In today’s dynamic financial landscape, understanding the nuances of market indices is crucial for informed investment decisions. Among these indices, the Market Value Weighted Index (MVWI) stands out as a valuable tool for gauging stock market performance and making strategic portfolio allocations. This comprehensive guide will delve into the intricacies of calculating the MVWI, empowering you with the knowledge to leverage its insights effectively.

Image: rhayzlzenia.blogspot.com

What is a Market Value Weighted Index?

A Market Value Weighted Index measures the overall performance of a group of stocks by assigning each stock a weight proportional to its market capitalization. Market capitalization is determined by multiplying the number of outstanding shares by the current market price of each stock within the index. The MVWI essentially mirrors the returns of a hypothetical portfolio that invests in each index constituent in proportion to their market value.

Calculating the Market Value Weighted Index

The calculation of an MVWI involves a straightforward process:

- Identify the Constituent Stocks: Determine the stocks that make up the index. This list is typically defined by the index provider and may include companies from specific sectors, countries, or industries.

- Calculate Market Capitalization: Multiply the current market price of each stock by the number of its outstanding shares to determine its market capitalization.

- Sum the Market Capitalizations: Add up the market capitalizations of all the constituent stocks to get the total market capitalization of the index.

- Calculate the Weighted Average: For each stock, divide its market capitalization by the total market capitalization. The resulting value represents the weight of that stock in the index.

- Multiply by Index Base Value: Multiply the weight of each stock by a predefined index base value. This base value is typically set at 100 or 500 to provide a convenient starting point for tracking index performance over time.

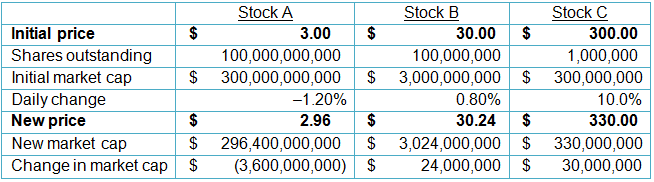

Example: Calculating an MVWI

Let’s illustrate the MVWI calculation process with an example. Consider an index comprised of three stocks:

| Stock | Market Price | Outstanding Shares | Market Capitalization |

|---|---|---|---|

| Apple | $150 | 10,000,000 | $1,500,000,000 |

| Microsoft | $200 | 8,000,000 | $1,600,000,000 |

| $250 | 6,000,000 | $1,500,000,000 |

Total Market Capitalization: $4,600,000,000

Weighted Averages:

| Stock | Market Capitalization | Weight |

|---|---|---|

| Apple | $1,500,000,000 | 0.33 |

| Microsoft | $1,600,000,000 | 0.35 |

| $1,500,000,000 | 0.33 |

Assuming an index base value of 100, the MVWI would be calculated as follows:

- Apple: 0.33 x 100 = 33

- Microsoft: 0.35 x 100 = 35

- Google: 0.33 x 100 = 33

MVWI = 33 + 35 + 33 = 101

Image: rhayzlzenia.blogspot.com

Benefits of Using an MVWI

Understanding how to calculate an MVWI offers numerous advantages for investors:

- Accurate Representation of Market Performance: MVWIs provide a weighted average of the performance of large-cap stocks, which heavily influence market trends.

- Industry Insights: MVWIs can be used to gauge the performance of specific sectors or industries by tracking indices that are focused on those segments.

- Portfolio Diversification: MVWIs allow investors to diversify their portfolios by spreading their investments across multiple stocks with varying market capitalizations.

- Benchmarks for Performance Evaluation: MVWIs serve as benchmarks against which investors can compare the performance of their portfolios or individual stocks.

- Enhanced Risk Management: By understanding the composition and weightings of MVWIs, investors can assess and manage market risk more effectively.

How To Calculate Market Value Weighted Index

Conclusion

The Market Value Weighted Index is a powerful tool that unlocks valuable insights into the financial markets. By understanding how to calculate an MVWI, investors can make informed investment decisions, monitor market performance, and diversify their portfolios. This guide has provided a comprehensive overview of the MVWI calculation process, empowering investors with the knowledge they need to leverage the benefits this key indicator offers. Whether you are a seasoned investor or just starting to navigate the financial landscape, the insights derived from MVWIs can be an invaluable asset in your investment journey.