Introduction

The foreign exchange (forex) market is a vast and dynamic global network where currencies are traded. As currencies flow across borders, they have a significant impact on the values of individual currencies and the economies they represent. In this article, we will delve into the intricate relationship between forex inflow and currency, exploring how these flows influence currency values and economic outcomes.

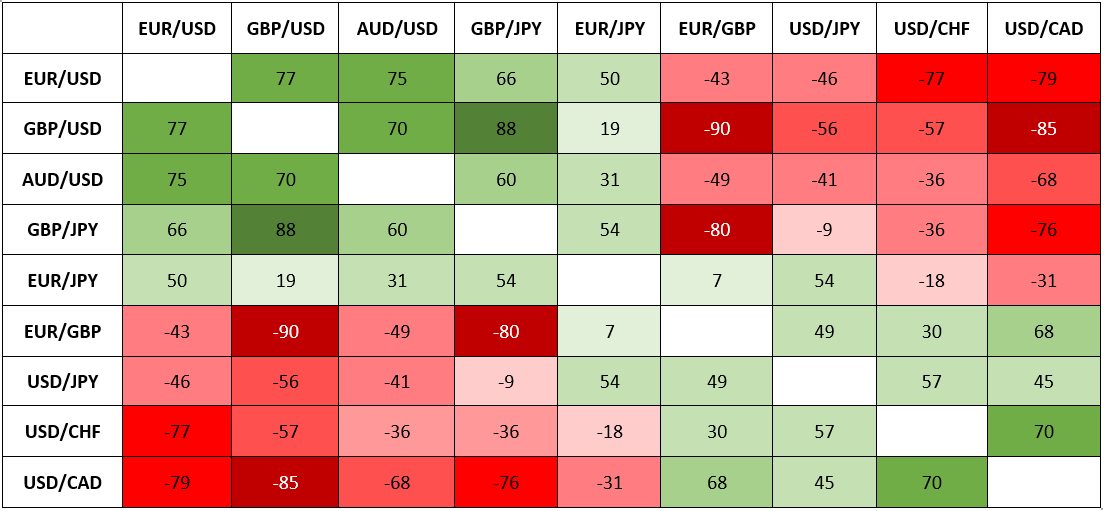

Image: www.cmcmarkets.com

Understanding Forex Inflow

Forex inflow refers to the influx of foreign currency into a particular country. This can occur through various channels, including:

- Exports: When a country sells goods or services to other countries, it receives foreign currency in exchange.

- Foreign Direct Investment (FDI): When foreign investors invest in businesses or assets in a country, they bring in foreign currency.

- Portfolio Investment: When international investors purchase stocks, bonds, or other financial instruments in a country, they invest foreign currency.

Influence on Currency Value

Forex inflow has a direct impact on the value of a country’s currency. An increase in forex inflow tends to strengthen the currency, while a decrease can lead to its depreciation. Here’s how it works:

- Increased Demand: When foreign currency flows into a country, the demand for the domestic currency increases. This is because businesses and individuals need to convert their foreign currency into the domestic currency to make purchases. As demand rises, the value of the domestic currency appreciates.

- Supply and Demand: The forex market operates on the principles of supply and demand. When forex inflow increases, the supply of foreign currency in the domestic market increases. This, coupled with the increased demand, can push the value of the domestic currency higher.

Economic Implications

Forex inflow not only affects currency values but also has far-reaching economic implications. Here are a few key outcomes:

- Trade Competitiveness: A stronger currency can make a country’s exports more expensive in international markets, potentially reducing export competitiveness.

- Inflation: A rapid increase in forex inflow can lead to inflation, as imported goods become cheaper and domestic demand rises.

- Economic Growth: Strong and sustained forex inflow can contribute to economic growth by stimulating investment, consumption, and overall economic activity.

- External Reserves: Forex inflow increases a country’s foreign reserves, which can be used to support the currency, pay off foreign debt, or bolster economic resilience.

Image: marketinvestopedia.com

Stabilizing Currency Fluctuations

While forex inflow has the potential to benefit a country’s economy, it can also lead to significant currency fluctuations. To mitigate these fluctuations and ensure stability, central banks often intervene in the forex market. They can buy or sell currencies to influence their value and prevent extreme volatility.

Expert Insights

“Forex inflow plays a crucial role in shaping currency values and influencing economic outcomes,” says Dr. Emily Carter, a senior economist at the International Monetary Fund. “It is important for central banks and governments to monitor and manage forex inflows to optimize their benefits and minimize potential risks.”

Actionable Tips

- Understand the Dynamics: Businesses and individuals should be aware of the relationship between forex inflow and currency fluctuations to make informed decisions about their financial strategies.

- Monitor Economic News: Keep abreast of economic news and events that can impact forex inflows and currency values.

- Hedge Currency Risk: Exporters and businesses engaged in international trade should consider hedging their currency risk to mitigate potential losses due to currency fluctuations.

Relation Between Forex Inflow And Currency

Conclusion

The relationship between forex inflow and currency is a complex and ever-evolving one. Understanding the dynamics of this relationship is essential for businesses, traders, investors, and economic policymakers alike. By monitoring forex inflows and implementing sound management strategies, countries and individuals can harness the benefits of forex inflow while mitigating potential risks and fostering sustainable economic growth.