For those accustomed to the ups and downs of the financial market, staying ahead of the curve is no small feat. As a trader navigating the ever-evolving landscape of economics, one must possess a keen eye for leading economic indicators.

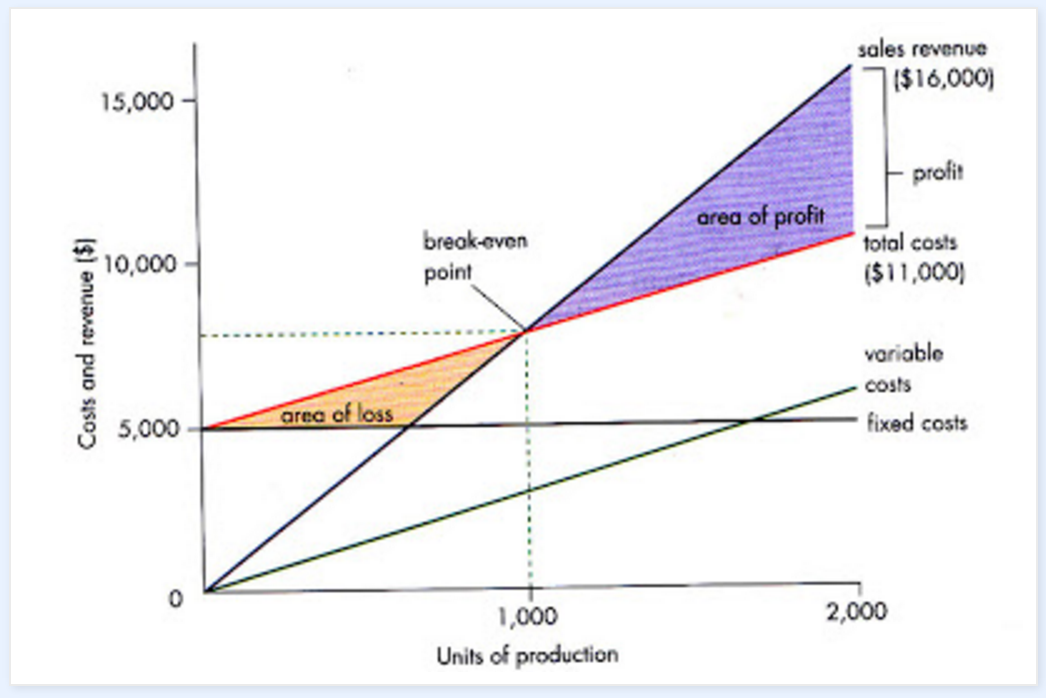

Image: igbusinesss.blogspot.co.ke

Leading economic indicators are critical in understanding the future direction of economies and making informed investment decisions. These indicators provide insights into the health of industries, from manufacturing to retail sales, offering glimpses beyond mere historical data into what the future holds. Uncovering the dynamics of these indicators empowers us as traders to make calculated decisions and stay a step ahead in the fast-paced world of investing.

New Approaches to Identifying Leading Indicators

The realm of leading economic indicators is constantly evolving, with innovation and technological advancements bringing new approaches to the forefront. These novel methods harness the power of big data, artificial intelligence, and real-time market information to identify economic trends with unprecedented accuracy.

Data-driven Analytics

Data-driven analytics have revolutionized the identification of leading indicators, leveraging massive datasets to unearth hidden patterns and correlations. By analyzing everything from consumer spending to social media trends, these advanced algorithms can uncover early signs of economic shifts, allowing for timely and informed investment decisions.

Forex Casting Record: A Tale of Predictive Power

The forex market, where currencies are traded globally, provides a fertile ground for testing and refining leading economic indicators. Forex casting record, a method of predicting currency movements based on economic data, attests to the power of these indicators in shaping market outcomes.

By constantly monitoring a wide array of leading indicators and applying sophisticated statistical models, forex casting record achieves remarkable accuracy in predicting currency fluctuations. This ability to discern future market trends empowers traders to develop more strategic trading plans and ride the waves of economic change.

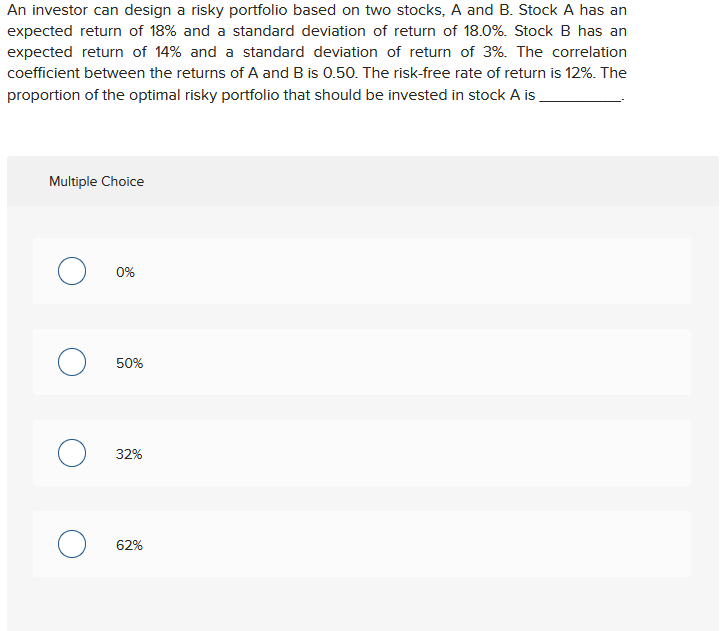

Image: www.chegg.com

Understanding the Importance of Leading Economic Indicators

For savvy investors, leading economic indicators are indispensable, offering the following advantages:

- Enhanced Market Insight: They provide a clear understanding of the underlying health of economies and industries, enabling traders to make informed decisions.

- Early Trend Identification: These indicators reveal emerging economic patterns, allowing investors to capitalize on growth opportunities or navigate potential risks proactively.

- Risk Management: Understanding leading economic indicators helps identify potential downturns, empowering traders to take precautionary measures and safeguard their investments.

By leveraging the insights gleaned from leading economic indicators, traders can gain a competitive edge in the volatile world of finance, making calculated decisions and increasing their chances of success.

Tips and Expert Advice for Leveraging Leading Economic Indicators

To maximize the benefits of leading economic indicators, consider the following tips and expert advice:

- Monitor a Diverse Range of Indicators: Don’t rely on a single indicator; a comprehensive view increases accuracy and reduces reliance on any one data point.

- Stay Informed about Market Conditions: Real-time market information and news can provide valuable context for evaluating leading indicators.

- Seek Expert Analysis: Consult with financial analysts and experts to gain valuable insights and perspectives.

FAQs on Leading Economic Indicators

Q: How do I access leading economic indicators?

A: Leading economic indicators are widely available from government agencies, central banks, and financial institutions websites.

Q: What are some examples of leading economic indicators?

A: Business investment, consumer confidence, and initial unemployment claims are common examples of leading economic indicators.

Q: Can leading economic indicators be used to predict stock market performance?

A: While not directly indicative of stock market performance, leading economic indicators can provide valuable insights into the broader economic environment that influences stock market trends.

Leading Economic Indicators New Approaches And Forex Casting Record

Conclusion

Leading economic indicators are indispensable tools for navigating the dynamic world of finance. By harnessing the latest approaches and leveraging the wisdom of experts, traders can gain a competitive advantage, make informed decisions, and ride the waves of economic change. As you delved deeper into this article, we hope you’ve gained valuable insights into the significance and power of leading economic indicators.

If you’re eager to further explore this captivating subject and gain actionable insights, we encourage you to consult our comprehensive resource guide exclusively dedicated to leading economic indicators. Unlock your trading potential and join a community of informed investors who are shaping the future of finance.