Introduction

In the dynamic realm of forex trading, the ability to identify and interpret support and resistance levels is paramount to maximizing profit potential and minimizing risk. This article delves into the intricacies of support and resistance in the Euro/USD currency pair, offering invaluable insights to empower traders with cutting-edge trading strategies.

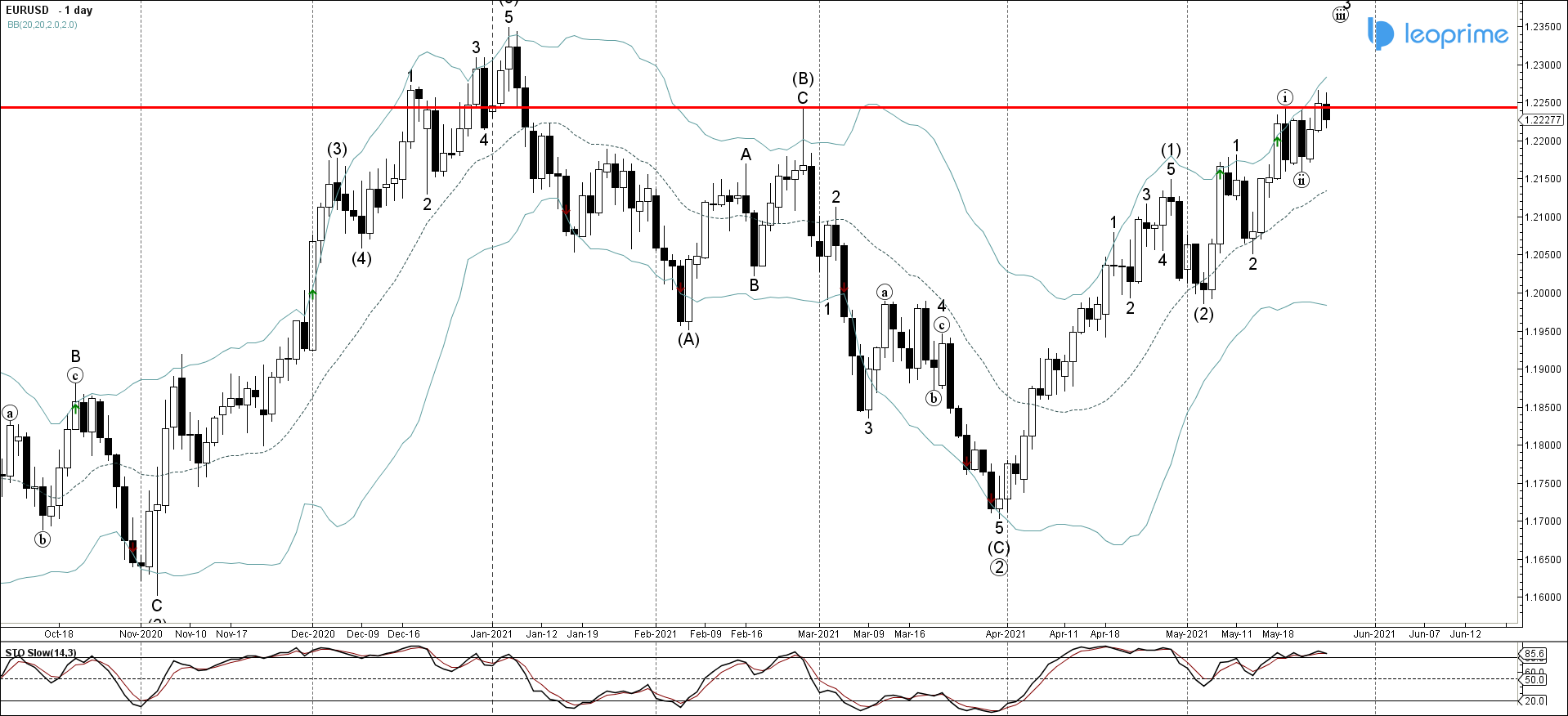

Image: analysis.leoprime.com

Support represents a price point beneath which a security is unlikely to fall, while resistance signifies a price ceiling beyond which upward momentum often stalls. These levels form crucial technical indicators, guiding traders in determining optimal entry and exit points for their trades.

Understanding Support and Resistance Levels

Support levels arise when demand for a currency exceeds supply, pushing its price upward until an equilibrium point is reached. Conversely, resistance levels emerge when supply outstrips demand, causing the price to decline and seek a balance point. The interplay between support and resistance creates a range within which the price fluctuates.

Identifying Support and Resistance in Euro/USD

Technical analysis techniques play a crucial role in pinpointing support and resistance levels in the Euro/USD market. Common methods include:

- Trendlines: These lines connect key price levels, forming an upward or downward sloping trajectory. Breaks above or below trendlines often indicate a potential reversal in the trend.

- Horizontal Levels: These are key price points that have been repeatedly tested over time, acting as strong support or resistance zones.

- Moving Averages: The moving average is a widely-used indicator that smooths out price data, highlighting potential support and resistance zones.

- Fibonacci retracement levels: This tool identifies potential reversal points based on key Fibonacci ratios.

Utilizing Support and Resistance in Your Forex Trading Strategy

Mastering support and resistance can significantly enhance your forex trading performance:

- Identifying Entry Points: Support levels provide low-risk entry points for buy trades, as the price is likely to bounce upward from this level. Conversely, resistance levels offer prime entry points for sell trades.

- Determining Exit Points: When prices approach resistance levels, consider placing sell orders to lock in profits. Similarly, approach support levels cautiously and set buy orders to capitalize on potential upward momentum.

- Risk Management: Support and resistance levels can act as crucial stop-loss points. Place stop-loss orders below support for buy trades and above resistance for sell trades to minimize potential losses.

- Identifying Potential Reversals: Failed attempts to break through support or resistance often signal a potential trend reversal. Keep an eye on price movements around these levels to anticipate potential trading opportunities.

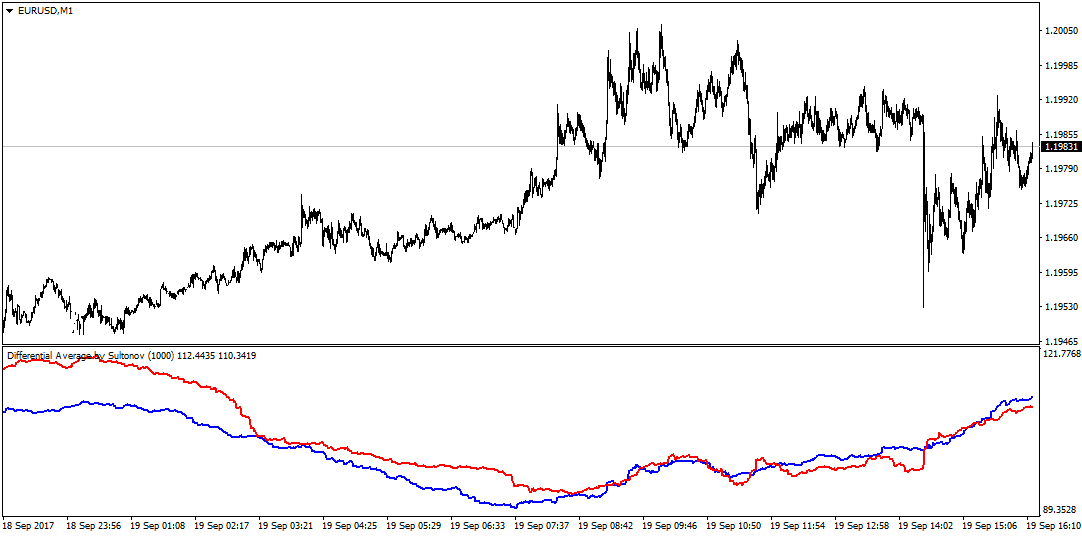

Image: www.mql5.com

Expert Insights on Euro/USD Support and Resistance

“Support and resistance levels are the backbone of technical analysis in the Euro/USD market,” says forex expert Anna Petrova. “By leveraging these levels, traders can make informed decisions, increase their win rate, and significantly improve their trading performance.”

Euro Usd Support And Resistance Forex Indicator Empty

Conclusion

Empowering yourself with the knowledge of support and resistance levels unlocks a world of trading opportunities. By mastering the principles outlined in this article, traders can identify lucrative entry and exit points, minimize risk, and elevate their overall forex trading experience. Remember to practice these techniques consistently, seek expert guidance when necessary, and stay informed about the latest market developments to maximize your chances of success in the dynamic world of Euro/USD trading.