Investing in stock markets can be a complex and challenging endeavor. One way to simplify your investment process is to use market capitalization weighted indices (or simply “cap-weighted indices”). These indices represent a group of stocks, and their performance is determined by the market capitalization of each company within the index. In this blog post, we will delve into the world of market capitalization weighted indices, exploring their benefits, and providing practical tips for using them. Get ready to unlock the power of indices and make informed investment decisions.

Image: elmwealth.com

The Anatomy of Market Capitalization Weighted Indices

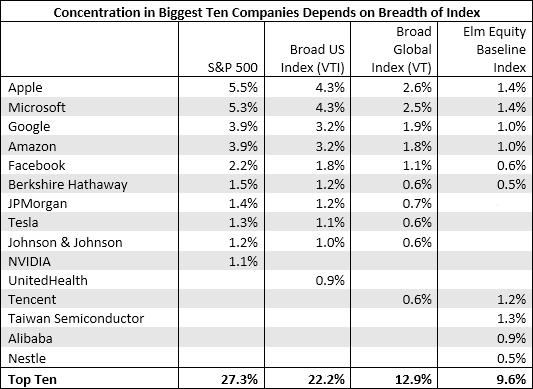

A market capitalization weighted index is a type of stock index that ranks the stocks it holds according to their market value or market capitalization. This means that companies with a larger market capitalization carry more weight in the index compared to smaller companies. The index portfolio reflects the price of these index constituents. Essentially, the index level mimics the returns and growth of the underlying stocks. Well-known examples of such indices are the S&P 500 and the FTSE 100.

Benefits of Using Market Capitalization Weighted Indices

- Market Representation: Cap-weighted indices provide a comprehensive view of a specific market by including a wide range of companies of different sizes.

- Diversification Benefits: By investing in an index, you automatically gain exposure to several stocks, reducing idiosyncratic risk associated with any single company.

- Transparency: The methodology of cap-weighted indices is straightforward and transparent, making it easy to understand how they are constructed and how they perform.

- Performance Tracking: Investors can monitor the performance of an index to assess the overall health of a market or sector.

- Passive Investing: Index funds and ETFs that track cap-weighted indices allow for passive investing, reducing the need for active stock selection.

- Consider Long-Term Goals: Cap-weighted indices are a long-term investment play. They reflect the overall trends of a market or sector and require consistency to witness significant gains.

- Diversify Portfolio: While indices offer diversification, don’t limit your investments solely to one index. Consider diversifying across multiple indices and asset classes to manage risk.

- Rebalance Regularly: Over time, the weight of stocks within the index can change due to market fluctuations. Regularly rebalance your portfolio to maintain your desired asset allocation.

- Monitor Underlying Stocks: Even though indices are composite, it’s wise to be aware of the top constituents and their influence on the index’s performance.

Understanding the Mechanism: How Cap-Weighted Indices Work

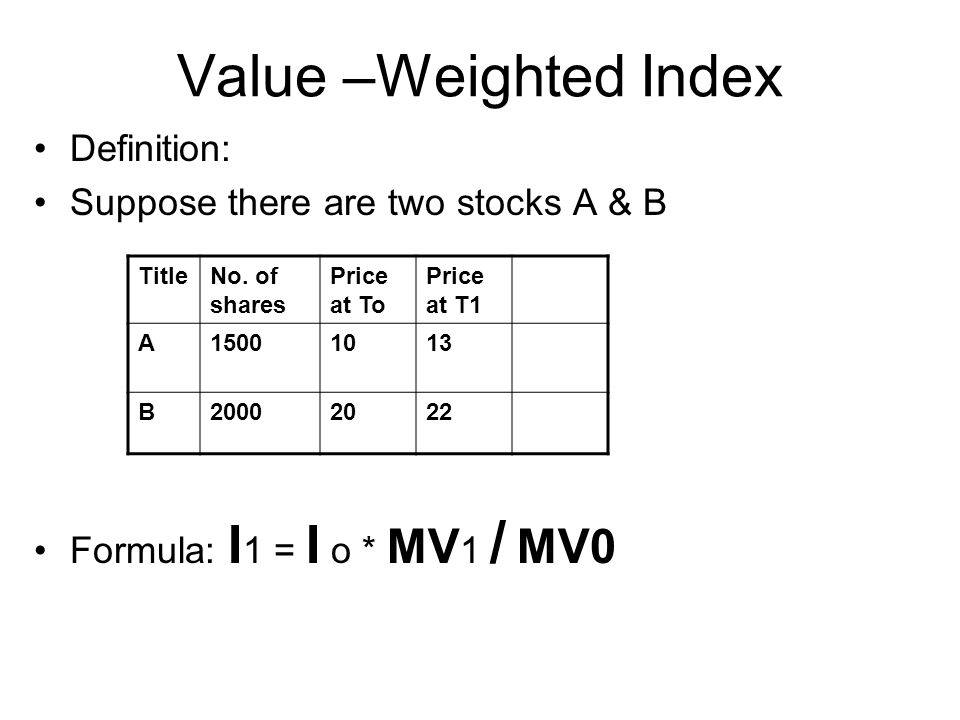

Cap-weighted indices assign a weight to each stock within the index. This weight is calculated by dividing a company’s market capitalization by the total market capitalization of all the companies in the index. Consequently, stocks with a higher market value have a greater influence on the index value. The collective performance of these index constituents determines the direction of the particular index price. Periodically, committees revise the index’s composition to maintain its integrity.

Image: necteo.com

Navigating Market Cap Indices: Tips and Expert Advice

Utilizing market cap indices effectively requires some strategies. Seasoned investors advise the following for beginners and experienced investors:

FAQs on Market Capitalization Weighted Indices

What is the difference between a market capitalization weighted index and an equal-weighted index?

In a market capitalization weighted index, stocks with a larger market value have a greater impact on the index’s performance, while in an equal-weighted index, each stock has the same influence.

How often are market cap indices updated?

The frequency of updates varies by index. Some are updated daily, while others may be revised quarterly or even bi-annually.

Market Capitalization Weighted Indices

https://youtube.com/watch?v=g6diE71GdpI

Conclusion: Unlocking the Power of Market Cap Indices

Market capitalization weighted indices provide investors with a powerful tool for tracking the performance of stocks of varying sizes within a market.