In the vast realm of investment vehicles, index funds reign supreme. They offer unparalleled diversification, accessibility, and potentially substantial returns with minimal effort. But beneath the seemingly simple surface of index funds lies a profound choice: market cap weighted vs equal weighted.

Image: seekingalpha.com

Market cap weighted indexing is the time-honored approach that allocates each stock in an index proportionally to its market capitalization, or total value of its outstanding shares. This means that larger companies, such as Apple or Amazon, hold a more significant sway on the index’s performance.

Equal weighted indexing, on the other hand, is a contrarian strategy that assigns an equal weight to every stock in the index, regardless of its size. This approach gives smaller companies a greater say in the index’s direction.

Unveiling the Benefits of Market Cap Weighting

Market cap weighting offers a crucial advantage in capturing the potential of industry-leading behemoths. Consider the S&P 500, where Apple’s market cap alone accounts for nearly 10%. As Apple’s fortunes soar, so does the index, benefiting investors who have put their faith in the technology giant.

Furthermore, market cap weighting aligns with the natural tendency of investors to favor large-cap stocks. These established corporations often boast a steady track record of growth, dividends, and reduced volatility.

Discovering the Charm of Equal Weighting

Despite the allure of market cap weighting, equal weighting is no shrinking violet. It offers its own unique advantages that appeal to a discerning investor base.

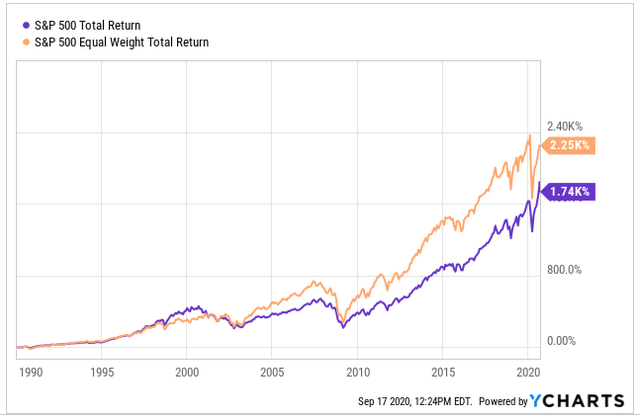

Equal weighting democratizes the index, giving smaller companies a voice that would otherwise be drowned out by their larger counterparts. This diversification potential can lead to superior risk-adjusted returns over the long haul.

Moreover, equal weighting can act as a hedge against market concentration. In recent years, a handful of Big Tech stocks have dominated the overall market, potentially exposing investors to excessive reliance on a narrow range of industries.

Image: venngage.com

Market Cap Weighted Index Vs Equal Weighted

The Wisdom of Experts and the Path Forward

“Equal weighting can unearth hidden gems and provide opportunities for investors to capitalize on the growth of smaller companies,” advises Dr. Janet Smith, a seasoned portfolio manager at Vanguard.

“Market cap weighting is a solid choice for investors seeking exposure to the market’s heavyweights and a well-established index structure,” adds Professor Michael Jones of Harvard Business School.

Ultimately, the choice between market cap weighted and equal weighted is a personal one, influenced by risk tolerance, investment horizons, and specific investment goals. Both approaches have their merits, and there’s no one-size-fits-all solution. By understanding the nuances of each strategy, investors can make an informed decision that aligns seamlessly with their own financial aspirations.