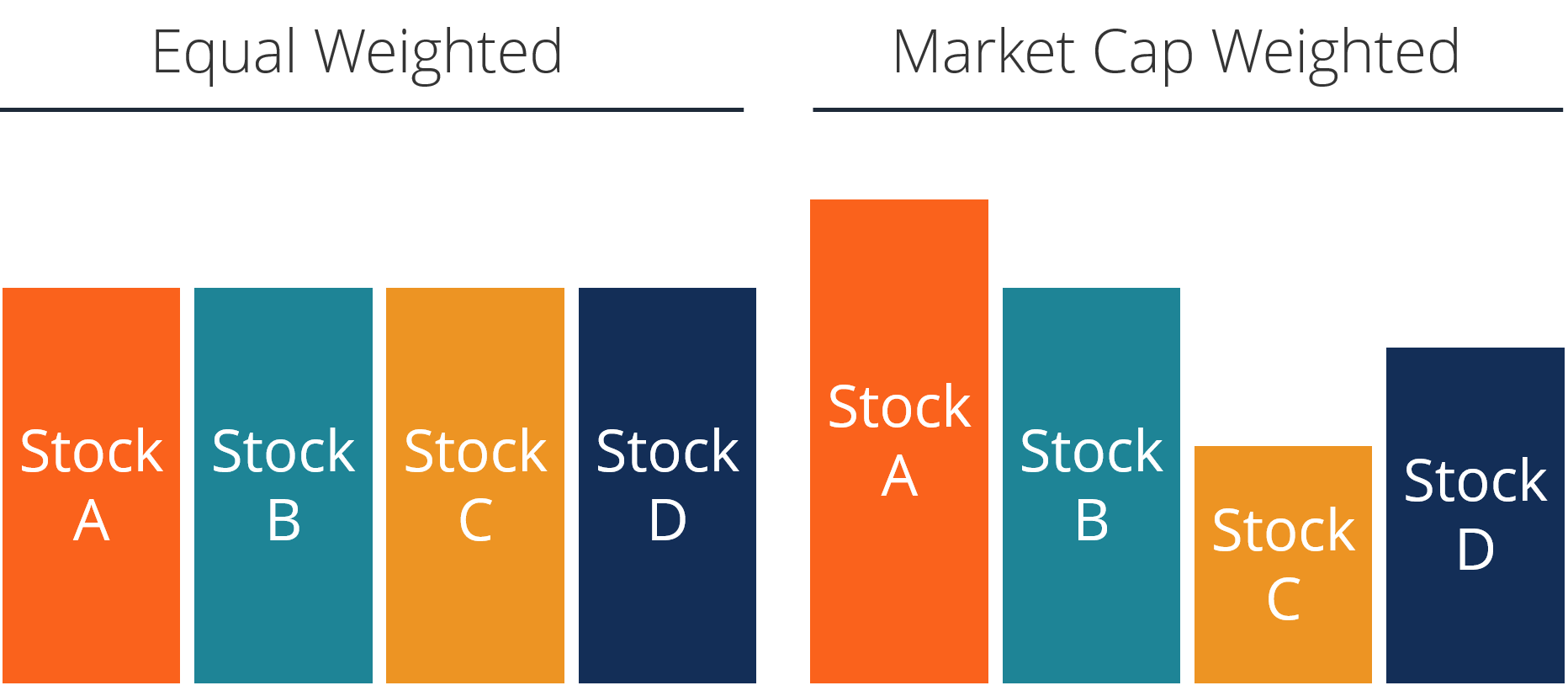

Imagine stepping into a bustling marketplace, where vendors represent various companies with stocks traded on an exchange. Each vendor’s stall size symbolizes the company’s market capitalization, the total value of its outstanding shares. As you navigate through the marketplace, you notice that the most spacious stalls belong to the largest and most prominent companies. This is where the concept of a market cap weighted index enters the picture, capturing the essence of this market dynamic.

Image: corporatefinanceinstitute.com

Market Cap Weighted Index: A Snapshot of Market Dominance

A market cap weighted index is a type of stock market index that allocates weightage to each constituent stock based on its market capitalization. Simply put, the larger the market capitalization of a company, the more influence it has on the index’s overall value. This weighting system ensures that the index closely reflects the relative size and importance of the companies it comprises.

As a result, market cap weighted indices tend to be heavily skewed towards large-cap stocks, representing well-established and financially stable companies. This bias towards size can impact investment strategies and market dynamics. Understanding the nuances of market cap weighted indices is crucial for investors aiming to navigate the stock market effectively.

The most well-known examples of market cap weighted indices include:

- The S&P 500 Index (largest 500 publicly traded companies in the United States)

- The FTSE 100 Index (100 largest companies listed on the London Stock Exchange)

- The DAX 30 Index (30 largest companies listed on the Frankfurt Stock Exchange)

Advantages and Disadvantages of Market Cap Weighted Indices

Advantages

- Broad representation: Market cap weighted indices offer a diversified exposure to a wide range of companies, capturing the broader market sentiment.

- Lower volatility: Due to their heavy concentration in large-cap stocks, market cap weighted indices tend to exhibit lower volatility compared to other types of indices.

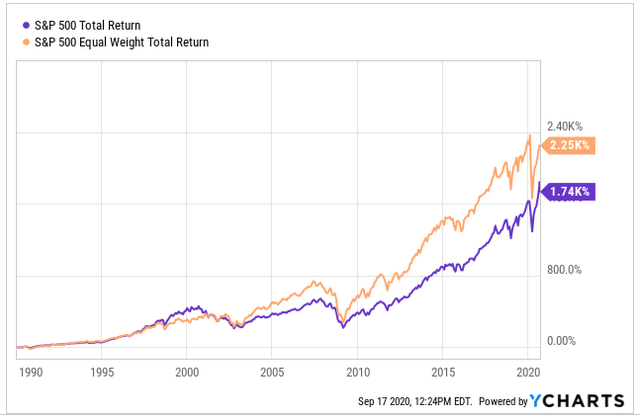

- Alignment with market trends: The weighting system ensures that the index mirrors the performance of the overall stock market, making it a suitable benchmark for passive investment strategies.

Image: seekingalpha.com

Disadvantages

- Overweighting of large-cap stocks: Market cap weighted indices can lead to overweighting of large-cap companies, potentially overshadowing the impact of smaller and mid-cap companies.

- Skewed performance towards market leaders: The performance of market cap weighted indices can be disproportionately influenced by the performance of a few dominant companies.

- Limited exposure to growth opportunities: While large-cap stocks offer stability, they may not always capture the potential upside of smaller, more innovative companies.

Tips and Expert Advice for Navigating the Market Cap Weighted Index Landscape

Effective investing in the stock market requires a comprehensive approach. Here are some tips and expert advice for navigating the market cap weighted index landscape:

- Diversify your portfolio: Don’t put all your eggs in one basket! Ensure your portfolio includes a mix of market cap weighted indices, industry-specific indices, and even alternative investments to spread your risk.

- Consider alternatives: Market cap weighted indices can be complemented with equal-weighted indices or factor-based indices to capture different aspects of the market.

- Monitor index composition: Keep an eye on the constituent companies of a market cap weighted index. Changes in company weightage can impact its overall performance and risk profile.

- Seek professional guidance: Don’t hesitate to consult with a financial advisor who can help tailor an investment strategy that aligns with your individual financial goals and risk tolerance.

FAQ on Market Cap Weighted Indices

Q: What’s the difference between market cap weighted and equal-weighted indices?

A: Market cap weighted indices allocate weightage to stocks based on their market capitalization, while equal-weighted indices assign equal weightage to all constituents, regardless of size.

Q: Can market cap weighted indices be manipulated?

A: While the weighting system is objective based on market capitalization, companies may use strategies to increase their stock price and consequently their weight in the index.

Q: How often are market cap weighted indices rebalanced?

A: Rebalancing frequency varies depending on the index. Some indices are rebalanced quarterly, while others may be rebalanced annually or semi-annually.

Market Cap Weighted Index

Conclusion

Understanding market cap weighted indices is paramount for investors navigating the stock market. Their heavy concentration in large-cap stocks provides diversification and stability, yet it’s crucial to consider their limitations and potential biases. By incorporating tips, seeking expert advice, and staying informed, investors can make informed decisions that align with their financial objectives. Are you confident in your understanding of market cap weighted indices? Let’s delve into further discussions and explore how you can leverage them effectively in your investment strategies.