the Forex market. Let’s explore each time frame in detail:

-

Scalping:

This high-frequency trading strategy involves numerous small trades executed within a short period, usually within minutes. It is ideal for traders who can dedicate significant time to monitoring the market.

-

Day Trading:

As the name suggests, day traders open and close positions within the same trading day, taking advantage of short-term price fluctuations. It offers a balance between risk and return.

-

Swing Trading:

Swing traders hold positions for several days or even weeks, aiming to capture larger market trends. This strategy is suitable for individuals with less active trading schedules.

-

Position Trading:

Position traders adopt a longer-term perspective, often holding positions for months or even years, targeting substantial price movements driven by macroeconomic factors.

Leveraging Technological Advancements

The advent of sophisticated trading platforms and automated trading tools has revolutionized the Forex market in India, empowering traders with cutting-edge technology to enhance their trading experience. These tools offer:

-

Real-Time Market Data:

Access to real-time market data is paramount for making informed trading decisions. Platforms provide streaming quotes, charts, and news updates to keep traders abreast of market movements.

-

Technical Analysis Tools:

Advanced charting software equipped with technical analysis indicators allows traders to identify trends, chart patterns, and potential trading opportunities.

-

Automated Trading:

Expert Advisors (EAs) and algorithmic trading bots automate trade execution based on predefined parameters, freeing up traders from manual monitoring and reducing emotional biases.

Educating Yourself: The Key to Sustainable Success

In the dynamic realm of Forex trading, continuous learning and education are essential for long-term success. Here are some effective ways to enhance your trading knowledge:

-

Forex Trading Courses:

Enrolling in comprehensive Forex trading courses provides a structured approach to learning the basics of the market, trading strategies, and risk management techniques.

-

Online Resources:

Numerous online resources, such as webinars, articles, and video tutorials, offer valuable insights into the Forex market and trading strategies.

-

Demo Accounts:

Many Forex brokers provide demo accounts with virtual funds, enabling traders to practice their skills and test strategies without risking real capital.

Best Time To Trading In Forex In India

Embracing the Forex Market’s Potential

Forex trading in India presents immense opportunities for investors seeking to capitalize on global currency fluctuations. By understanding the intricacies of the markets, strategically timing your trades, and leveraging technological advancements, you can optimize your trading experience and reap the potential rewards of this dynamic financial landscape. Remember, knowledge, discipline, and a sound risk-management strategy are the cornerstones of successful Forex trading.