In the realm of investments, the concept of market capitalization has played a pivotal role in determining the weightage of stocks within an index. Traditional indices, such as the S&P 500, assign greater importance to companies with larger market capitalizations, potentially overweighting their influence in the index’s overall performance.

Image: www.mssqltips.com

However, an alternative approach, known as market weighted index formula, has emerged to address this potential bias and provide a more balanced representation of the market. Let’s delve into its intricacies and explore its significance.

Market Weighted Index

Foundation and Implementation

A market weighted index is a type of index where the weight of each stock in the index is determined by its market capitalization relative to the total market capitalization of all stocks in the index. In simpler terms, companies with larger market caps have a greater influence on the index’s performance compared to those with smaller market caps.

This approach aims to create a more diversified index that is less susceptible to the dominance of a few large companies. It ensures that even smaller companies with promising growth potential can contribute to the index’s overall returns, painting a more holistic picture of the market’s performance.

Advantages over Traditional Weighting

Market weighted indices offer several advantages over traditionally weighted indices

- **Enhanced Diversification**: By reducing the influence of mega-cap companies, market weighted indices promote diversification and reduce the risk of over-concentration in a few select stocks.

- **Fairer Representation**: This weighting method ensures that all stocks, regardless of size, have a proportional impact on the index’s performance, providing a more balanced representation of the market.

- **Growth Potential**: Market weighted indices allow smaller companies with strong growth prospects to make a significant contribution to the index’s returns, fostering innovation and capturing emerging market trends.

Image: www.valueresearchonline.com

Formula and Calculation

The market weighted index formula is straightforward and transparent:

Index Value = (Market Cap of Company A / Total Market Cap of All Companies) x Index Base Value

The index base value is typically set to a specific starting date, and the index is recalculated periodically (e.g., daily or weekly) to reflect changes in market capitalizations.

Latest Trends and Developments

Market weighted indices have gained significant popularity in recent years, as investors seek more balanced and diversified investment options. As a result, many index providers have introduced market weighted versions of their traditional indices.

One notable trend is the emergence of thematic market weighted indices that focus on specific sectors, industries, or investment themes. These indices provide investors with targeted exposure to specific market segments, allowing them to tailor their portfolios to their unique investment objectives.

Tips and Expert Advice

- Consider incorporating market weighted indices into your investment portfolio to enhance diversification and reduce risk.

- Explore thematic market weighted indices to gain exposure to specific market trends or sectors that align with your investment goals.

- Regularly review your investment portfolio to ensure that your asset allocation aligns with your risk tolerance and financial objectives.

- Consult with a qualified financial advisor to develop an investment strategy that incorporates market weighted indices.

Frequently Asked Questions

What is the difference between market weighted and equal weighted indices?

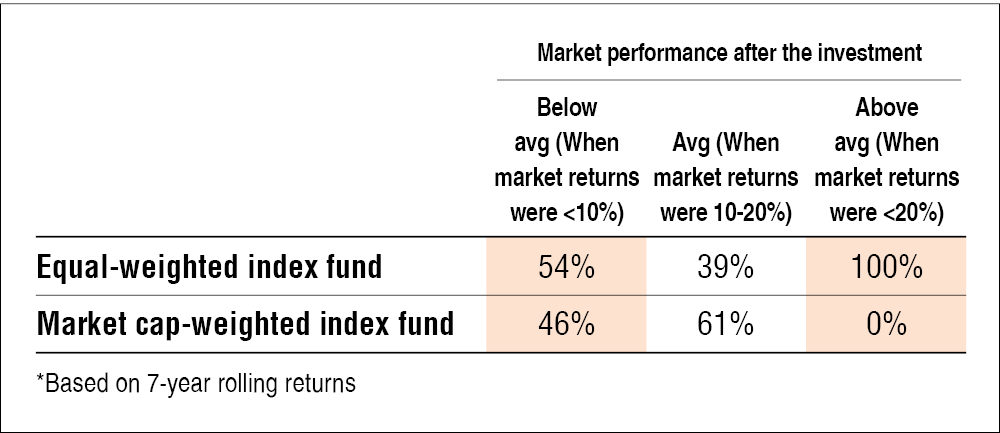

Market weighted indices assign greater weight to companies with larger market capitalizations, while equal weighted indices give equal weight to all stocks in the index, regardless of size.

How often is a market weighted index recalculated?

The frequency of recalculation varies depending on the index provider, but it is typically done daily or weekly.

Market Weighted Index Formula

Conclusion

Understanding the market weighted index formula is crucial for investors seeking a balanced and diversified approach to their investments. By reducing the influence of large-cap companies, market weighted indices provide a more comprehensive representation of the market’s performance, allowing investors to capture growth potential from promising smaller companies.

As you embark on your investment journey, I urge you to explore the benefits of market weighted indices and consider incorporating them into your portfolio. By embracing this innovative approach to market indexing, you can enhance your investment strategy and position yourself for long-term success.

Are you interested in learning more about market weighted index formula? Share your thoughts and questions in the comments below.