Introduction

Forex candlesticks are an essential part of technical analysis, providing valuable insights into market trends and patterns. They offer traders a visual representation of price movements, making it easier to identify support and resistance levels, trends, and potential trading opportunities. Through this comprehensive guide, we’ll delve into the many types of forex candlesticks, deciphering their structure, significance, and utility in the trading arena.

Image: www.tradingwolf.com

What are Forex Candlesticks?

Forex candlesticks are a type of price chart that depicts the movement of an asset over a designated time frame. These “candles” consist of two parts: the body, which represents the range between the open and close prices; and the wicks, or tails, which extend beyond the body, indicating the highest and lowest prices reached during the specified time period.

Types of Candlesticks

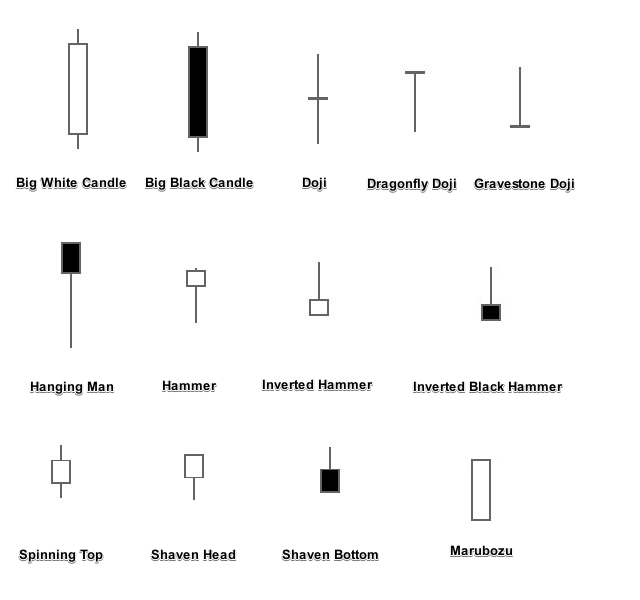

Forex candlesticks come in various patterns, each with unique implications for traders. The most common candlestick patterns include:

- Bullish Candlestick Patterns (uptrend):

- Hammer: Green body with a small upper wick and long lower wick, indicating buyers’ temporary loss of control.

- Inverted Hammer: Green body with a long upper wick and small or no lower wick, signaling a potential trend reversal.

- Piercing Line: Long green body, engulfing the entire red body of the previous candle, suggesting a bullish reversal.

- Green Marubozu: Green body with no wicks, indicating a strong uptrend and no opposition from bears.

- Bearish Candlestick Patterns (downtrend):

- Hanging Man: Red body with a small lower wick and long upper wick, indicating sellers’ temporary loss of control.

- Shooting Star: Red body with a long upper wick and small or no lower wick, signaling a potential trend reversal.

- Dark Cloud Cover: Red body with a long dark body, engulfing the entire green body of the previous candle, suggesting a bearish reversal.

- Red Marubozu: Red body with no wicks, indicating a strong downtrend and no opposition from bulls.

- Other Candlestick Patterns (neutral or consolidation):

- Doji: Body is a small cross, T, or plus sign, indicating indecision or consolidation.

- Spinning Top: Small body with long upper and lower wicks, suggesting a possible change in trend.

- Harami: A candlestick pattern with a small body inside a larger body, signifying a potential trend reversal.

Tips for Using Candlesticks in Forex Trading

Effectively utilizing candlestick patterns in forex trading requires an understanding of their dynamics and the ability to interpret their implications correctly. Here are some tips to consider:

- Identify Key Support and Resistance Levels: Candlestick patterns can help identify areas of support and resistance, which are crucial for determining potential trading opportunities.

- Confirm Signals: Avoid making trading decisions based solely on a single candlestick pattern. Look for confirmation from other technical indicators or price action analysis.

- Manage Risk Effectively: Implement proper risk management techniques such as stop-loss orders to protect your capital, especially when trading based on candlestick patterns.

- Understand Market Context: Consider the overall market conditions and other technical analysis techniques to gain a comprehensive view before making trading decisions.

Image: www.pinterest.fr

FAQs about Forex Candlesticks

- What is the most bullish candlestick pattern?

- What is a key difference between a hammer and a hanging man candlestick?

- Which candlestick pattern indicates indecision in the market?

- Can candlestick patterns be used to predict future market movements?

- Are there any limitations to using candlestick patterns?

Green Marubozu

The color of the body (bullish for hammer, bearish for hanging man)

Doji

While candlestick patterns provide valuable insights, they should not be relied upon solely for making trading decisions.

Candlestick patterns may not be effective in all market conditions or with all trading strategies.

Conclusion

Forex candlesticks are essential tools for technical analysis in the forex market, providing traders with a visual representation of price movements and the ability to identify trends, support and resistance levels, and potential trading opportunities. By understanding the various types of candlestick patterns, incorporating them into a comprehensive trading strategy, and managing risk effectively, traders can enhance their decision-making process and increase their chances of success.

Types Of Forex Candle Sticks

https://youtube.com/watch?v=FQc4hKetzig

Interested in learning more about Forex candlestick trading?

Check out our other articles on this blog or join our community forum to connect with other traders and exchange ideas.